Question: please complete all 3 parts in a clear format Which of the following is consistent with the liquidity premium theory of the yleld curve? Check

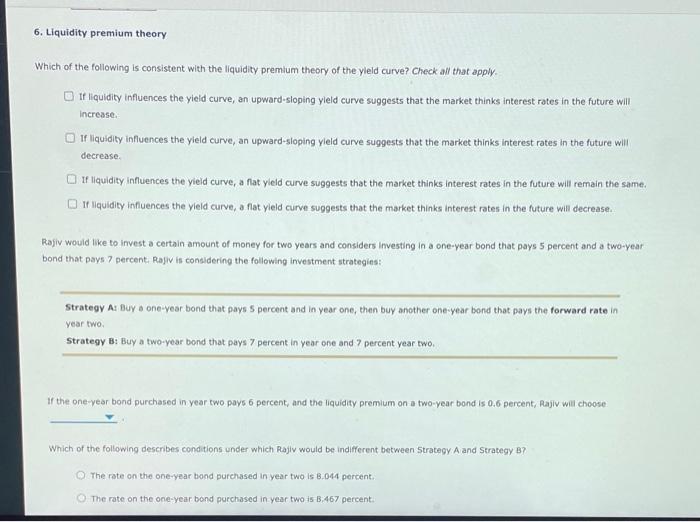

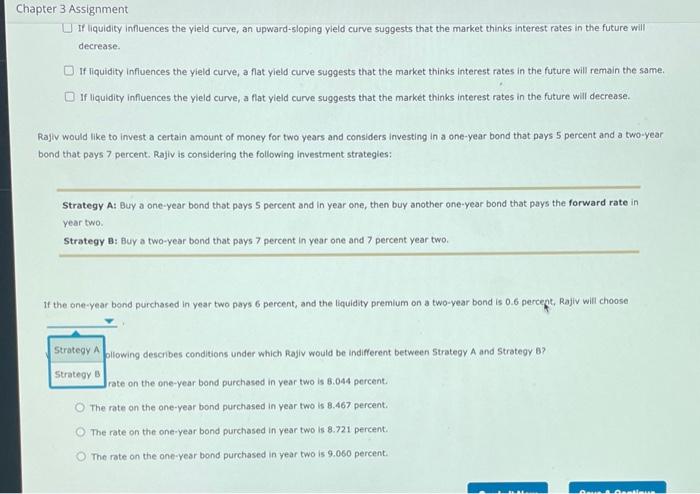

Which of the following is consistent with the liquidity premium theory of the yleld curve? Check all that apply. If liquidity influences the yieid curve, an upward-sloping yleld curve suggests that the market thinks interest rates in the future will increase. If liquidity influences the yield curve, an upward-sloping yield curve suggests that the market thinks interest rates in the future will decrease. If liquidity influences the yieid curve, a fiat yield curve suggests that the market thinks interest rates in the future will remain the same. If liquidity influences the vield curve, a flat yield curve suggests that the market thinks interest rates in the future will decrease. Rajiv would like to invest a certain amount of money for two years and considers investing in a one-year bond that pays 5 percent and a two-year bond that pays 7 percent. Ragiv is considering the following investment strategies: Strategy A: Buy a one-year bond that pays 5 percent and in year one, then buy another one-year bond that pays the forward rate in year two. Strategy B: Buy a two-year bond that pays 7 percent in year one and 7 percent year two. If the one-year bond purchased in year two pays 6 percent, and the liquidity premium on a two-year bond is 0.6 percent, Rajlu will choose Which of the following describes conditions under which Rajlv would be indifferent between Strategy A and Strategy B? The rate on the one-year bond purchased in year two is 8.044 percent. The rate on the one-year bond purchased in year two is B,467 persent. If liquidity influences the yield curve, an upward-sloping yield curve suggests that the market thinks interest rates in the future will decrease. If liquidity influences the yield curve, a flat yield curve suggests that the market thinks interest rates in the future will remain the same. If liquidity influences the yleld curve, a flat yield curve suggests that the market thinks interest rates in the future will decrease. Rajlv would like to invest a certain amount of money for two years and considers investing in a one-year bond that pays 5 percent and a two-year bond that pays 7 percent. Rajiv is considering the following investment strategies: Strategy A: Buy a one-year bond that pays 5 percent and in year one, then buy another one-year bond that pays the forward rate in year two. Strategy B: Buy a two-year bond that pays 7 percent in year one and 7 percent year two. If the one-year bond purchased in year two pays 6 percent, and the liquidity premium on a two-vear bond is 0.6 percept, Rajiv will choose llowing describes conditions under which Rajiv would be indifferent between Strategy A and Strategy B? rate on the one-year bond purchased in year two is 8.044 percent. The rate on the one-year bond purchased in year two is 8.467 percent. The rate on the one-year bond purchased in year two is 8.721 percent. The rate on the one-year bond purchased in year two is 9.060 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts