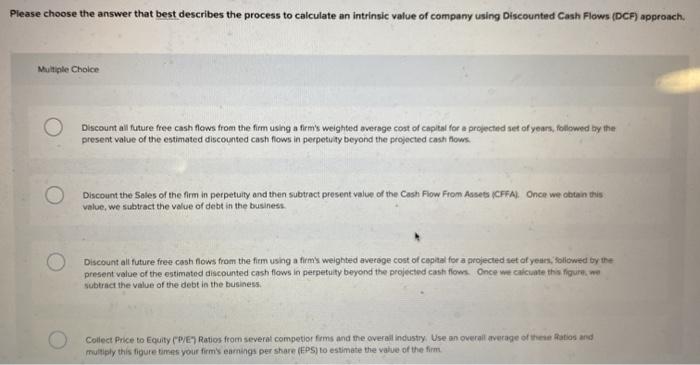

Question: Please choose the answer that best describes the process to calculate an intrinsic value of company using Discounted Cash Flows (DCF) approach. Multiple Choice Discount

Please choose the answer that best describes the process to calculate an intrinsic value of company using Discounted Cash Flows (DCF) approach. Multiple Choice Discount all future free cash news from the firm using a firm's weighted average cost of capital for a projected set of years, followed by the present value of the estimated discounted cash flows in perpetuty beyond the projected cash flows. Discount the Sales of the firm in perpetuity and then subtract prosent value of the Cash Flow From Assets (CFFA). Once we obtain this value, we subtract the value of debt in the business Discount all future free cash flows from the firm using a firm's weighted average cost of capital for a projected set of yours followed by the present value of the estimated discounted cash flows in perpetuity beyond the projected cash flows. Once we calcite this figure Subtract the value of the debt in the business Collect Price to Equity (DE) Ratios from several competior firms and the overall industry. Use an overall average of the Ratios and multiply this figure times your firm's earnings per share (EPS) to estimate the value of the firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts