Question: **Please chose the correct answer for each question ( no need for explanation of the answer) What is the value of the free cash flow

**Please chose the correct answer for each question ( no need for explanation of the answer)

- What is the value of the free cash flow from the end of year 4 to infinity?

- 1,466,270.25

- 1,569,100.23

- 1,520,000.00

- What is the present value of the company's cash flow?

- 1,278,375

- 1,434,787.57

- 1,114,692.61

- What is the total value of the common stock?

- 327,678.12

- 344,567.12

- 364,692.61

- How much is the value of the stock per share?

- 3.65

- 4.23

- 5.68

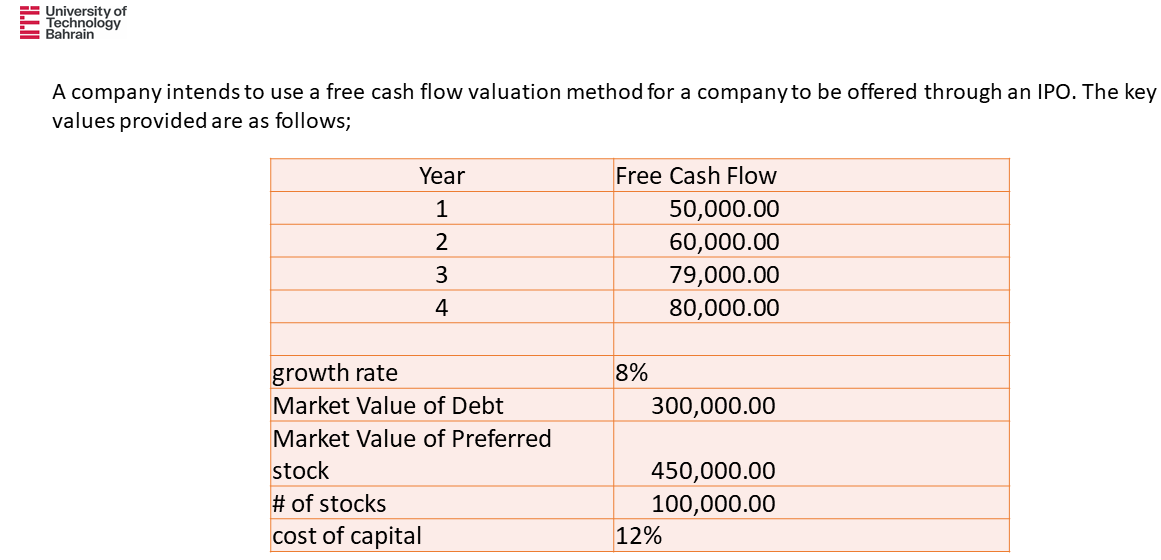

University of Technology Bahrain A company intends to use a free cash flow valuation method for a company to be offered through an IPO. The key values provided are as follows; Year 1 2 Free Cash Flow 50,000.00 60,000.00 79,000.00 80,000.00 3 4 8% 300,000.00 growth rate Market Value of Debt Market Value of Preferred stock # of stocks cost of capital 450,000.00 100,000.00 12% University of Technology Bahrain A company intends to use a free cash flow valuation method for a company to be offered through an IPO. The key values provided are as follows; Year 1 2 Free Cash Flow 50,000.00 60,000.00 79,000.00 80,000.00 3 4 8% 300,000.00 growth rate Market Value of Debt Market Value of Preferred stock # of stocks cost of capital 450,000.00 100,000.00 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts