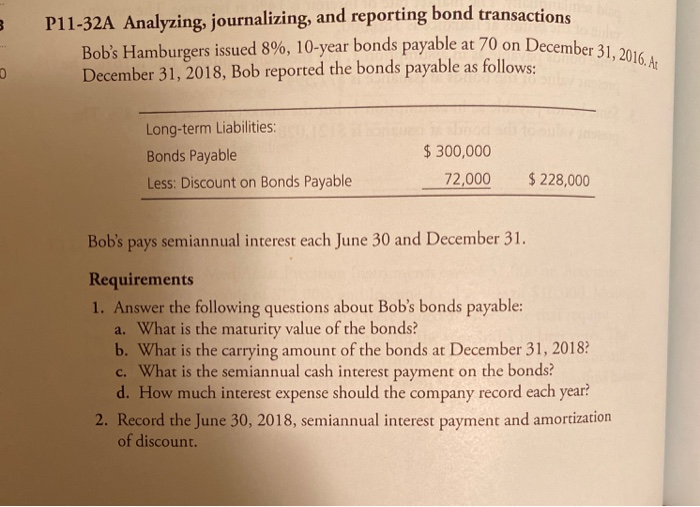

Question: Please complete 32A and 34A P11-32A Analyzing journalizing, and reporting bond transactions Bob's Hamburgers issued 8%, 10-year bonds payable at 70 on December 31 December

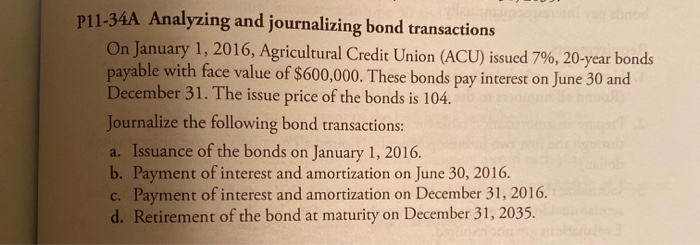

P11-32A Analyzing journalizing, and reporting bond transactions Bob's Hamburgers issued 8%, 10-year bonds payable at 70 on December 31 December 31, 2018, Bob reported the bonds payable as follows: vable at 70 on December 31, 2016. At Long-term Liabilities: Bonds Payable Less: Discount on Bonds Payable $ 300,000 72,000 $228,000 Bob's pays semiannual interest each June 30 and December 31. Requirements 1. Answer the following questions about Bob's bonds payable: a. What is the maturity value of the bonds? b. What is the carrying amount of the bonds at December 31, 2018? c. What is the semiannual cash interest payment on the bonds? d. How much interest expense should the company record each year? 2. Record the June 30, 2018, semiannual interest payment and amortization of discount. P11-34A Analyzing and journalizing bond transactions On January 1, 2016, Agricultural Credit Union (ACU) issued 7%, 20-year bonds payable with face value of $600,000. These bonds pay interest on June 30 and December 31. The issue price of the bonds is 104. Journalize the following bond transactions: a. Issuance of the bonds on January 1, 2016. b. Payment of interest and amortization on June 30, 2016. c. Payment of interest and amortization on December 31, 2016. d. Retirement of the bond at maturity on December 31, 2035

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts