Question: please complete both for upvote QUESTION 3 Javier recently graduated and started his career with DNL Inc. DNL provides a defined benefit plan to all

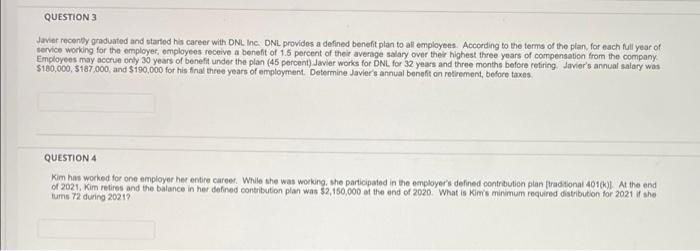

QUESTION 3 Javier recently graduated and started his career with DNL Inc. DNL provides a defined benefit plan to all employees. According to the terms of the plan, for each full year of service working for the employer, employees receive a benefit of 1.5 percent of their average salary over their highest three years of compensation from the company Employees may accrue only 30 years of benefit under the plan (45 percent) Javier works for DNL for 32 years and three months before retiring. Javier's annual salary was $180,000, $187,000, and $190,000 for his final three years of employment. Determine Javier's annual benefit on retirement, before taxes. QUESTION 4 Kim has worked for one employer her entire career. While she was working, she participated in the employer's defined contribution plan (traditional 401(k)] At the end of 2021, Kim retires and the balance in her defined contribution plan was $2,150,000 at the end of 2020. What is Kim's minimum required distribution for 2021 if she tums 72 during 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts