Question: Please check my work in part one, and please explain the process of the other parts of the question Required information Problem 6-6A Record transactions

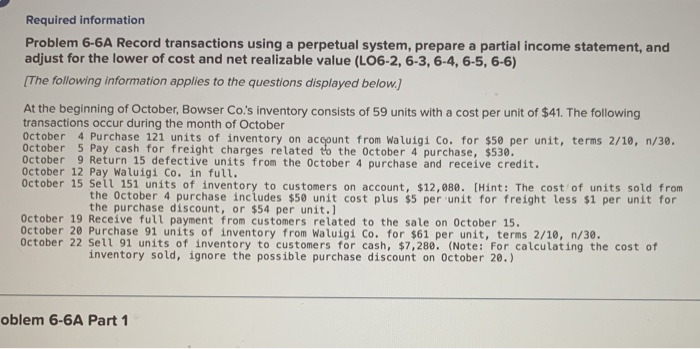

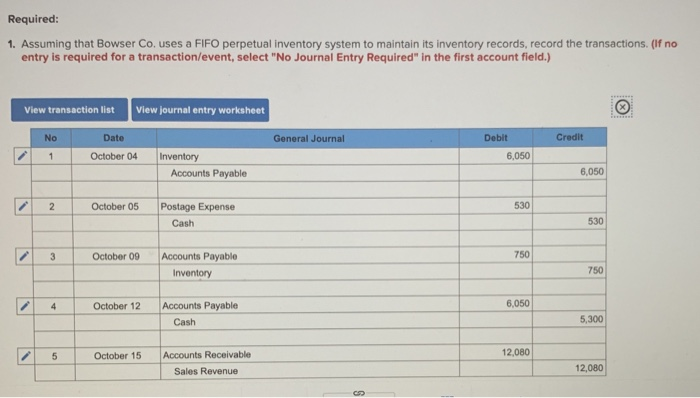

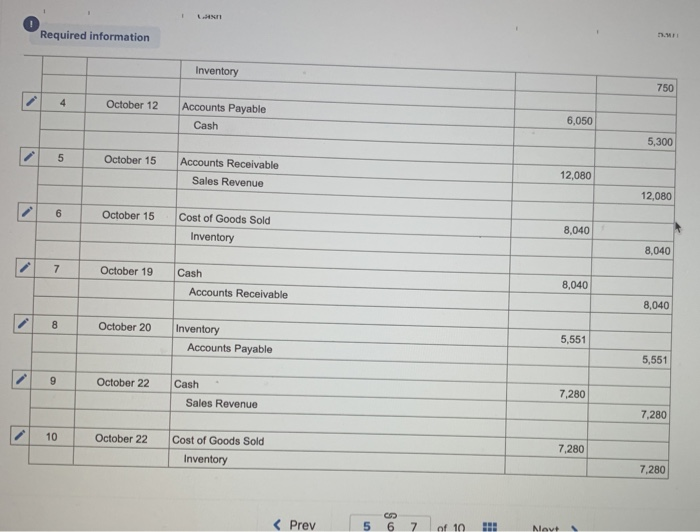

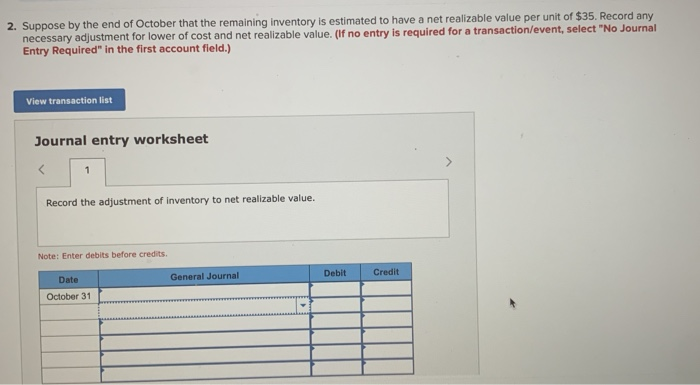

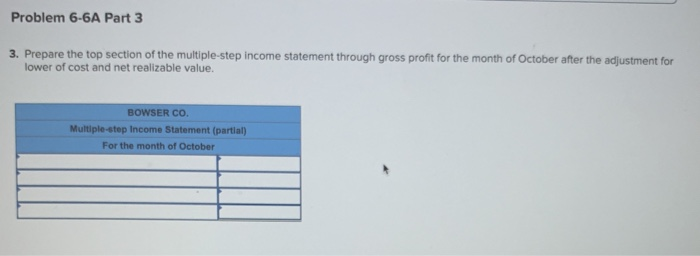

Required information Problem 6-6A Record transactions using a perpetual system, prepare a partial income statement, and adjust for the lower of cost and net realizable value (LO6-2, 6-3, 6-4, 6-5, 6-6) (The following information applies to the questions displayed below.) At the beginning of October, Bowser Co's inventory consists of 59 units with a cost per unit of $41. The following transactions occur during the month of October October 4 Purchase 121 units of inventory on account from Waluigi Co. for $50 per unit, terms 2/10, 1/30. October 5 Pay cash for freight charges related to the October 4 purchase, $530. October 9 Return 15 defective units from the October 4 purchase and receive credit. October 12 Pay Waluigi Co. in full. October 15 Sell 151 units of inventory to customers on account, $12,080. (Hint: The cost of units sold from the October 4 purchase includes $50 unit cost plus $5 per unit for freight less $1 per unit for the purchase discount, or $54 per unit.] October 19 Receive full payment from customers related to the sale on October 15. October 20 Purchase 91 units of inventory from Waluigi Co. for $61 per unit, terms 2/10, n/30. October 22 Sell 91 units of inventory to customers for cash, $7,280. (Note: For calculating the cost of inventory sold, ignore the possible purchase discount on October 20.) oblem 6-6A Part 1 Required: 1. Assuming that Bowser Co. uses a FIFO perpetual inventory system to maintain its inventory records, record the transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet No Date General Journal Credit Debit 6,050 1 October 04 Inventory Accounts Payable 6,050 2 October 05 530 Postage Expense Cash 530 3 October 09 750 Accounts Payable Inventory 750 4 October 12 6,050 Accounts Payable Cash 5,300 5 October 15 12,080 Accounts Receivable Sales Revenue 12,080 1 Required information . Inventory 750 4 October 12 Accounts Payable Cash 6,050 5,300 5 October 15 Accounts Receivable Sales Revenue 12,080 12,080 6 October 15 Cost of Goods Sold Inventory 8,040 8,040 7 October 19 Cash Accounts Receivable 8,040 8,040 8 October 20 Inventory Accounts Payable 5,551 5,551 9 October 22 Cash Sales Revenue 7,280 7,280 10 October 22 Cost of Goods Sold Inventory 7.280 7,280

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts