Question: PLEASE COMPLETE A-C! I GIVE RATINGS!! SHOW WORK!! (a) Jeffries, Inc., has 6 percent coupon bonds on the market that currently have 11 years left

PLEASE COMPLETE A-C!

PLEASE COMPLETE A-C!

I GIVE RATINGS!! SHOW WORK!!

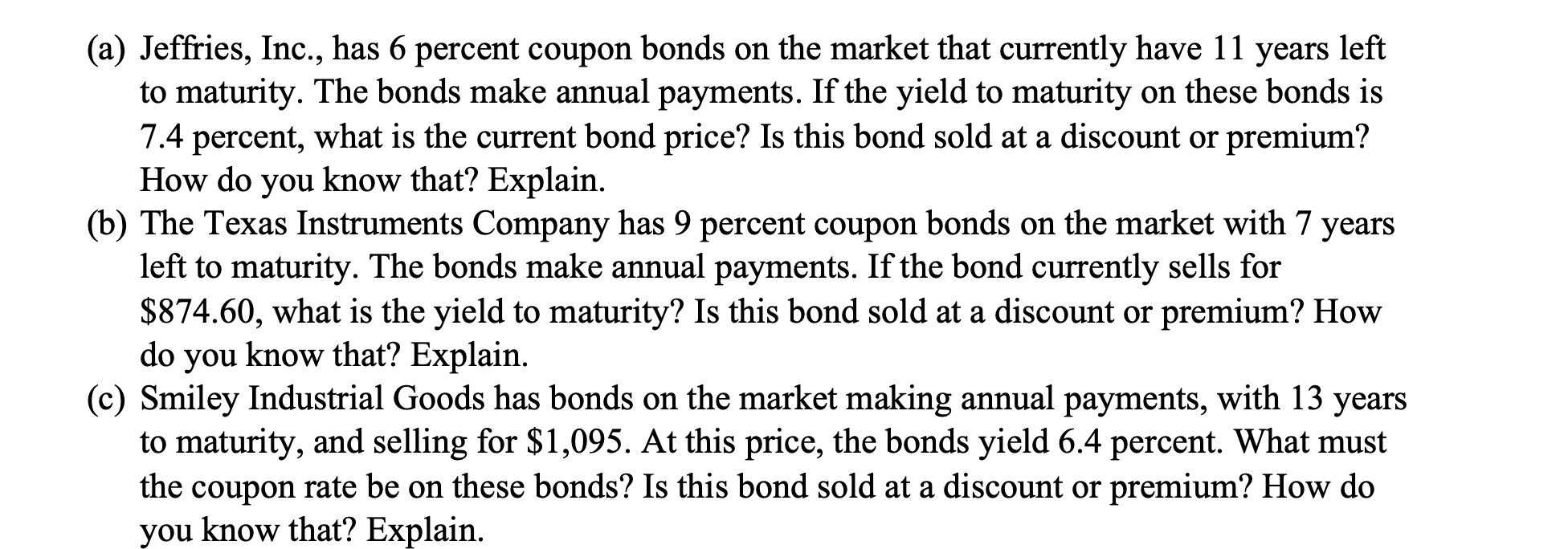

(a) Jeffries, Inc., has 6 percent coupon bonds on the market that currently have 11 years left to maturity. The bonds make annual payments. If the yield to maturity on these bonds is 7.4 percent, what is the current bond price? Is this bond sold at a discount or premium? How do you know that? Explain. (b) The Texas Instruments Company has 9 percent coupon bonds on the market with 7 years left to maturity. The bonds make annual payments. If the bond currently sells for $874.60, what is the yield to maturity? Is this bond sold at a discount or premium? How do you know that? Explain. (c) Smiley Industrial Goods has bonds on the market making annual payments, with 13 years to maturity, and selling for $1,095. At this price, the bonds yield 6.4 percent. What must the coupon rate be on these bonds? Is this bond sold at a discount or premium? How do you know that? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts