Question: Please complete each problem in excel and show formulas and work on how you got each answer!!! 9 problems. E7-3 (Algo) Inferring Missing Amounts Based

Please complete each problem in excel and show formulas and work on how you got each answer!!! 9 problems.

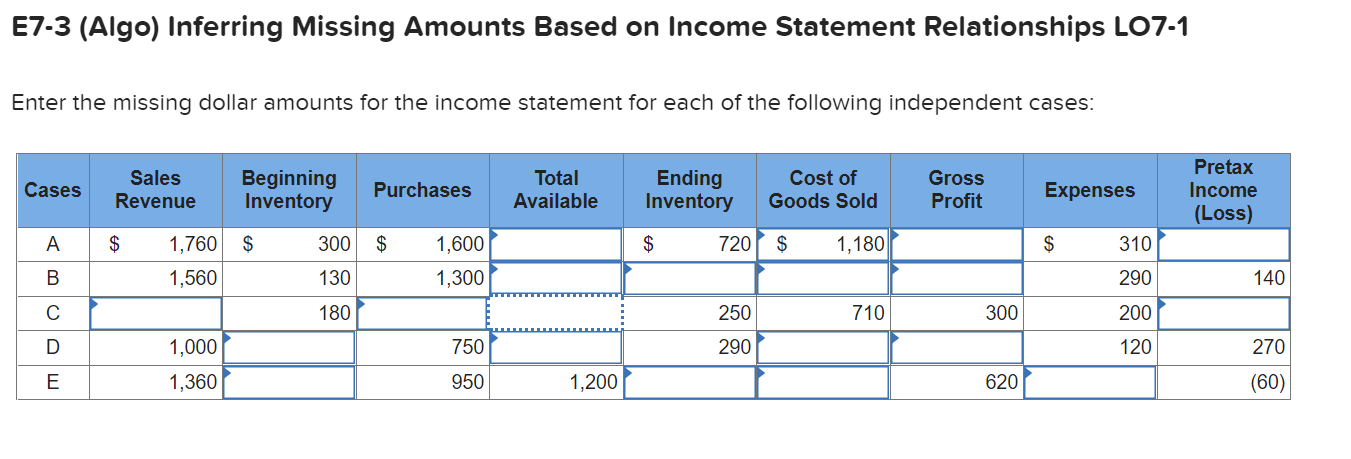

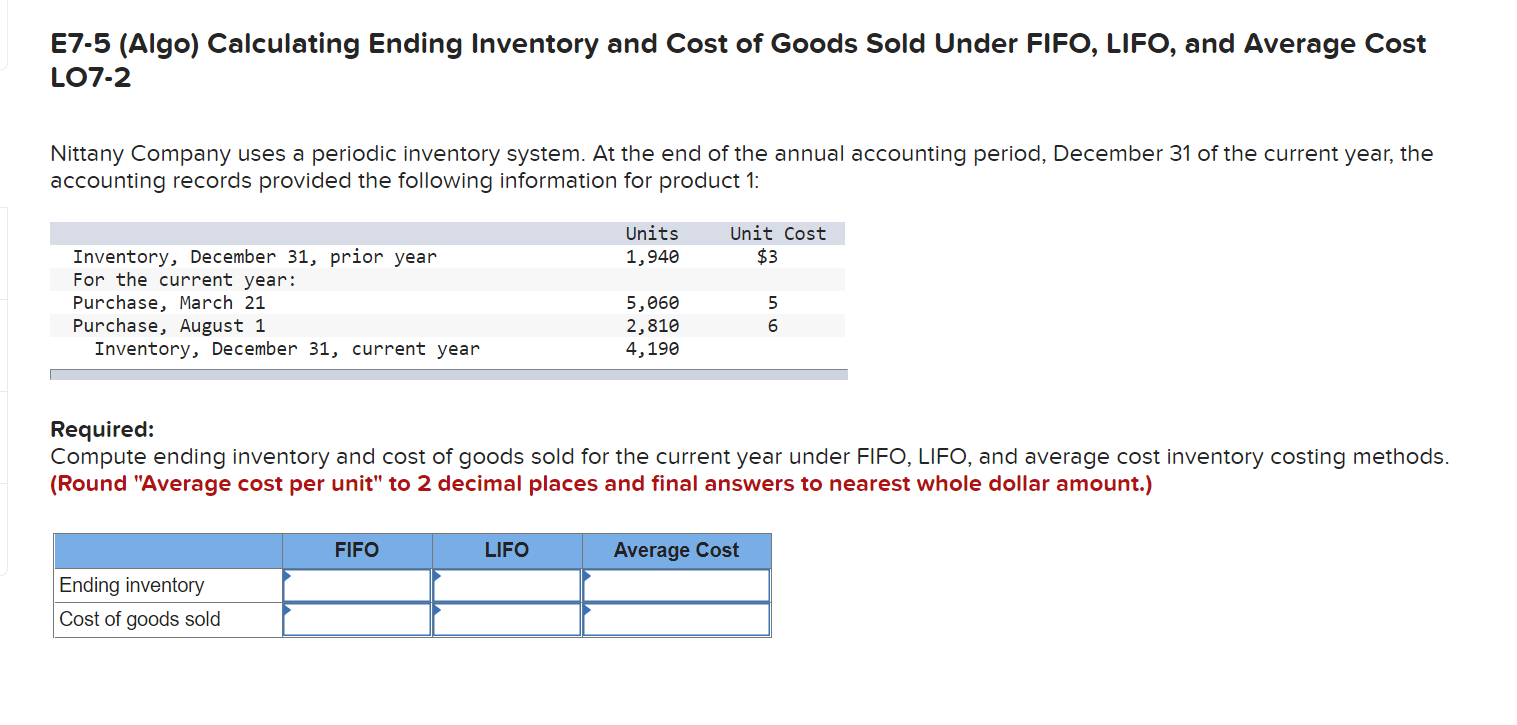

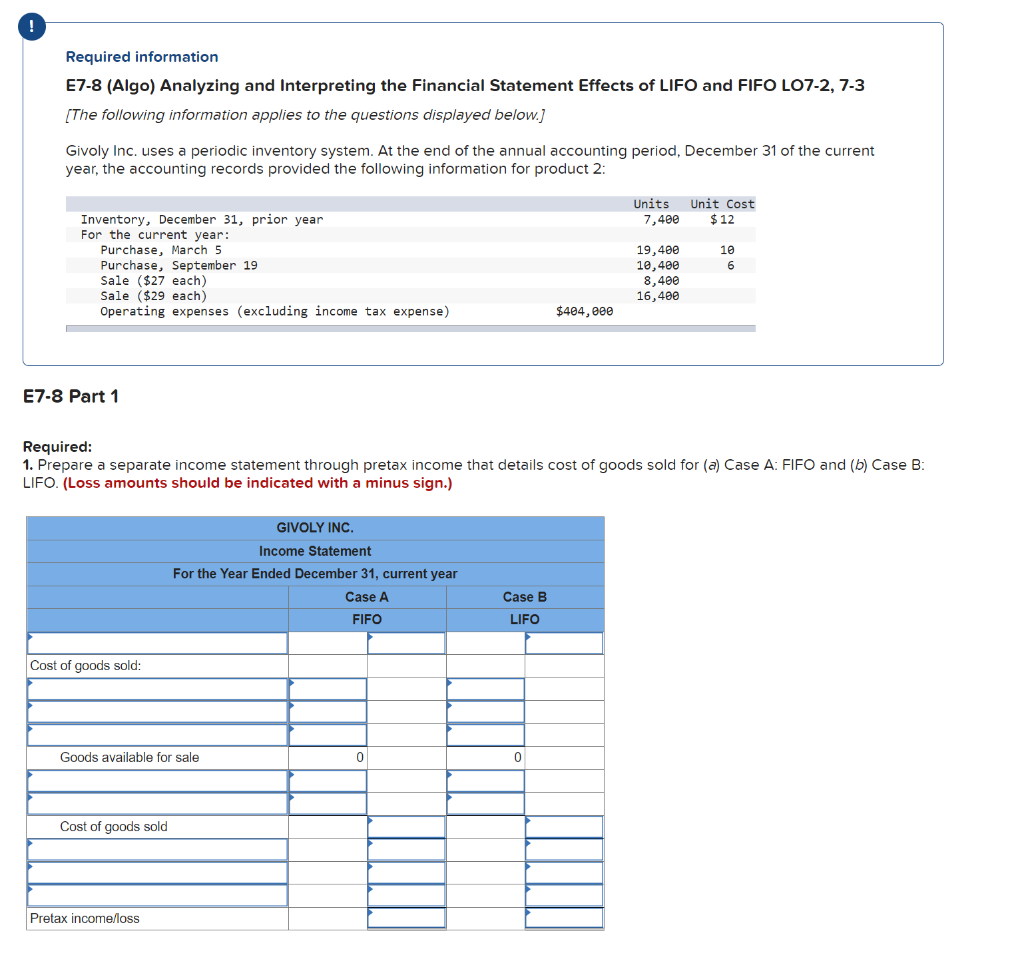

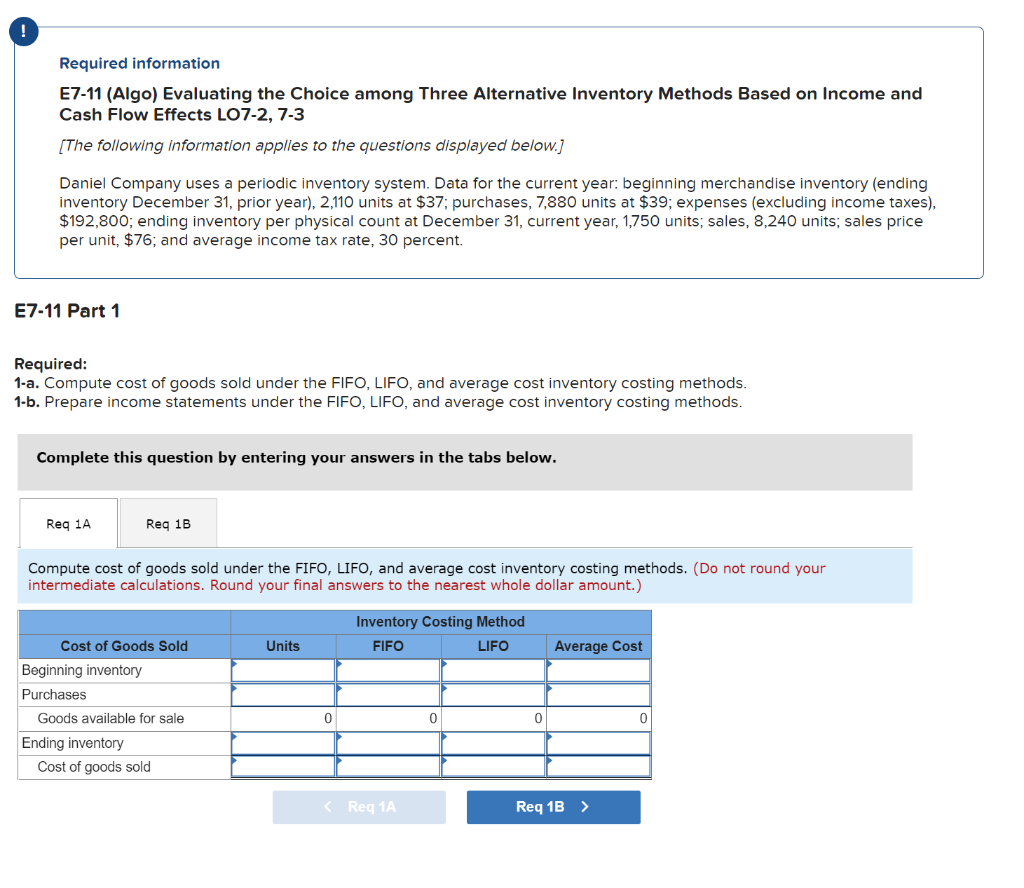

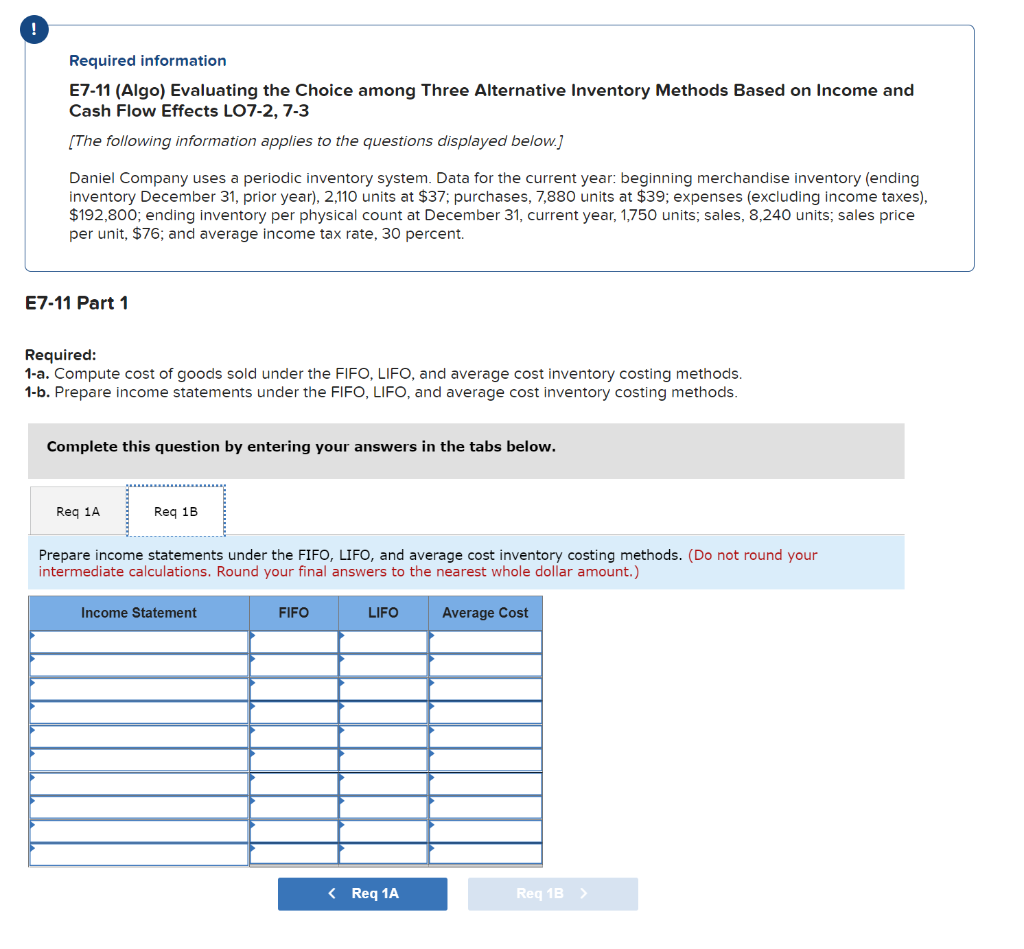

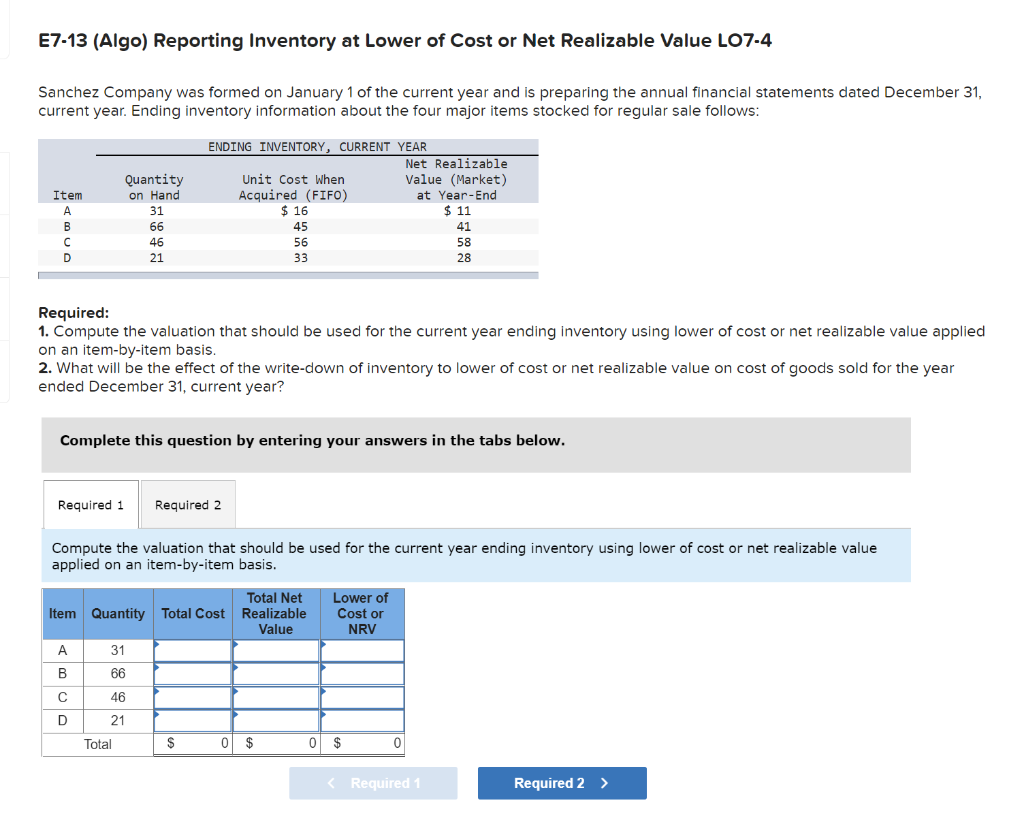

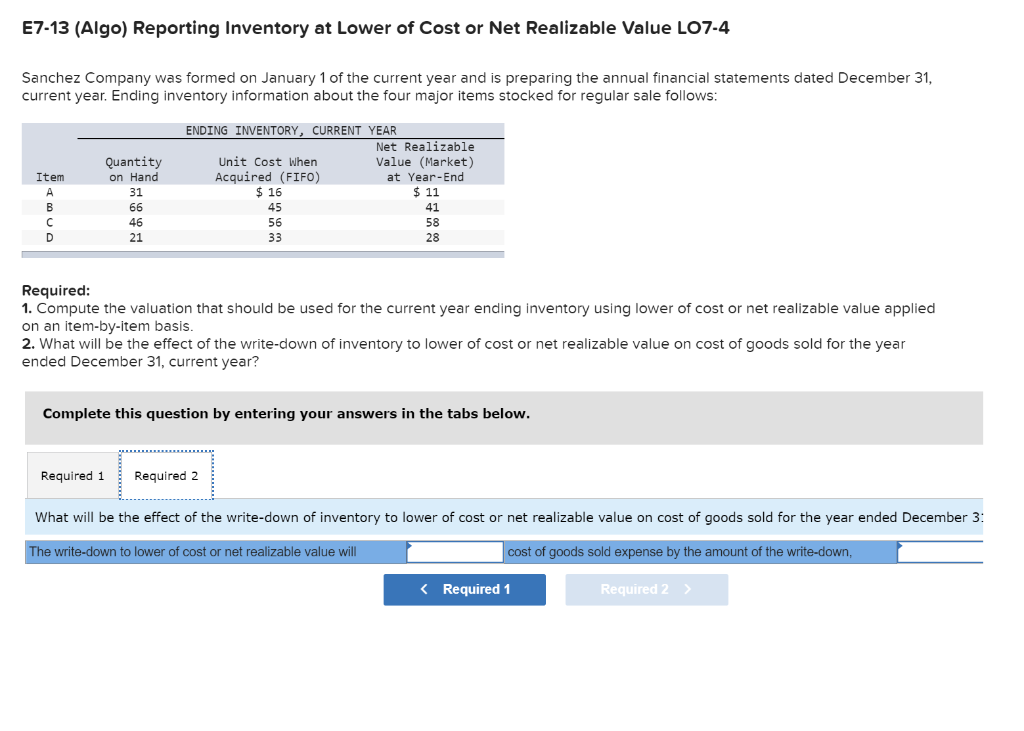

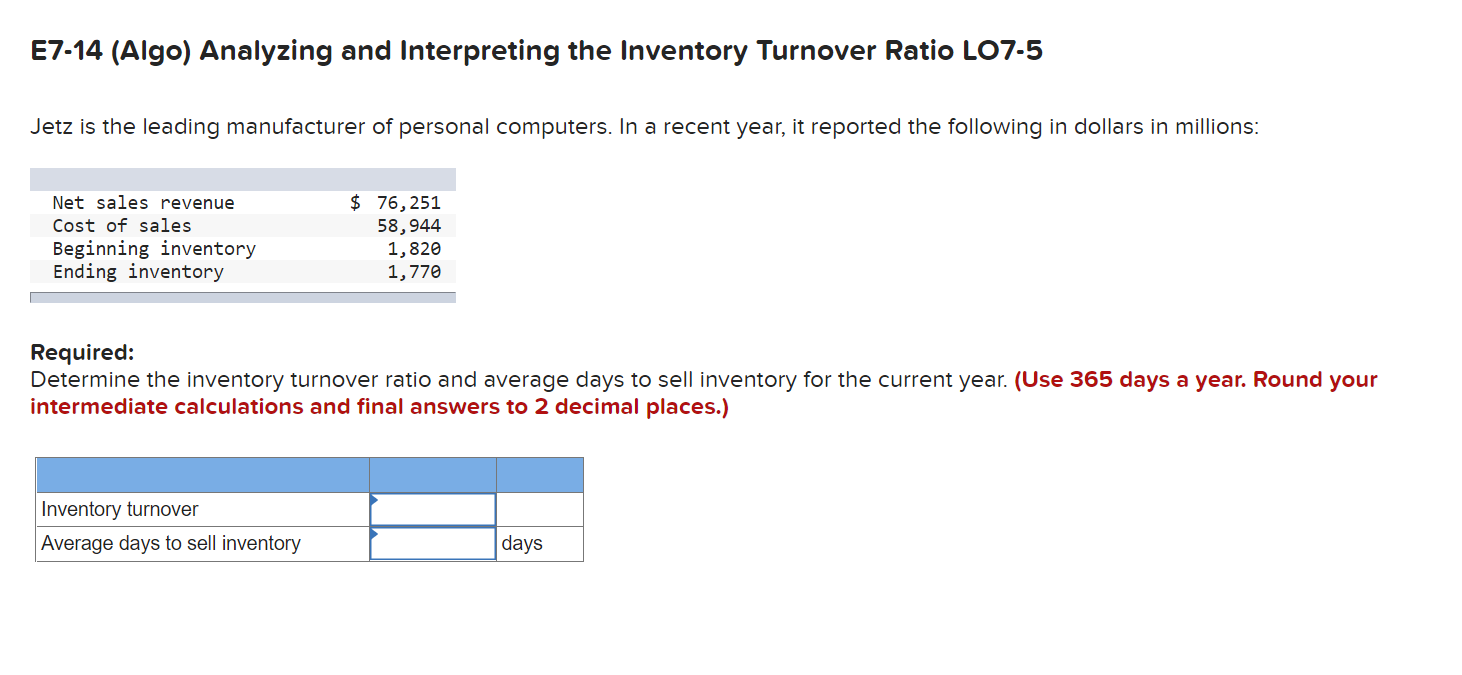

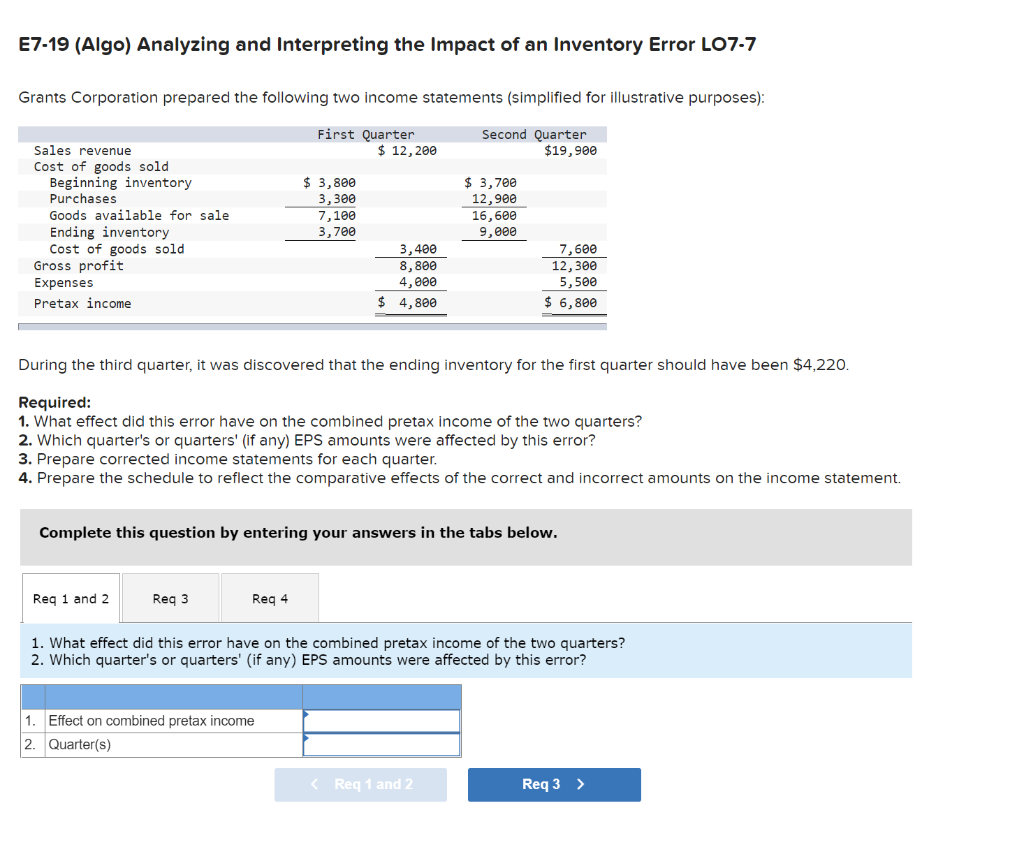

E7-3 (Algo) Inferring Missing Amounts Based on Income Statement Relationships L07-1 Enter the missing dollar amounts for the income statement for each of the following independent cases: Cases Sales Revenue Beginning Inventory Purchases Total Available Ending Inventory Cost of Goods Sold Gross Profit Expenses Pretax Income (Loss) A $ 300 $ $ 720 $ 1,180 $ 310 1,760 $ 1,560 1,600 1,300 B 130 290 140 180 250 710 300 200 D 750 290 120 270 1,000 1,360 E 950 1,200 620 (60) E7-5 (Algo) Calculating Ending Inventory and Cost of Goods Sold Under FIFO, LIFO, and Average Cost LO7-2 Nittany Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 1: Units 1,940 Unit Cost $3 Inventory, December 31, prior year For the current year: Purchase, March 21 Purchase, August 1 Inventory, December 31, current year 5,060 2,810 4,190 5 6 Required: Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, and average cost inventory costing methods. (Round "Average cost per unit" to 2 decimal places and final answers to nearest whole dollar amount.) FIFO LIFO Average Cost Ending inventory Cost of goods sold Required information E7-8 (Algo) Analyzing and Interpreting the Financial Statement Effects of LIFO and FIFO LO7-2, 7-3 [The following information applies to the questions displayed below.) Givoly Inc. uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 2: Units 7,400 Unit Cost $12 Inventory, December 31, prior year For the current year: Purchase, March 5 Purchase, September 19 Sale ($27 each) Sale $29 each) Operating expenses (excluding income tax expense) 10 6 19,400 10,400 8,400 16,400 $404,000 E7-8 Part 1 Required: 1. Prepare a separate income statement through pretax income that details cost of goods sold for (a) Case A: FIFO and (b) Case B: LIFO. (Loss amounts should be indicated with a minus sign.) GIVOLY INC. Income Statement For the Year Ended December 31, current year Case A FIFO Case B LIFO Cost of goods sold: Goods available for sale 0 0 Cost of goods sold Pretax income/loss Required information E7-11 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Income and Cash Flow Effects LO7-2, 7-3 [The following information applies to the questions displayed below. Daniel Company uses a periodic inventory system. Data for the current year: beginning merchandise inventory (ending inventory December 31, prior year), 2,110 units at $37; purchases, 7,880 units at $39; expenses (excluding income taxes), $192,800; ending inventory per physical count at December 31, current year, 1,750 units, sales, 8,240 units, sales price per unit, $76, and average income tax rate, 30 percent. E7-11 Part 1 Required: 1-a. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. 1-b. Prepare income statements under the FIFO, LIFO, and average cost inventory costing methods. Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. (Do not round your intermediate calculations. Round your final answers to the nearest whole dollar amount.) Inventory Costing Method FIFO LIFO Cost of Goods Sold Units Average Cost Beginning inventory Purchases Goods available for sale Ending inventory Cost of goods sold 0 0 0 0 Reg 1A Req 1B > ! Required information E7-11 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Income and Cash Flow Effects LO7-2, 7-3 (The following information applies to the questions displayed below.] Daniel Company uses a periodic inventory system. Data for the current year: beginning merchandise inventory (ending inventory December 31, prior year), 2,110 units at $37; purchases, 7,880 units at $39; expenses (excluding income taxes), $192,800; ending inventory per physical count at December 31, current year, 1,750 units, sales, 8,240 units; sales price per unit, $76; and average income tax rate, 30 percent. E7-11 Part 1 Required: 1-a. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. 1-b. Prepare income statements under the FIFO, LIFO, and average cost inventory costing methods. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Prepare income statements under the FIFO, LIFO, and average cost inventory costing methods. (Do not round your intermediate calculations. Round your final answers to the nearest whole dollar amount.) Income Statement FIFO LIFO Average Cost E7-13 (Algo) Reporting Inventory at Lower of Cost or Net Realizable Value LO7-4 Sanchez Company was formed on January 1 of the current year and is preparing the annual financial statements dated December 31, current year. Ending inventory information about the four major items stocked for regular sale follows: Item A B C D Quantity on Hand 31 66 46 21 ENDING INVENTORY, CURRENT YEAR Net Realizable Unit Cost When Value (Market) Acquired (FIFO) at Year-End $ 16 $ 11 45 41 56 58 33 28 Required: 1. Compute the valuation that should be used for the current year ending inventory using lower of cost or net realizable value applied on an item-by-item basis. 2. What will be the effect of the write-down of inventory to lower of cost or net realizable value on cost of goods sold for the year ended December 31, current year? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What will be the effect of the write-down of inventory to lower of cost or net realizable value on cost of goods sold for the year ended December 3: The write-down to lower of cost or net realizable value will cost of goods sold expense by the amount of the write-down, E7-14 (Algo) Analyzing and Interpreting the Inventory Turnover Ratio L07-5 Jetz is the leading manufacturer of personal computers. In a recent year, it reported the following in dollars in millions: Net sales revenue Cost of sales Beginning inventory Ending inventory $ 76,251 58,944 1,820 1,770 Required: Determine the inventory turnover ratio and average days to sell inventory for the current year. (Use 365 days a year. Round your intermediate calculations and final answers to 2 decimal places.) Inventory turnover Average days to sell inventory days E7-19 (Algo) Analyzing and Interpreting the Impact of an Inventory Error LO7-7 Grants Corporation prepared the following two income statements (simplified for illustrative purposes): First Quarter $ 12, 200 Second Quarter $19,900 Sales revenue Cost of goods sold Beginning inventory Purchases Goods available for sale Ending inventory Cost of goods sold Gross profit Expenses Pretax income $ 3,800 3,300 7,100 3,700 $ 3,700 12,902 16,600 9,000 3,400 8,800 7,600 12,300 4,000 5,500 $ 4,800 $ 6,800 During the third quarter, it was discovered that the ending inventory for the first quarter should have been $4,220. Required: 1. What effect did this error have on the combined pretax income of the two quarters? 2. Which quarter's or quarters' (if any) EPS amounts were affected by this error? 3. Prepare corrected income statements for each quarter. 4. Prepare the schedule to reflect the comparative effects of the correct and incorrect amounts on the income statement. Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Reg 4 1. What effect did this error have on the combined pretax income of the two quarters? 2. Which quarter's or quarters' (if any) EPS amounts were affected by this error? 1. Effect on combined pretax income 2. Quarter(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts