Question: please choose the correct answer 3) The form used to determine an employee's net claim code is called a * A) T4. B) Record of

please choose the correct answer

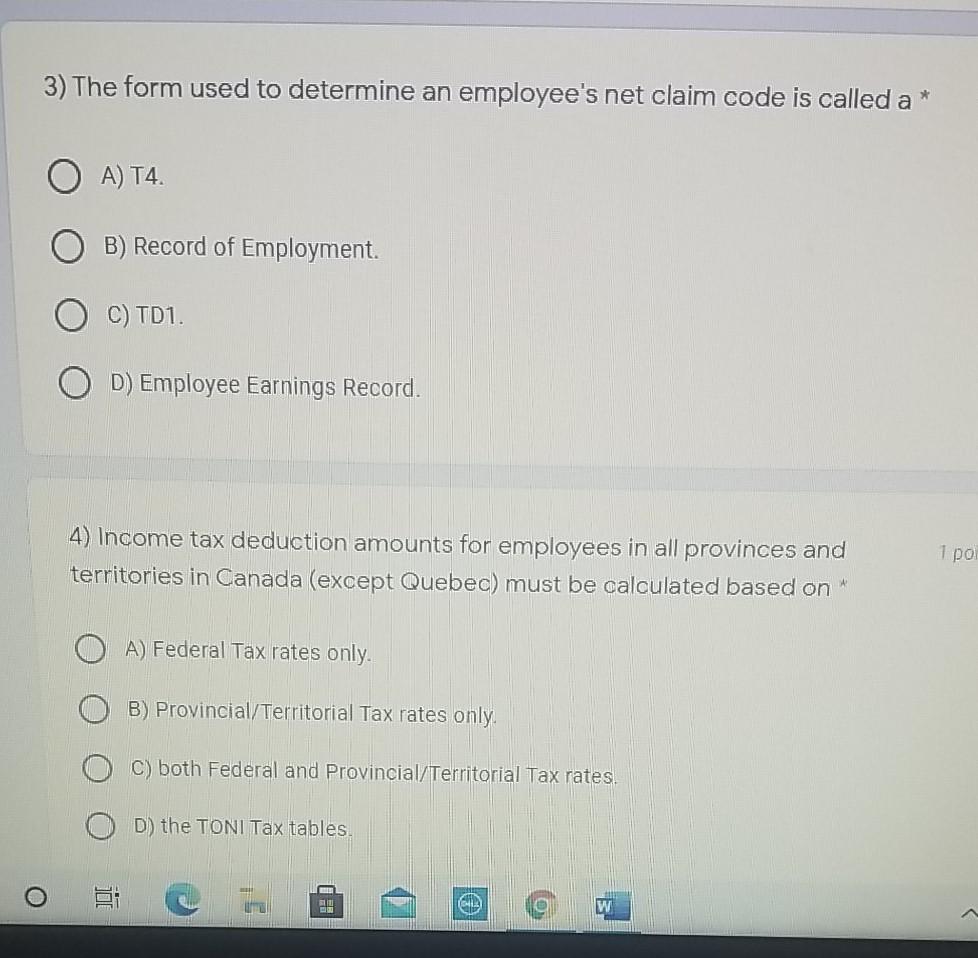

3) The form used to determine an employee's net claim code is called a * A) T4. B) Record of Employment. C) TD1. D) Employee Earnings Record. 4) Income tax deduction amounts for employees in all provinces and territories in Canada (except Quebec) must be calculated based on * A) Federal Tax rates only. B) Provincial/Territorial Tax rates only. C) both Federal and Provincial/Territorial Tax rates. D) the TONI Tax tables. GILA W 1 pol

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below i The Record of Employment is the form used to determine an employees net claim code ROE ... View full answer

Get step-by-step solutions from verified subject matter experts