Question: please complete all 4 questions Using the double declining method of depreciation, a company has a building costing $500,000 that needed a new roof costing

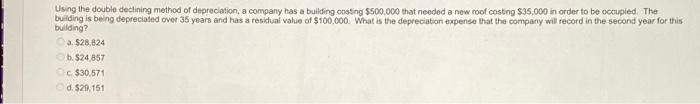

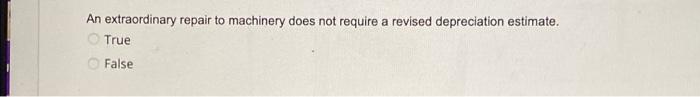

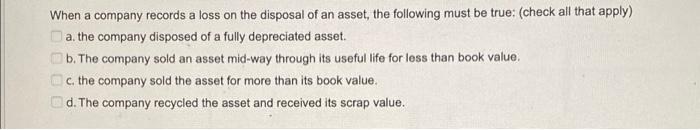

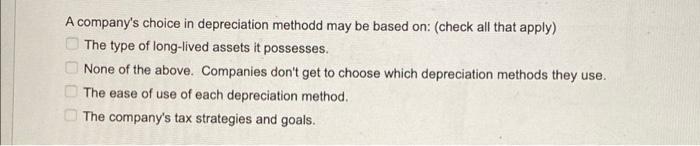

Using the double declining method of depreciation, a company has a building costing $500,000 that needed a new roof costing $35,000 in order to be occupied. The building is being depreciated over 35 years and has a residual value of $100,000. What is the depreciation expense that the company will record in the second year for this building? a $28,824 b. $24.857 c $30.571 d. $29.151 An extraordinary repair to machinery does not require a revised depreciation estimate. True False When a company records a loss on the disposal of an asset, the following must be true: (check all that apply) a the company disposed of a fully depreciated asset. b. The company sold an asset mid-way through its useful life for less than book value c. the company sold the asset for more than its book value. d. The company recycled the asset and received its scrap value. A company's choice in depreciation methodd may be based on: (check all that apply) The type of long-lived assets it possesses. None of the above. Companies don't get to choose which depreciation methods they use. The ease of use of each depreciation method. The company's tax strategies and goals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts