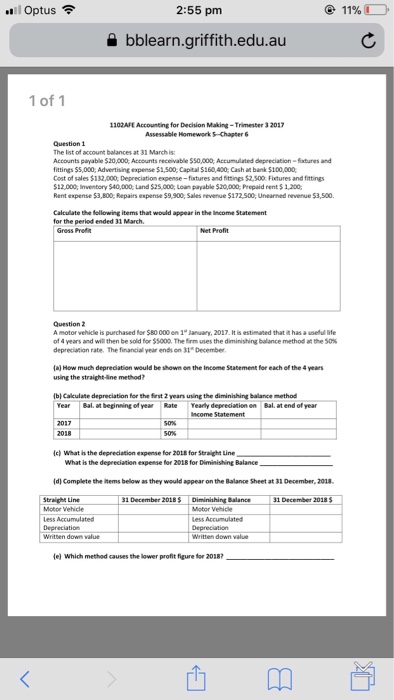

Question: Please complete both questions and show work, format does not matter. Thanks!! #811 Optus 2:55 pm bblearn.griffith.edu.au 1 of 1 1102AFE Accounting for Decision Making-Trimester

#811 Optus 2:55 pm bblearn.griffith.edu.au 1 of 1 1102AFE Accounting for Decision Making-Trimester 3 2037 Assessable Homework Chapter6 Question1 Accounts payable $20,000 Accounts receivable $50,000 Accumulated depreciation-fxtures and fittings $5,000, Advertising expense $1,500, Capital $160,400 Cash a bank $100,000 Cost of sales $132,000, Depreciation expense-fxtures and fittings $2,500 Ftures and fittings $12,000, Inventory $40,000 Land $25,000, Loan payable $20,000, Prepaid rent $ 1,200 Rent expense $3,800, Repairs expense $9,900, Sales revenue $172 500, Unearned revenue $3,500 Calculate the following items that would appear in the Income Statement for the period ended 31 March Gross Prefit Question 2 A motor vehicle is purchased for $80 000 on 1" January, 2017. It is estimated that it has a uselul life Of 4 years and wil then be sold for $5000, Therm uses the diminishing balance method at the 50% depreciation rate. The financial year endi on 31 December (a) How much depreciation would be shown en the Income Statement for each of the 4 years using the straight-ine method? bl Calculate depreciation for the first 2 years using the diminishing balance method Year Bal, at beginning of yr Rate Yealy depredation on Bal. at end of year c) What is the depreciation expense for 20L8 for Straicht Line What is the depreciation expense for 2018 for Diminishing Balance (d) Complete the items below as they would appear on the Balance Sheet at 3 December, 2018 1 Decembe2018 Diminishing Balance3 December 2018 Motor Vehicle e) Which methed causes the lower profit figure for 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts