Question: Please complete all During the current year, Hal Leff sustained a serious injury in the course of his employment. As a result of this injury,

Please complete all

Please complete all

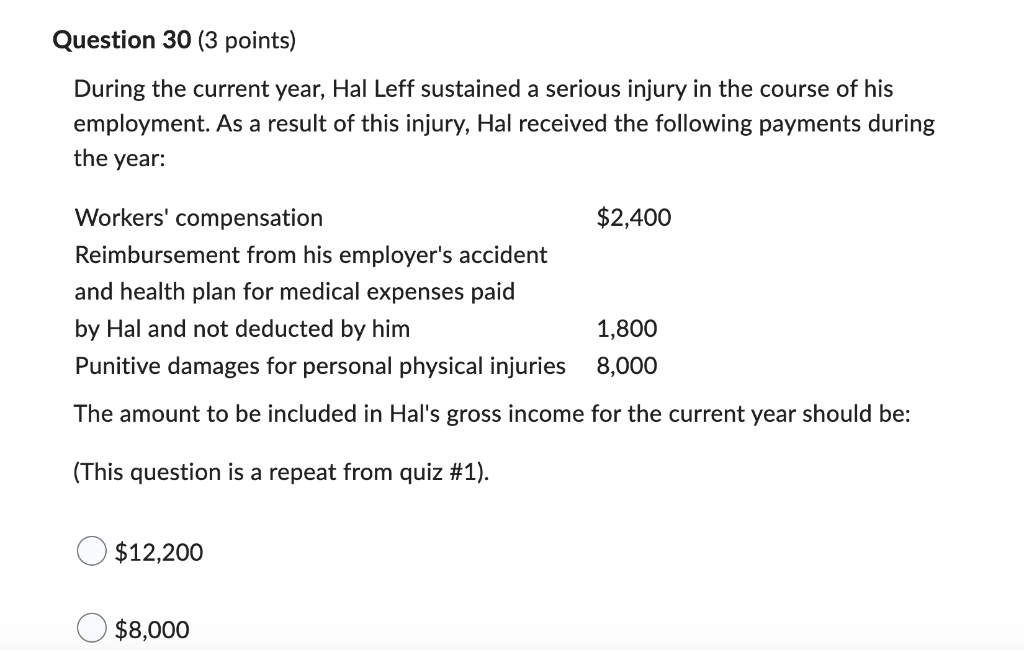

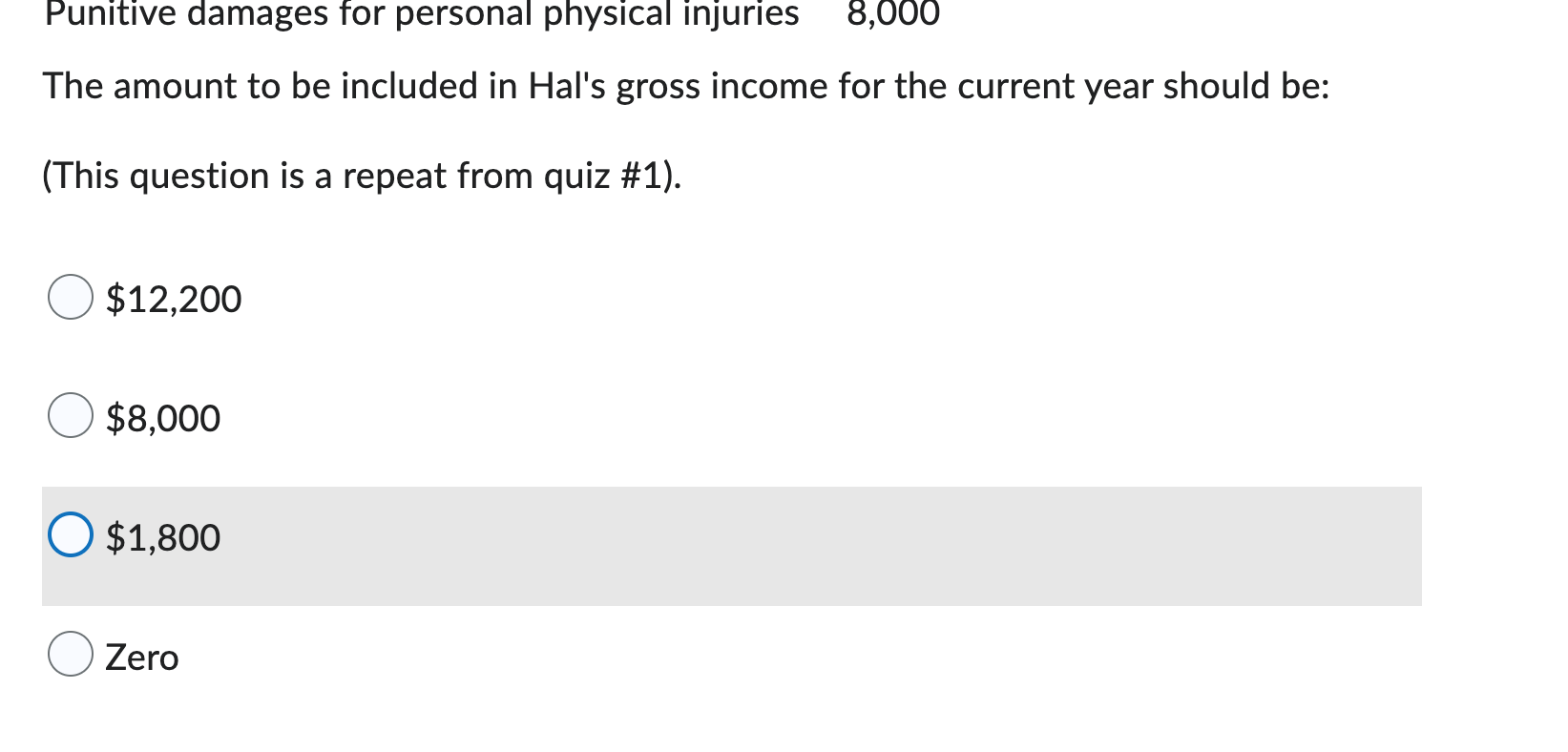

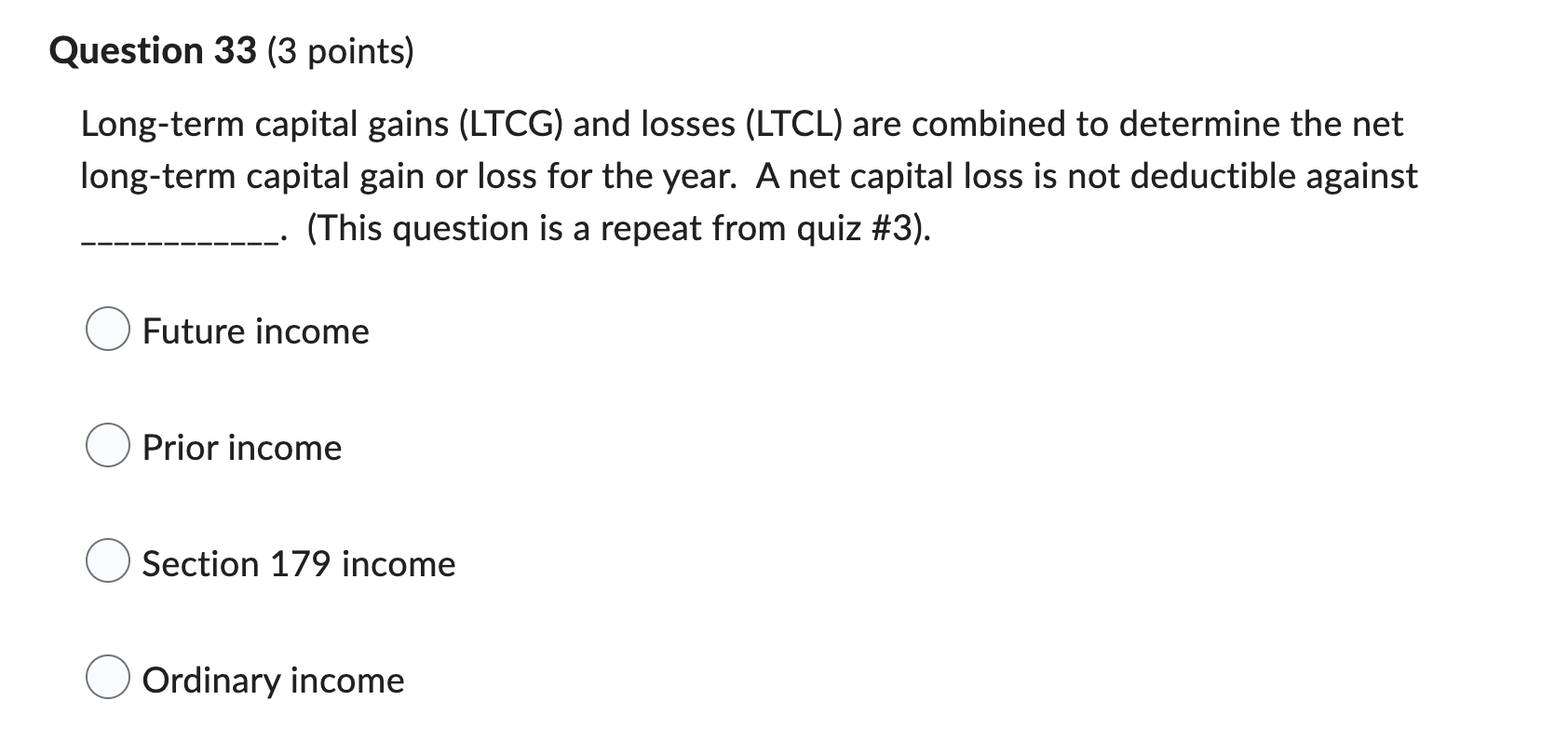

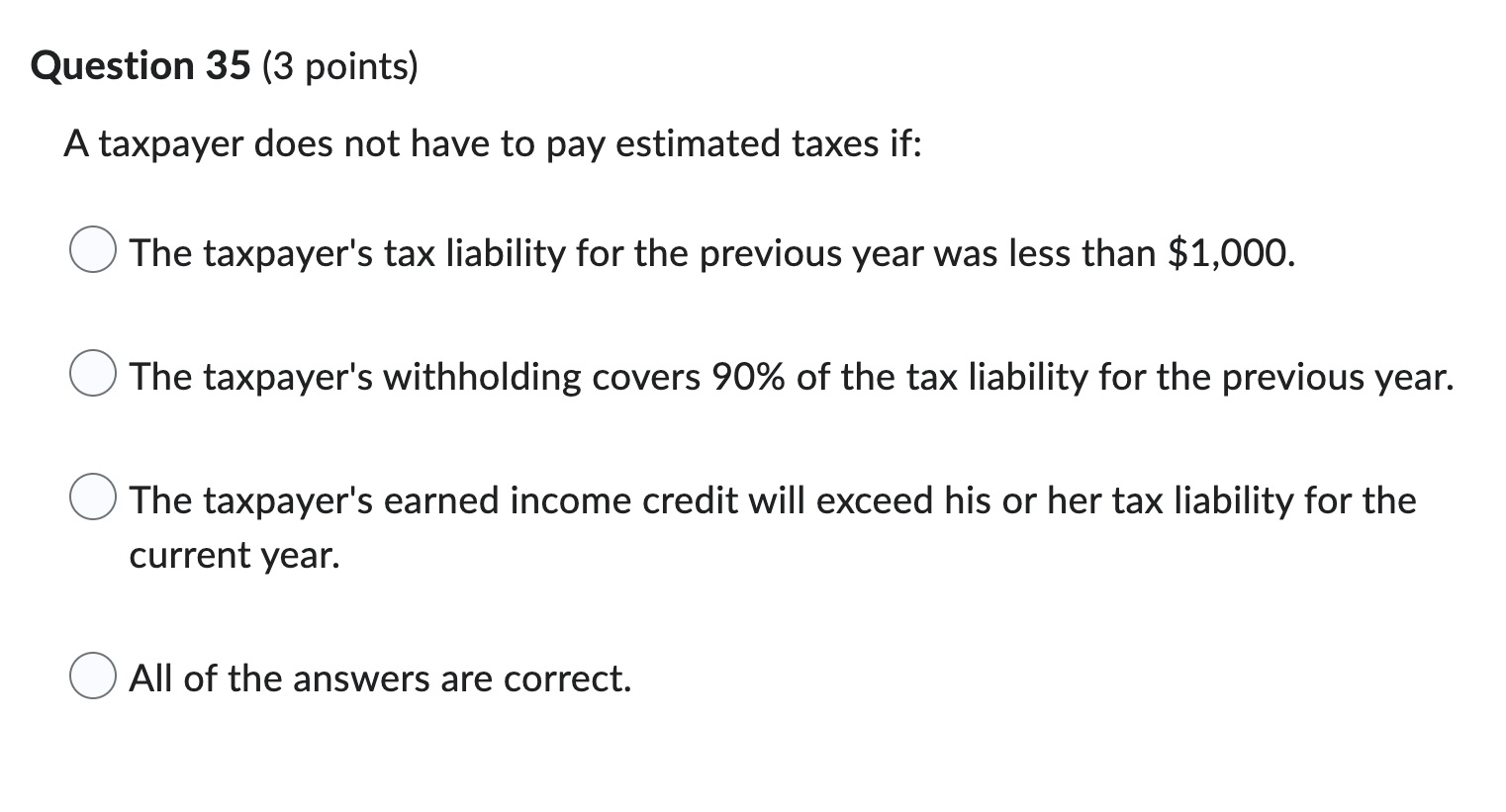

During the current year, Hal Leff sustained a serious injury in the course of his employment. As a result of this injury, Hal received the following payments during the year: The amount to be included in Hal's gross income for the current year should be: (This question is a repeat from quiz #1). $12,200 $8,000 Punitive damages for personal physical injuries 8,000 The amount to be included in Hal's gross income for the current year should be: (This question is a repeat from quiz #1). $12,200 $8,000 $1,800 Zero Long-term capital gains (LTCG) and losses (LTCL) are combined to determine the net long-term capital gain or loss for the year. A net capital loss is not deductible against (This question is a repeat from quiz #3). Future income Prior income Section 179 income Ordinary income Ruestion 35 (3 points) A taxpayer does not have to pay estimated taxes if: The taxpayer's tax liability for the previous year was less than $1,000. The taxpayer's withholding covers 90% of the tax liability for the previous year. The taxpayer's earned income credit will exceed his or her tax liability for the current year. All of the answers are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts