Question: Please complete all stages: 1) Total cost with table 2) Journal Entry for acquisition 3) Journal Entry for each case (4 cases) On October 1,

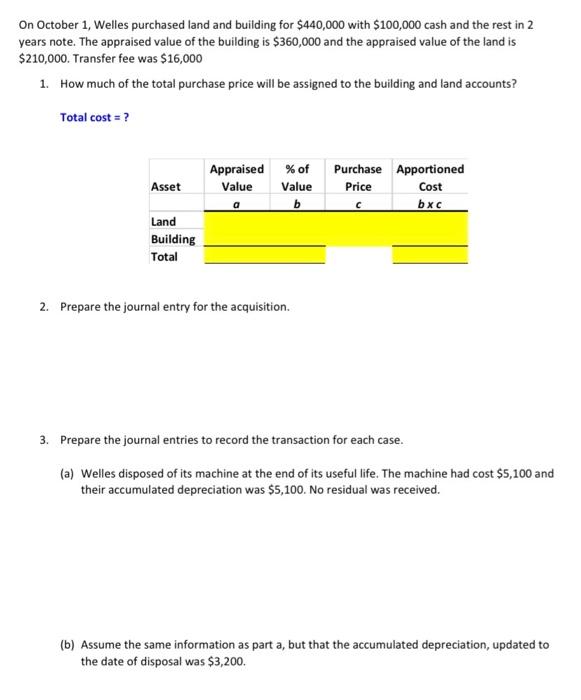

On October 1, Welles purchased land and building for $440,000 with $100,000 cash and the rest in 2 years note. The appraised value of the building is $360,000 and the appraised value of the land is $210,000. Transfer fee was $16,000 1. How much of the total purchase price will be assigned to the building and land accounts? Total cost = ? Appraised Value Asset % of Value b Purchase Apportioned Price Cost bxc a C Land Building Total 2. Prepare the journal entry for the acquisition. 3. Prepare the journal entries to record the transaction for each case. (a) Welles disposed of its machine at the end of its useful life. The machine had cost $5,100 and their accumulated depreciation was $5,100. No residual was received. (b) Assume the same information as part a, but that the accumulated depreciation, updated to the date of disposal was $3,200. (c) Assume the same information as part a, but that the accumulated depreciation, updated to the date of disposal was $3,200, and the cash was received for the salvage value of $1,000. (d) Assume the same information as part a, but that the accumulated depreciation, updated to the date of disposal was $4,600, and the cash was received for the salvage value of $1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts