Question: Please choose one answer for each question: If there is perfect capital mobility between Canada and the US and a Canadian asset offers a return

Please choose one answer for each question:

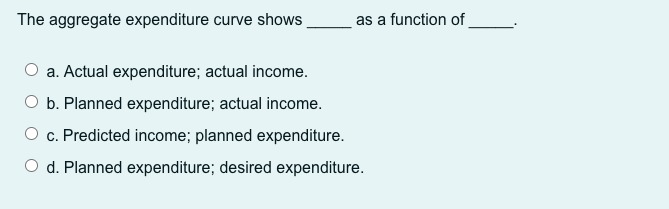

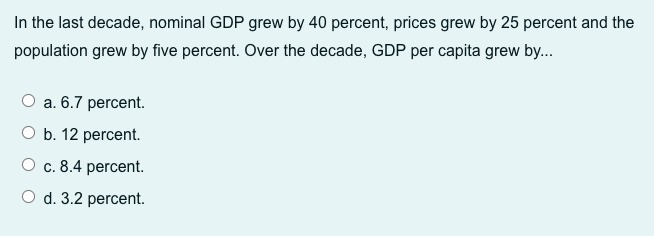

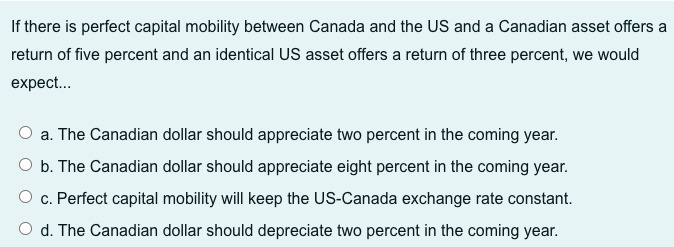

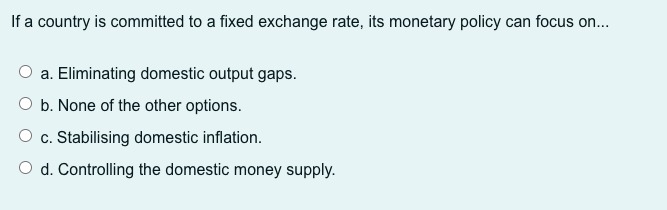

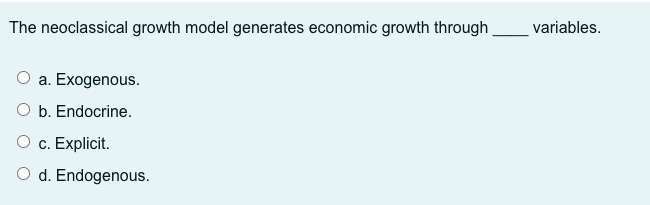

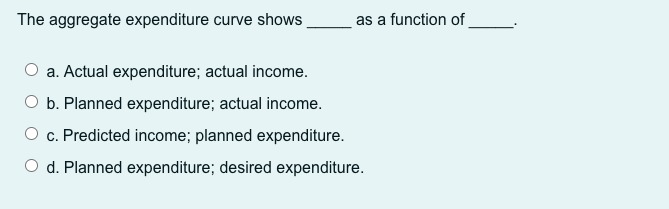

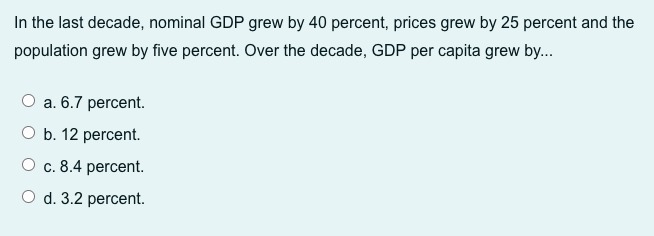

If there is perfect capital mobility between Canada and the US and a Canadian asset offers a return of five percent and an identical US asset offers a return of three percent, we would expect... O a. The Canadian dollar should appreciate two percent in the coming year. O b. The Canadian dollar should appreciate eight percent in the coming year. O c. Perfect capital mobility will keep the US-Canada exchange rate constant. O d. The Canadian dollar should depreciate two percent in the coming year.If a country is committed to a fixed exchange rate, its monetary policy can focus on... O a. Eliminating domestic output gaps. O b. None of the other options. O c. Stabilising domestic inflation. O d. Controlling the domestic money supply.The neoclassical growth model generates economic growth through variables. O a. Exogenous. O b. Endocrine. O c. Explicit. O d. Endogenous.The aggregate expenditure curve shows as a function of O a. Actual expenditure; actual income. O b. Planned expenditure; actual income. O c. Predicted income; planned expenditure. O d. Planned expenditure; desired expenditure.In the last decade, nominal GDP grew by 40 percent, prices grew by 25 percent and the population grew by five percent. Over the decade, GDP per capita grew by... O a. 6.7 percent. O b. 12 percent. O c. 8.4 percent. O d. 3.2 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts