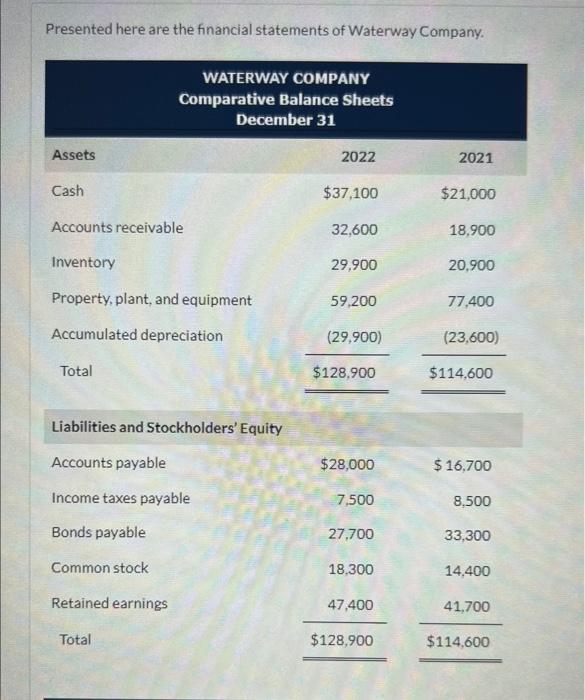

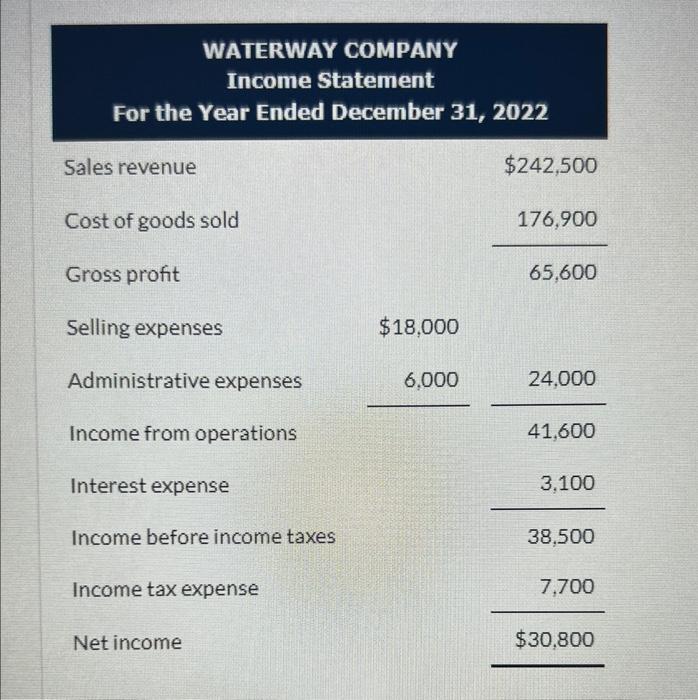

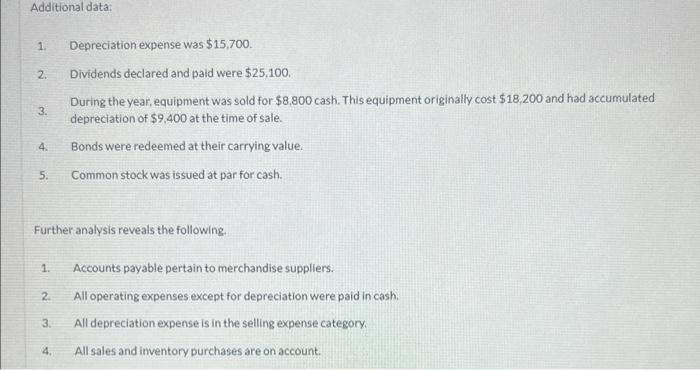

Question: please complete both steps drop down options drop down options Presented here are the financial statements of Waterway Company. 1. Depreciation expense was $15,700. 2.

drop down options

drop down options  drop down options

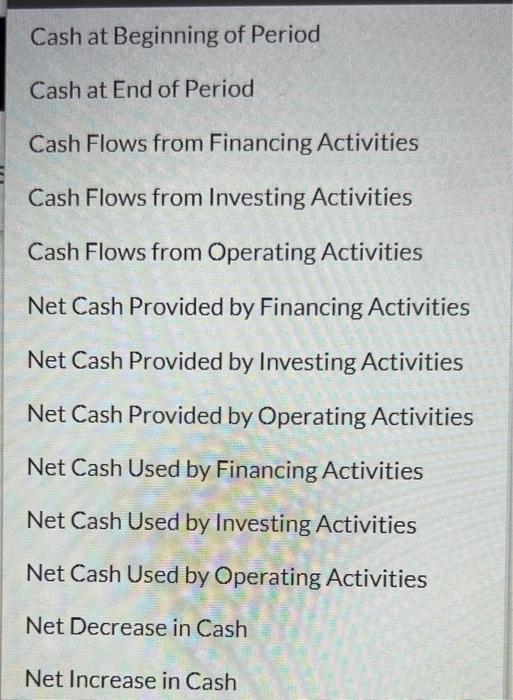

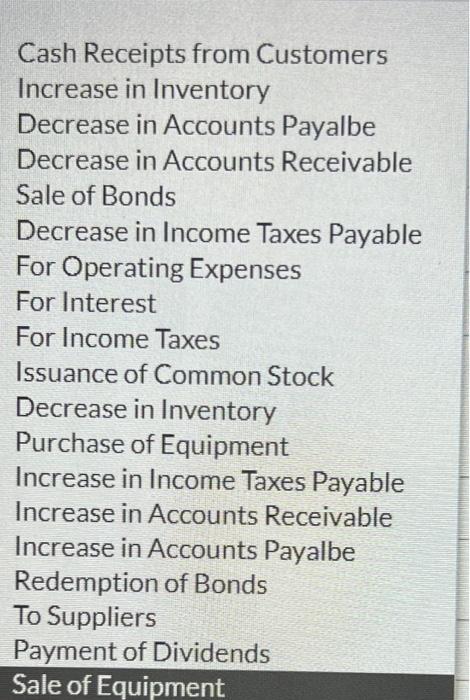

drop down options Presented here are the financial statements of Waterway Company. 1. Depreciation expense was $15,700. 2. Dividends declared and paid were $25,100. 3. During the year, equipment was sold for $8,800 cash. This equipment originally cost $18,200 and had accumulated depreciation of $9,400 at the time of sale. 4. Bonds were redeemed at their carrying value. 5. Common stock was issued at par for cash. Further analysis reveals the following. 1. Accounts payable pertain to merchandise suppliers. 2. All operating expenses except for depreciation were paid in cash. 3.- All depreciation expense is in the selling expense category. 4. All sales and inventory purchases are on account. smoby ysed jo zuawaqeas Compute free cash flow. (Enter negative amount using either a negative sign preceding the number eg. 45 or porentheses e.g. (45).) Free cashflow $ Cash at Beginning of Period Cash at End of Period Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash Used by Financing Activities Net Cash Used by Investing Activities Net Cash Used by Operating Activities Net Decrease in Cash Net Increase in Cash Cash Receipts from Customers Increase in Inventory Decrease in Accounts Payalbe Decrease in Accounts Receivable Sale of Bonds Decrease in Income Taxes Payable For Operating Expenses For Interest For Income Taxes Issuance of Common Stock Decrease in Inventory Purchase of Equipment Increase in Income Taxes Payable Increase in Accounts Receivable Increase in Accounts Payalbe Redemption of Bonds To Suppliers Payment of Dividends Sale of Equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts