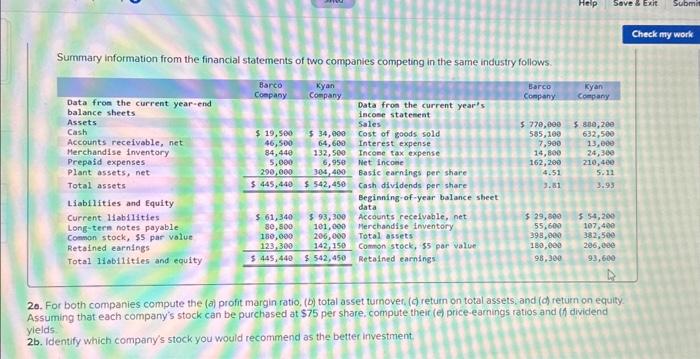

Question: please complete each chart/table Summary information from the financial statements of two companies competing in the same industry follows. 20. For both companies compute the

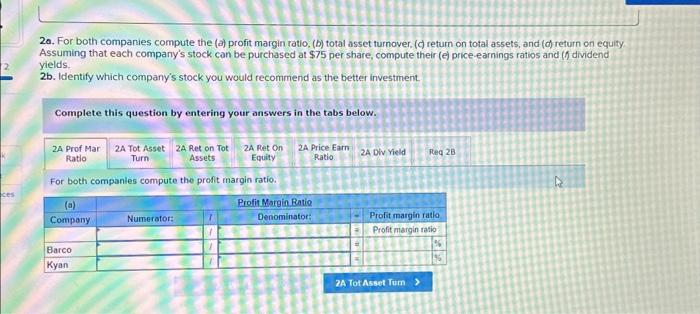

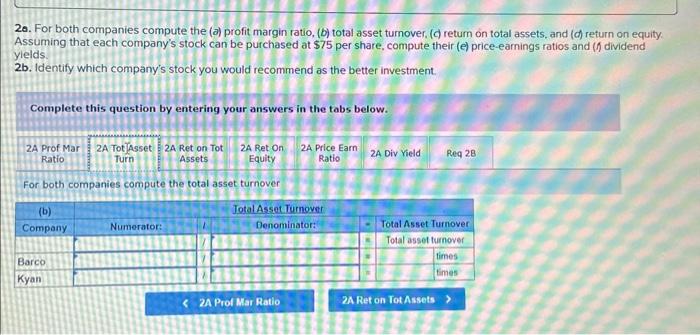

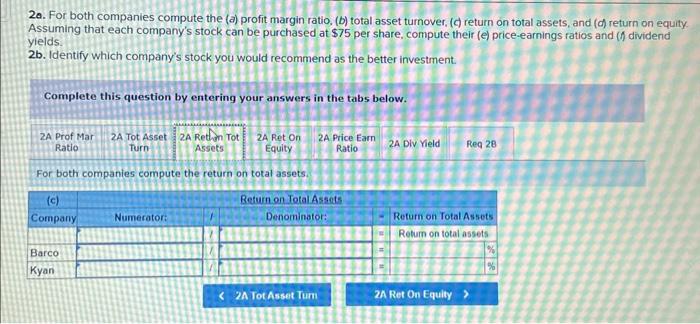

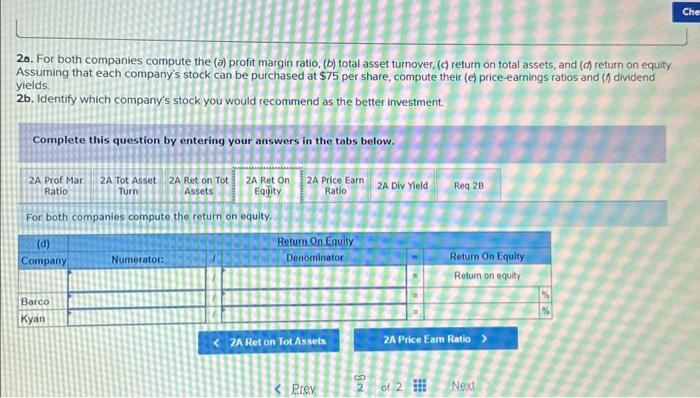

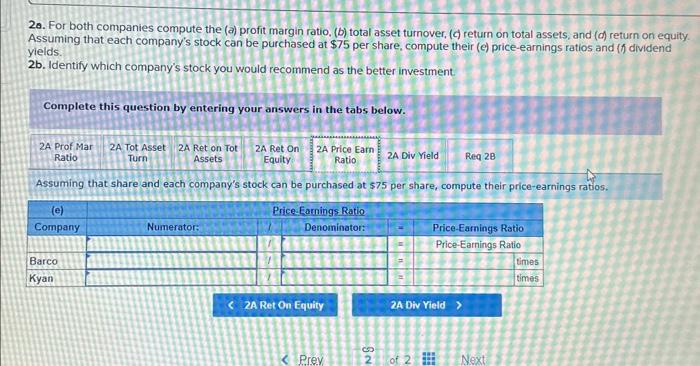

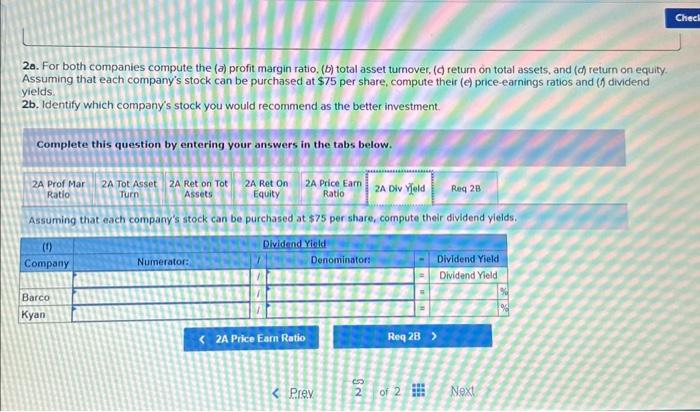

Summary information from the financial statements of two companies competing in the same industry follows. 20. For both companies compute the (a) profit margin ratio, (b) total asset turnovet. (d) retum on total assets, and (d) return on equity. Assuming that each company's stock can be purchased at $75 per share, compute their (e) price-earnings ratios and (f) dividend ylelds. 2b. Identify which company's stock you would recommend as the better investment. 20. For both companies compute the (a) profit margin ratio, (b) total asset tumover, ( d ) return on total assets, and (d) return on equit) Assuming that each company's stock can be purchased at $75 per share, compute their ( (e) price-earnings ratios and ( f dividend yields. 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. For both companies compute the profit margin ratio. 20. For both companies compute the (a) profit margin ratio, (b) total asset turnover, ( d return on total assets, and (d) return on equity. Assuming that each company's stock can be purchased at $75 per share, compute their () price-earnings ratios and ( dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. For both companies compute the total asset turnover 20. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on total assets, and (d) return on equity Assuming that each company's stock can be purchased at $75 per share, compute their (e) price-earnings ratios and (f) dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. For both companies compute the return on total assets. 20. For both companies compute the (a) profit margin ratio, (b) total asset turnover, ( d ) return on total assets, and ( (d) return on equity. Assuming that each company's stock can be purchased at $75 per share, compute their (e) price-earnings ratios and (f) dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. For both companies compute the return on equity. 20. For both companies compute the (a) profit margin ratio. (b) total asset turnover, ( c ) return on total assets, and ( d ) return on equity Assuming that each company's stock can be purchased at $75 per share, compute their ( e) price-earnings ratios and (i) dividend yields. 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. 20. For both companies compute the (d) profit margin ratio, (b) total asset turnover, ( ( ) return on total assets, and (d) return on equity Assuming that each company's stock can be purchased at $75 per share, compute their ( (e) price-earnings ratios and (f) dividend yields: 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. Assuming that each company's stock can be purchased at $75 per share, compute their dividend yields

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts