Question: PLEASE COME UP WITH ORIGINAL ANSWER AND DO NOT COPY PREVIOUS ANSWERS OF THIS QUESTION ON CHEGG 5. (a) Suppose that a stock currently trades

PLEASE COME UP WITH ORIGINAL ANSWER AND DO NOT COPY PREVIOUS ANSWERS OF THIS QUESTION ON CHEGG

PLEASE COME UP WITH ORIGINAL ANSWER AND DO NOT COPY PREVIOUS ANSWERS OF THIS QUESTION ON CHEGG

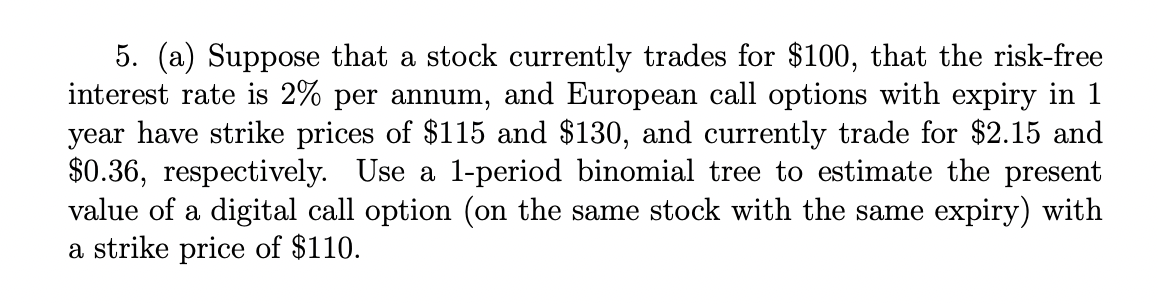

5. (a) Suppose that a stock currently trades for $100, that the risk-free interest rate is 2% per annum, and European call options with expiry in 1 year have strike prices of $115 and $130, and currently trade for $2.15 and $0.36, respectively. Use a 1-period binomial tree to estimate the present value of a digital call option (on the same stock with the same expiry) with a strike price of $110

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts