Question: please code in C# on Visual Basics, Thanks!! Description Through the subsequent assignments, you will gradually develop a human resource management program for Continental University.

please code in C# on Visual Basics, Thanks!!

please code in C# on Visual Basics, Thanks!!

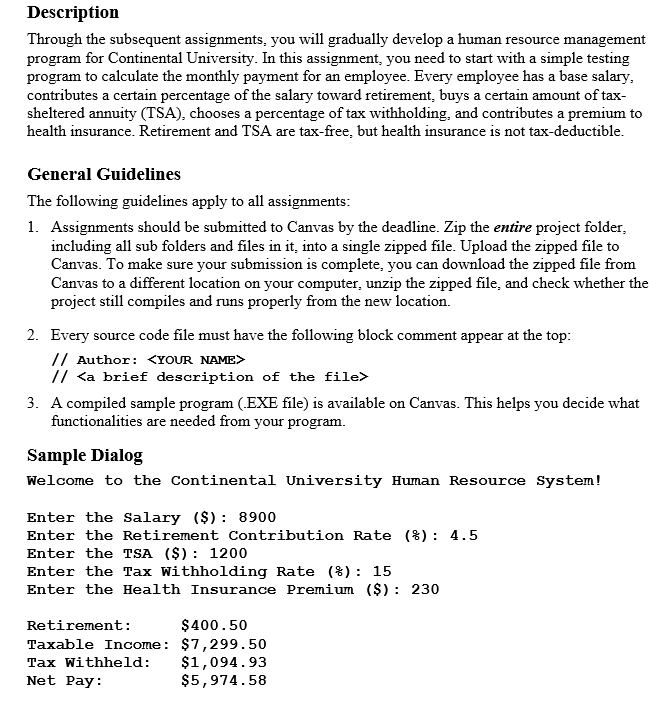

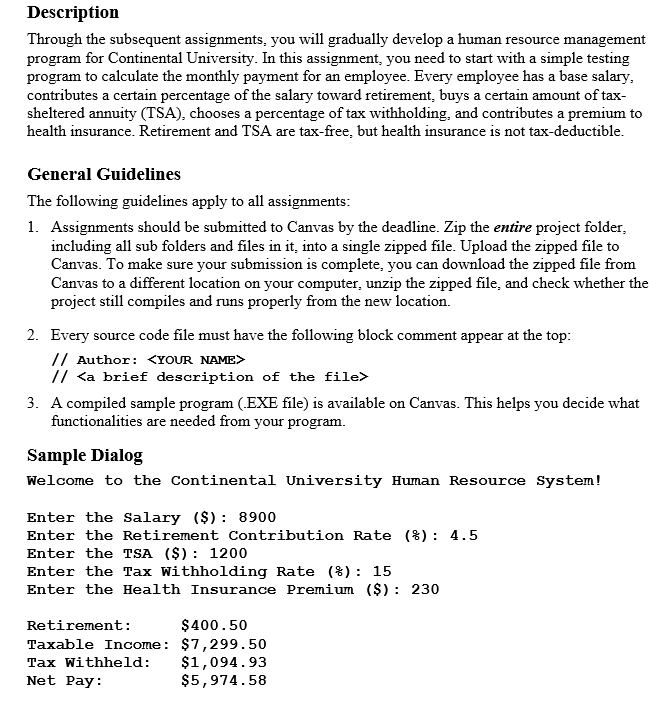

Description Through the subsequent assignments, you will gradually develop a human resource management program for Continental University. In this assignment, you need to start with a simple testing program to calculate the monthly payment for an employee. Every employee has a base salary, contributes a certain percentage of the salary toward retirement, buys a certain amount of tax- sheltered annuity (TSA), chooses a percentage of tax withholding, and contributes a premium to health insurance. Retirement and TSA are tax-free, but health insurance is not tax-deductible. General Guidelines The following guidelines apply to all assignments: 1. Assignments should be submitted to Canvas by the deadline. Zip the entire project folder, including all sub folders and files in it into a single zipped file. Upload the zipped file to Canvas. To make sure your submission is complete, you can download the zipped file from Canvas to a different location on your computer, unzip the zipped file, and check whether the project still compiles and runs properly from the new location. 2. Every source code file must have the following block comment appear at the top: // Author: // 3. A compiled sample program (.EXE file) is available on Canvas. This helps you decide what functionalities are needed from your program. Sample Dialog Welcome to the Continental University Human Resource System! Enter the Salary ($): 8900 Enter the Retirement Contribution Rate (8): 4.5 Enter the TSA ($): 1200 Enter the Tax Withholding Rate (8): 15 Enter the Health Insurance Premium ($): 230 Retirement: $400.50 Taxable Income: $7,299.50 Tax Withheld: $1,094.93 Net Pay: $5,974.58 Description Through the subsequent assignments, you will gradually develop a human resource management program for Continental University. In this assignment, you need to start with a simple testing program to calculate the monthly payment for an employee. Every employee has a base salary, contributes a certain percentage of the salary toward retirement, buys a certain amount of tax- sheltered annuity (TSA), chooses a percentage of tax withholding, and contributes a premium to health insurance. Retirement and TSA are tax-free, but health insurance is not tax-deductible. General Guidelines The following guidelines apply to all assignments: 1. Assignments should be submitted to Canvas by the deadline. Zip the entire project folder, including all sub folders and files in it into a single zipped file. Upload the zipped file to Canvas. To make sure your submission is complete, you can download the zipped file from Canvas to a different location on your computer, unzip the zipped file, and check whether the project still compiles and runs properly from the new location. 2. Every source code file must have the following block comment appear at the top: // Author: // 3. A compiled sample program (.EXE file) is available on Canvas. This helps you decide what functionalities are needed from your program. Sample Dialog Welcome to the Continental University Human Resource System! Enter the Salary ($): 8900 Enter the Retirement Contribution Rate (8): 4.5 Enter the TSA ($): 1200 Enter the Tax Withholding Rate (8): 15 Enter the Health Insurance Premium ($): 230 Retirement: $400.50 Taxable Income: $7,299.50 Tax Withheld: $1,094.93 Net Pay: $5,974.58

please code in C# on Visual Basics, Thanks!!

please code in C# on Visual Basics, Thanks!!