Question: please complete all parts to the question. answer for part a is wrong and is NOT $23.88 You are evaluating a project that requires an

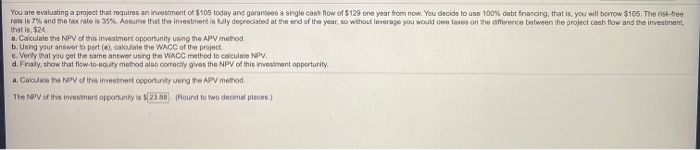

You are evaluating a project that requires an investment of $105 today and garantees a single cash flow of $129 one year from now. You decide to use 100% debt financing, that is, you will borrow $105. The risk-free rate is 7% and the tax rate is 35%. Assume that the investment is fully deprecated at the end of the year, so without leverage you would owe taxes on the difference between the project cash flow and the investment, that is, 524 a. Calculate the NPV of this investment opportunity using the APV method b. Using your answer to purt (a), calculate the WACC of the project Verly that you get the same answer using the WACC method to calculate NPV. d. Finally, show that flow.to-equity method also correctlygves the NPV of this investment opportunity a. Cal. NPV of this investment opportunity using the APV method The NPV of this investment opportunity is $23.80 (Round to two decimal places) You are evaluating a project that requires an investment of $105 today and garantees a single cash flow of $129 one year from now. You decide to use 100% debt financing, that is, you will borrow $105. The risk-free rate is 7% and the tax rate is 35%. Assume that the investment is fully deprecated at the end of the year, so without leverage you would owe taxes on the difference between the project cash flow and the investment, that is, 524 a. Calculate the NPV of this investment opportunity using the APV method b. Using your answer to purt (a), calculate the WACC of the project Verly that you get the same answer using the WACC method to calculate NPV. d. Finally, show that flow.to-equity method also correctlygves the NPV of this investment opportunity a. Cal. NPV of this investment opportunity using the APV method The NPV of this investment opportunity is $23.80 (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts