Question: Please choose each option and write the numbers as well. I will give thumbs up The declaration, record, and payment dates in connection with a

Please choose each option and write the numbers as well. I will give thumbs up

Please choose each option and write the numbers as well. I will give thumbs up

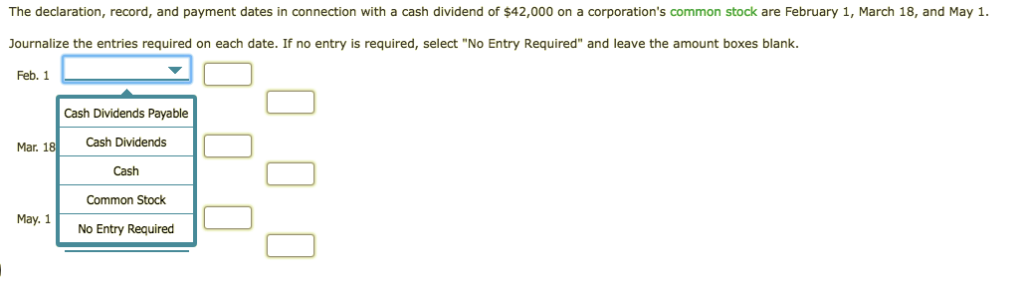

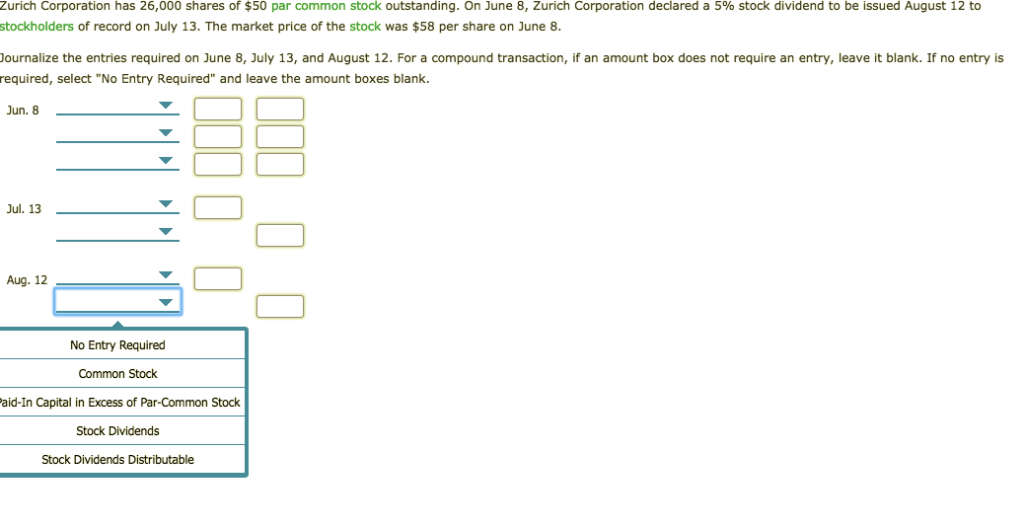

The declaration, record, and payment dates in connection with a cash dividend of $42,000 on a corporation's common stock are February 1, March 18, and May 1 ournalize the entries required on each date. If no entry is required, select "No Entry Required" and leave the amount boxes blank. Feb. 1 Cash Dividends Payable Cash Dividends Cash Common Stock No Entry Required Mar. 18 May. 1 Zurich Corporation has 26,000 shares of $50 par common stock outstanding. On June 8, Zurich Corporation declared a 5% stock dividend to be issued August 12 to stockholders of record on July 13. The market price of the stock was $58 per share on June 8 ournalize the entries required on June 8, July 13, and August 12. For a compound transaction, if an amount box does not require an entry, leave it blank. If no entry is required, select "No Entry Required" and leave the amount boxes blank. Jun. 8 Jul. 13 Aug. 12 No Entry Required Common Stock aid-In Capital in Excess of Par-Common Stock Stock Dividends Stock Dividends Distributable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts