Question: Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 58, 63,

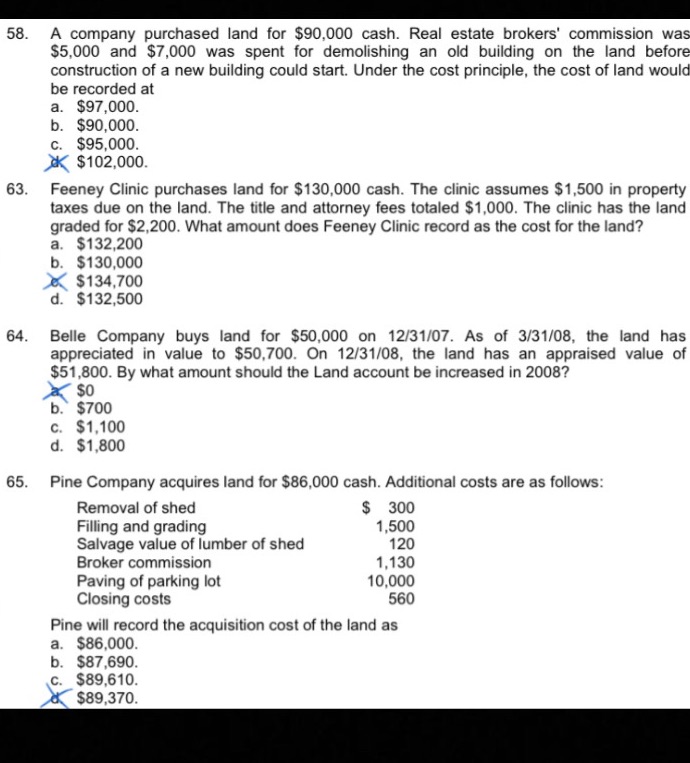

Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 58, 63, 64, and 65PLANT ASSETS, NATURAL RESOURCES, AND INTANGIBLE ASSETS58. A company purchased land for $90,000 cash. Real estate brokers' commission was $5,000 and $7,000 was spent for demolishing an old building on the land before construction of a new building could start. Under the cost principle, the cost of land would be recorded at 63. Feeney Clinic purchases land for $130,000 cash. The clinic assumes $1,500 in property taxes due on the land. The title and attorney fees totaled $1,000. The clinic has the land graded for $2,200. What amount does Feeney Clinic record as the cost for the land?64. Belle Company buys land for $50,000 on 12/31/07. As of 3/31/08, the land has appreciated in value to $50,700. On 12/31/08, the land has an appraised value of $51,800. By what amount should the Land account be increased in 2008?65. Pine Company acquires land for $86,000 cash. Additional costs are as follows: Pine will record the acquisition cost of the land as?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts