Question: Please clearly indicate what each answer is so that I can check my work. Thank you. Martinez, Inc. acquired a patent on January 1, 2016

Please clearly indicate what each answer is so that I can check my work. Thank you.

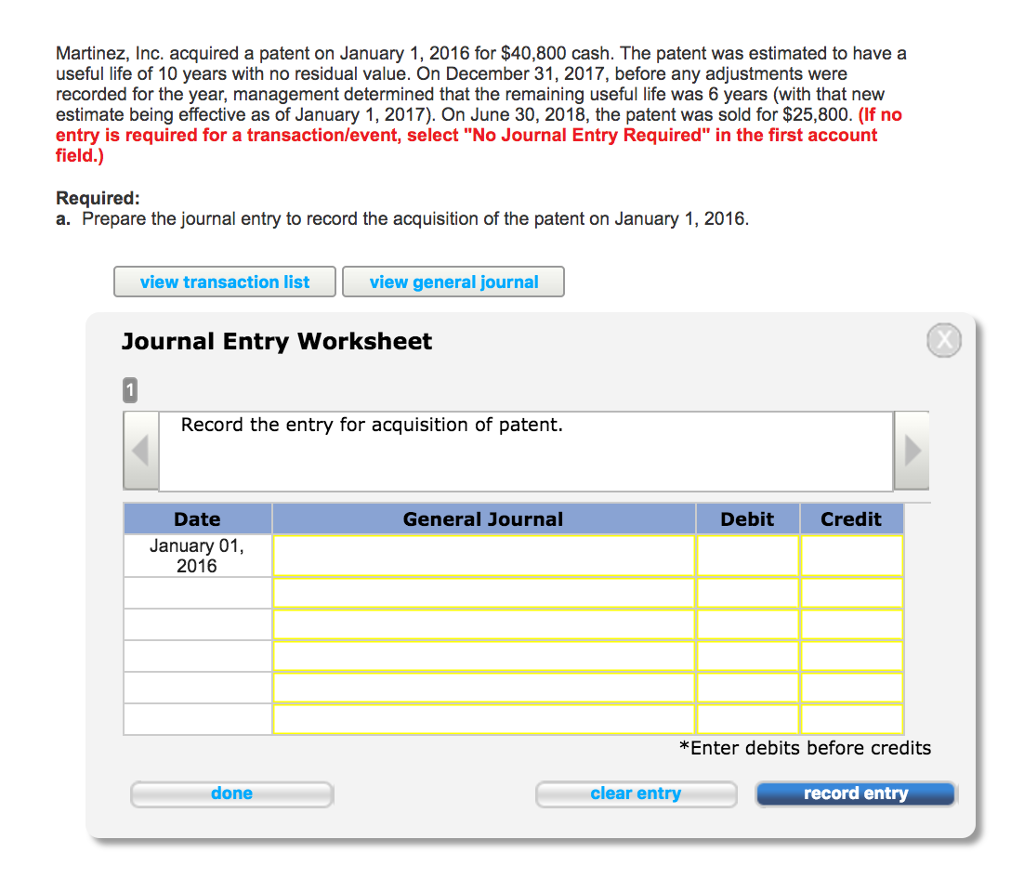

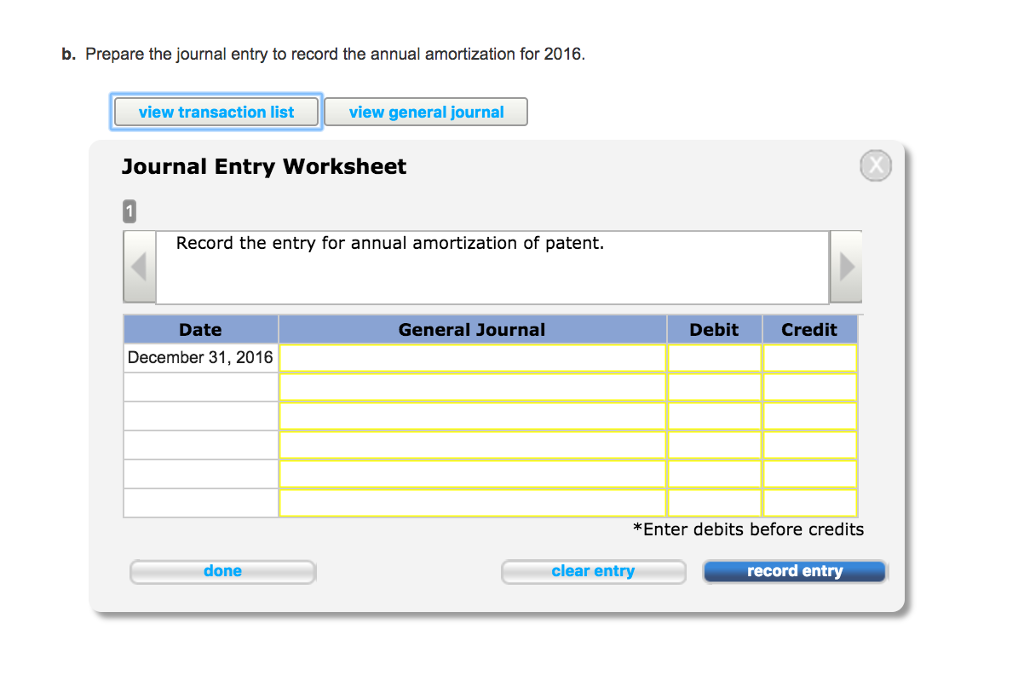

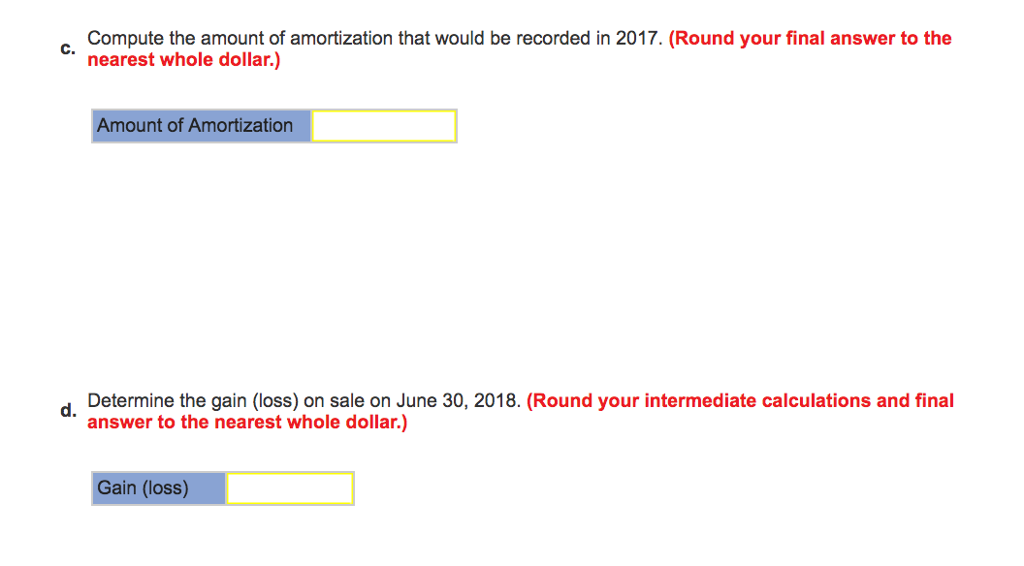

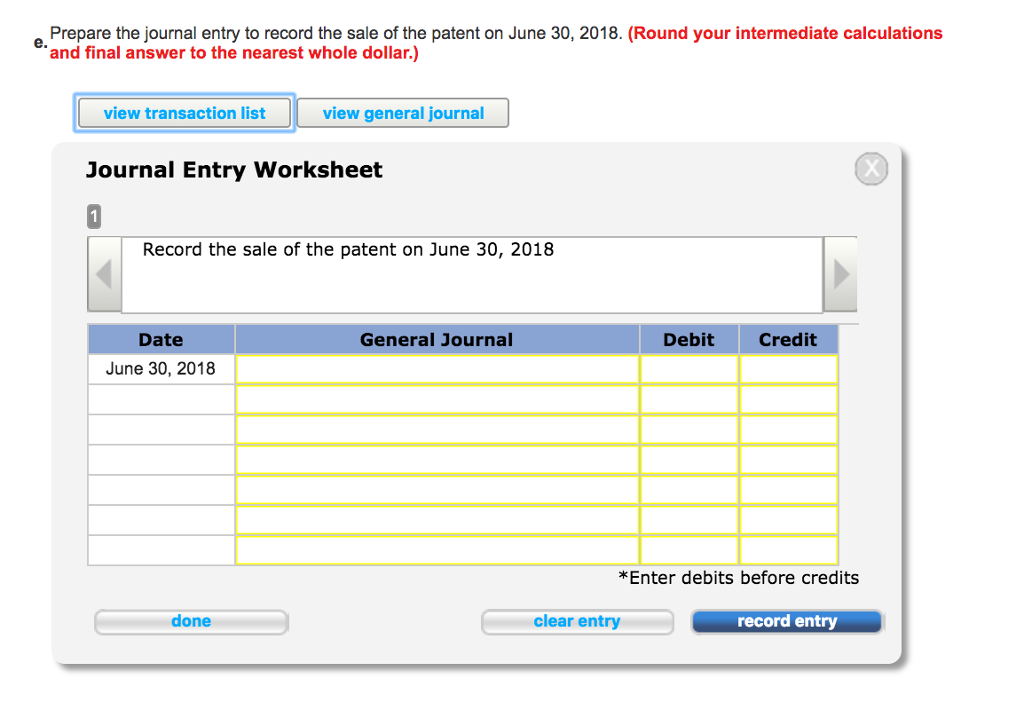

Martinez, Inc. acquired a patent on January 1, 2016 for $40,800 cash. The patent was estimated to have a useful life of 10 years with no residual value. On December 31, 2017, before any adjustments were recorded for the year, management determined that the remaining useful life was 6 years (with that new estimate being effective as of January 1, 2017). On June 30, 2018, the patent was sold for $25,800. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Required: a. Prepare the journal entry to record the acquisition of the patent on January 1, 2016. view transaction list view general journal Journal Entry Worksheet Record the entry for acquisition of patent. General Journal Credit Date Debit January 01 2016 *Enter debits before credits clear entry done record entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts