Question: Please complete all parts 2a - 3b Exercise 5-78 Establish an allowance for uncollectible accounts and write off accounts receivable (LO5- 3,5-4) During Year 1,

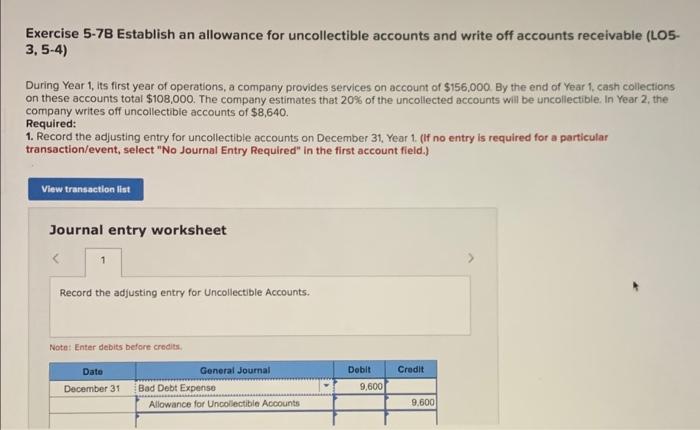

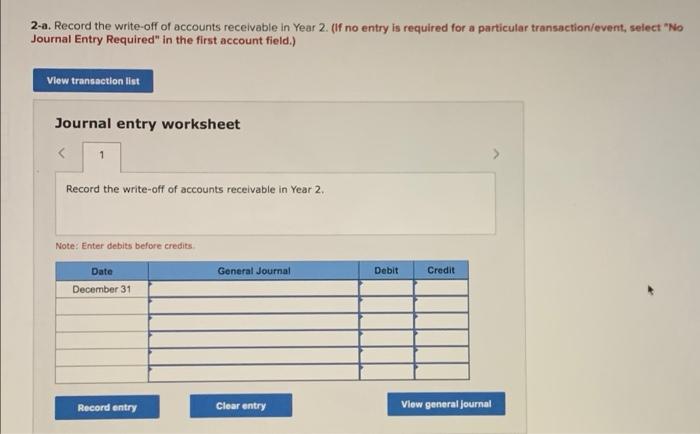

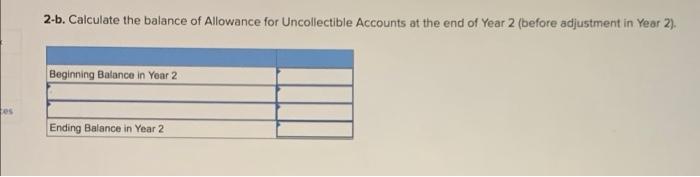

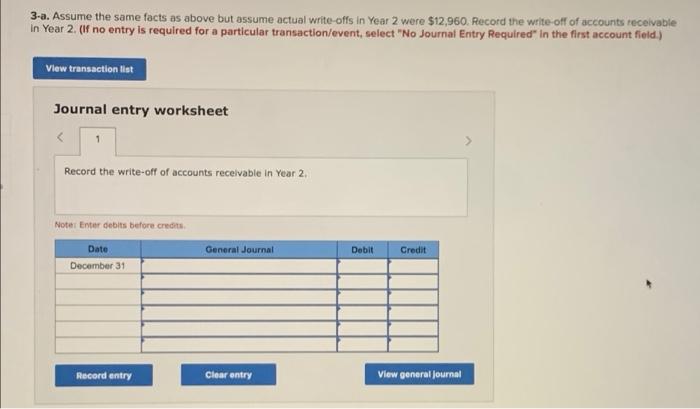

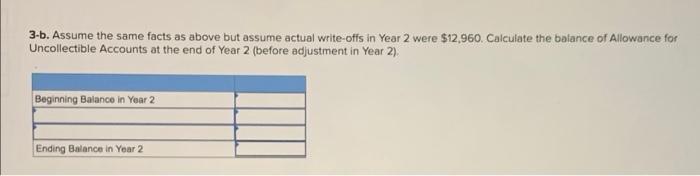

Exercise 5-78 Establish an allowance for uncollectible accounts and write off accounts receivable (LO5- 3,5-4) During Year 1, its first year of operations, a company provides services on account of $156,000. By the end of Year 1. cash collections on these accounts total $108,000. The company estimates that 20% of the uncollected accounts will be uncollectible In Year 2, the company writes off uncollectible accounts of $8,640. Required: 1. Record the adjusting entry for uncollectible accounts on December 31, Year 1. (if no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the adjusting entry for Uncollectible Accounts. Note: Enter debits before credits. Credit Dato December 31 General Journal Bad Debt Expense Allowance for Uncollectible Accounts Dobit 9,600 9,600 2-a. Record the write-off of accounts receivable In Year 2. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the write-off of accounts receivable in Year 2. Note: Enter debits before credits General Journal Debit Credit Date December 31 Record entry Clear entry View general Journal 2-b. Calculate the balance of Allowance for Uncollectible Accounts at the end of Year 2 (before adjustment in Year 2). Beginning Balance in Year 2 es Ending Balance in Year 2 3-a. Assume the same facts as above but assume actual write-offs in Year 2 were $12,960. Record the write-off of accounts receivable In Year 2. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts