Question: please complete a value analysis and D&D schedule for the date of acquisition. complete a value analysis and determination and distribution schedule for thr date

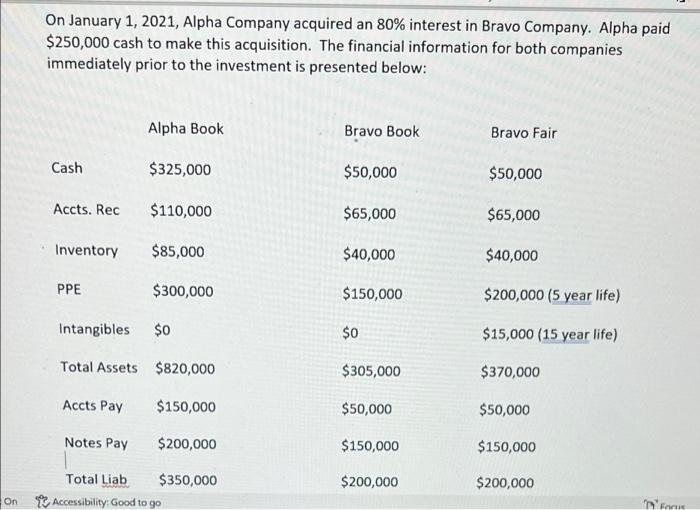

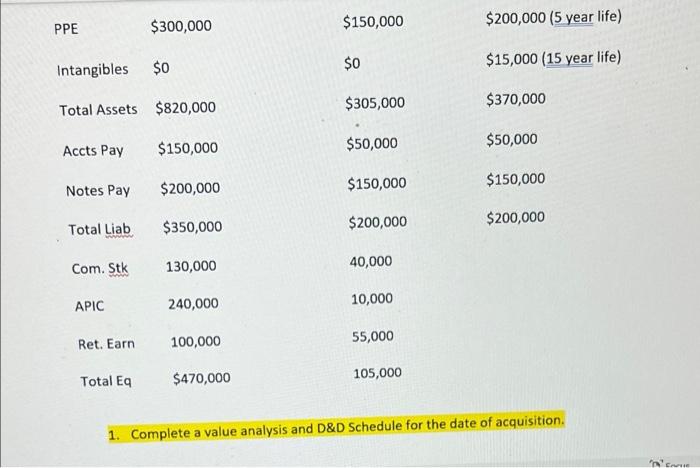

On January 1, 2021, Alpha Company acquired an 80% interest in Bravo Company. Alpha paid $250,000 cash to make this acquisition. The financial information for both companies immediately prior to the investment is presented below: Alpha Book Bravo Book Bravo Fair Cash $325,000 $50,000 $50,000 Accts. Rec $110,000 $65,000 $65,000 Inventory $85,000 $40,000 $40,000 PPE $300,000 $150,000 $200,000 (5 year life) Intangibles $0 $0 $15,000 (15 year life) Total Assets $820,000 $305,000 $370,000 Accts Pay $150,000 $50,000 $50,000 Notes Pay $200,000 $150,000 $150,000 $200,000 Total Liab $350,000 on Accessibility: Good to go $200,000 Faru PPE $300,000 $150,000 $200,000 (5 year life) Intangibles $0 $0 $15,000 (15 year life) $305,000 $370,000 Total Assets $820,000 $50,000 Accts Pay $150,000 $50,000 $200,000 Notes Pay $150,000 $150,000 $200,000 Total Liab $350,000 $200,000 Com. Stk 130,000 40,000 APIC 240,000 10,000 Ret. Earn 100,000 55,000 Total Eq $470,000 105,000 1. Complete a value analysis and D&D Schedule for the date of acquisition. NE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts