Question: Please clearly write or show all the calculations and steps, please do not use Excel to calculate. Question 2 (18 marks) David Palmer identified the

Please clearly write or show all the calculations and steps, please do not use Excel to calculate.

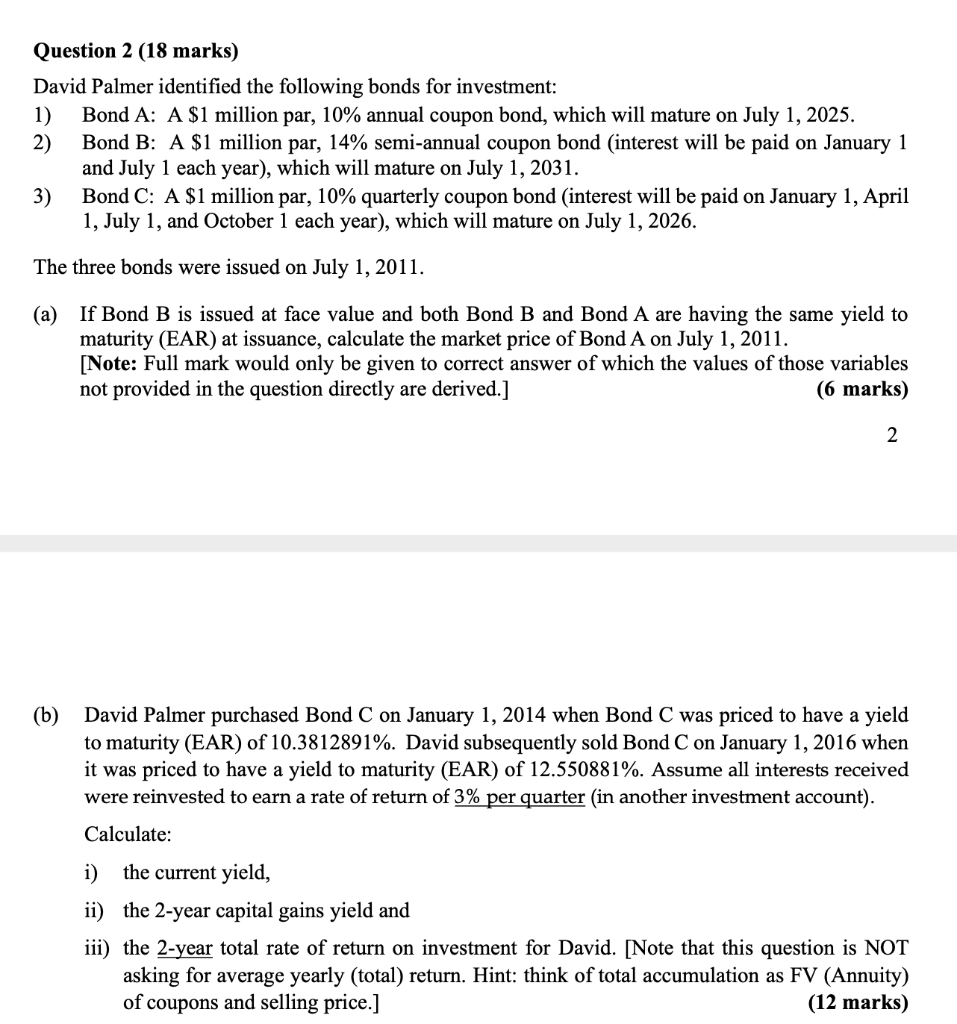

Question 2 (18 marks) David Palmer identified the following bonds for investment: 1) Bond A: A $1 million par, 10% annual coupon bond, which will mature on July 1, 2025. 2) Bond B: A $1 million par, 14% semi-annual coupon bond interest will be paid on January 1 and July 1 each year), which will mature on July 1, 2031. 3) Bond C: A $1 million par, 10% quarterly coupon bond (interest will be paid on January 1, April 1, July 1, and October 1 each year), which will mature on July 1, 2026. The three bonds were issued on July 1, 2011. (a) If Bond B is issued at face value and both Bond B and Bond A are having the same yield to maturity (EAR) at issuance, calculate the market price of Bond A on July 1, 2011. [Note: Full mark would only be given to correct answer of which the values of those variables not provided in the question directly are derived.] (6 marks) (b) David Palmer purchased Bond C on January 1, 2014 when Bond C was priced to have a yield to maturity (EAR) of 10.3812891%. David subsequently sold Bond C on January 1, 2016 when it was priced to have a yield to maturity (EAR) of 12.550881%. Assume all interests received were reinvested to earn a rate of return of 3% per quarter (in another investment account). Calculate: i) the current yield, ii) the 2-year capital gains yield and iii) the 2-year total rate of return on investment for David. [Note that this question is NOT asking for average yearly (total) return. Hint: think of total accumulation as FV (Annuity) of coupons and selling price.] (12 marks) Question 2 (18 marks) David Palmer identified the following bonds for investment: 1) Bond A: A $1 million par, 10% annual coupon bond, which will mature on July 1, 2025. 2) Bond B: A $1 million par, 14% semi-annual coupon bond interest will be paid on January 1 and July 1 each year), which will mature on July 1, 2031. 3) Bond C: A $1 million par, 10% quarterly coupon bond (interest will be paid on January 1, April 1, July 1, and October 1 each year), which will mature on July 1, 2026. The three bonds were issued on July 1, 2011. (a) If Bond B is issued at face value and both Bond B and Bond A are having the same yield to maturity (EAR) at issuance, calculate the market price of Bond A on July 1, 2011. [Note: Full mark would only be given to correct answer of which the values of those variables not provided in the question directly are derived.] (6 marks) (b) David Palmer purchased Bond C on January 1, 2014 when Bond C was priced to have a yield to maturity (EAR) of 10.3812891%. David subsequently sold Bond C on January 1, 2016 when it was priced to have a yield to maturity (EAR) of 12.550881%. Assume all interests received were reinvested to earn a rate of return of 3% per quarter (in another investment account). Calculate: i) the current yield, ii) the 2-year capital gains yield and iii) the 2-year total rate of return on investment for David. [Note that this question is NOT asking for average yearly (total) return. Hint: think of total accumulation as FV (Annuity) of coupons and selling price.] (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts