Question: Please circle answer 7. More on ratio analysis Analysts and investors often use return on equity (ROE) to compare profitability of a company with other

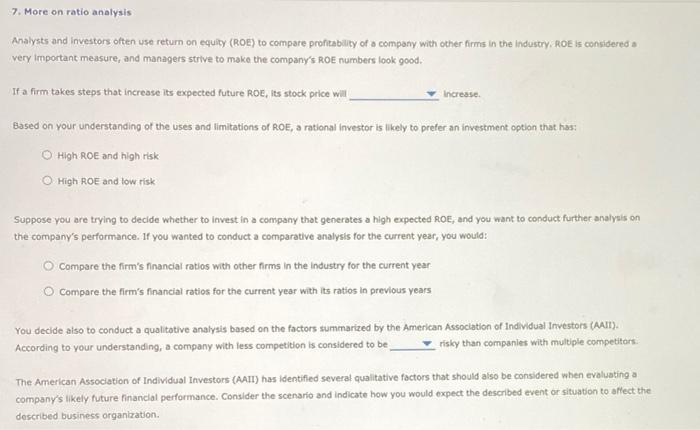

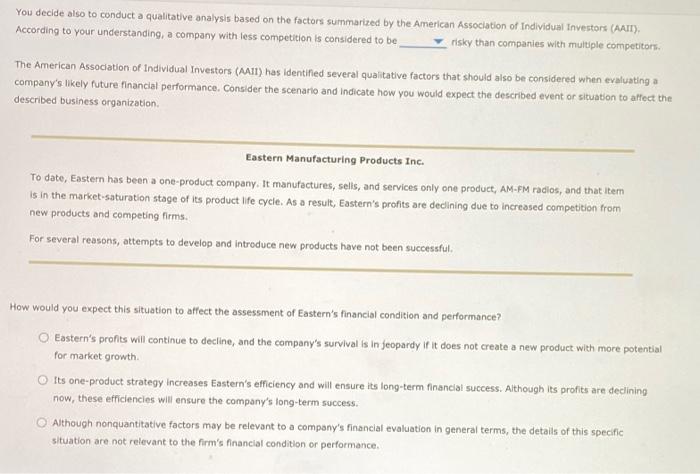

7. More on ratio analysis Analysts and investors often use return on equity (ROE) to compare profitability of a company with other firms in the industry, ROE is considered a very important measure, and managers strive to make the company's ROE numbers look good. If a firm takes steps that increase its expected future Roe, its stock price wil Increase Based on your understanding of the uses and limitations of ROE, a rational Investor is likely to prefer an investment option that has: High ROE and high risk High ROE and low risk Suppose you are trying to decide whether to invest in a company that generates a high expected ROE, and you want to conduct further analysis on the company's performance. If you wanted to conduct a comparative analysis for the current year, you would Compare the firm's financial ratios with other firms in the Industry for the current year O Compare the firm's financial ratios for the current year with its ratlos in previous years You decide also to conduct a qualitative analysis based on the factors summarized by the American Association of Individual Investors (AATI). According to your understanding, a company with less competition is considered to be risky than companies with multiple competitors. The American Association of Individual Investors (AAII) has identified several qualitative factors that should also be considered when evaluating a company's likely future financial performance. Consider the scenario and indicate how you would expect the described event or situation to affect the described business organization You decide also to conduct a qualitative analysis based on the factors summarized by the American Association of Individual Investors (AAR) According to your understanding, a company with less competition is considered to be risky than companies with multiple competitors. The American Association of Individual Investors (All) has identified several qualitative factors that should also be considered when evaluating a company's likely future financial performance. Consider the scenario and indicate how you would expect the described event or situation to affect the described business organization Eastern Manufacturing Products Inc. To date, Eastern has been a one-product company. It manufactures, sells, and services only one product, AM-FM radios, and that item is in the market-saturation stage of its product life cycle. As a result, Eastern's profits are dedining due to increased competition from new products and competing firms. For several reasons, attempts to develop and introduce new products have not been successful. How would you expect this situation to affect the assessment of Eastern's financial condition and performance? Eastern's profits will continue to decline, and the company's survival 's In Jeopardy if it does not create a new product with more potential for market growth Its one-product strategy Increases Eastern's efficiency and will ensure its long-term financial success. Although its profits are declining now, these efficiencies will ensure the company's long-term success. Although nonquantitative factors may be relevant to a company's financial evaluation in general terms, the details of this specific situation are not relevant to the firm's financial condition or performance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts