Question: please complete both 1. You are trying to decide whether to refinance your property loan. Four years ago you took out a 30 year fixed

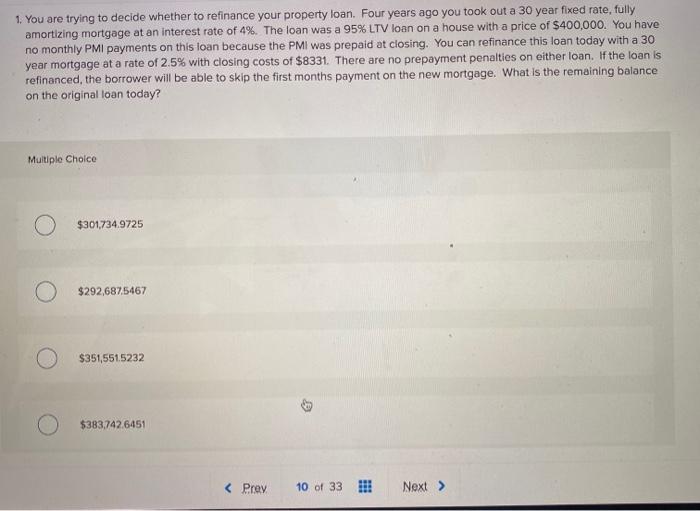

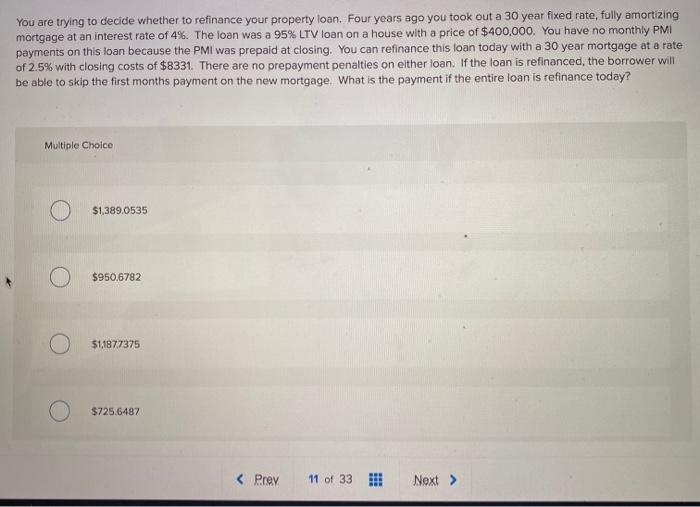

1. You are trying to decide whether to refinance your property loan. Four years ago you took out a 30 year fixed rate, fully amortizing mortgage at an interest rate of 4%. The loan was a 95% LTV loan on a house with a price of $400,000. You have no monthly PMI payments on this loan because the PMI was prepaid at closing. You can refinance this loan today with a 30 year mortgage at a rate of 2.5% with closing costs of $8331. There are no prepayment penalties on either loan. If the loan is refinanced, the borrower will be able to skip the first months payment on the new mortgage. What is the remaining balance on the original loan today? Multiple Choice O $301,734.9725 $292,687,5467 $351,551.5232 $383,742.6451 You are trying to decide whether to refinance your property loan. Four years ago you took out a 30 year fixed rate, fully amortizing mortgage at an interest rate of 4%. The loan was a 95% LTV loan on a house with a price of $400,000. You have no monthly PMI payments on this loan because the PMI was prepaid at closing. You can refinance this loan today with a 30 year mortgage at a rate of 2.5% with closing costs of $8331. There are no prepayment penalties on either loan. If the loan is refinanced, the borrower will be able to skip the first months payment on the new mortgage. What is the payment if the entire loan is refinance today? Multiple Choice O $13890535 $950.6782 51,187.7375 $725.6487

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts