Question: please check my work. will drop a like. if you would work it differently please explain. 2. Valuing a call option Current stock price: $

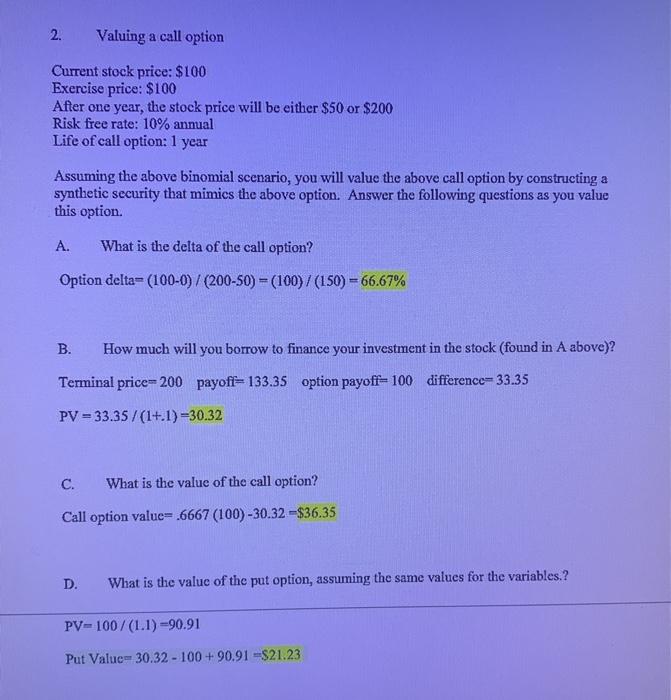

2. Valuing a call option Current stock price: $ 100 Exercise price: $100 After one year, the stock price will be either $50 or $200 Risk free rate: 10% annual Life of call option: 1 year Assuming the above binomial scenario, you will value the above call option by constructing a synthetic security that mimics the above option. Answer the following questions as you value this option. A. What is the delta of the call option? Option delta= (100-0)/(200-50) = (100)/(150) = 66.67% B. How much will you borrow to finance your investment in the stock (found in A above)? Terminal price=200 payoff-133.35 option payoff-100 difference-33.35 PV = 33.35/(1+1)=30.32 C. What is the value of the call option? Call option value= .6667 (100)-30.32 $36.35 D. What is the value of the put option, assuming the same values for the variables.? PV-100/(1.1) =90.91 Put Value 30.32-100+ 90.91 $21.23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts