Question: please complete everything from req 2A, req2B, req3A,req3b,req4a, eq4B 4 Problem 6A-5 Super-Variable Costing, Variable Costing, and Absorption Costing Income Statements [LO6-2, LO6-6) 10 points

please complete everything from req 2A, req2B, req3A,req3b,req4a, eq4B

please complete everything from req 2A, req2B, req3A,req3b,req4a, eq4B

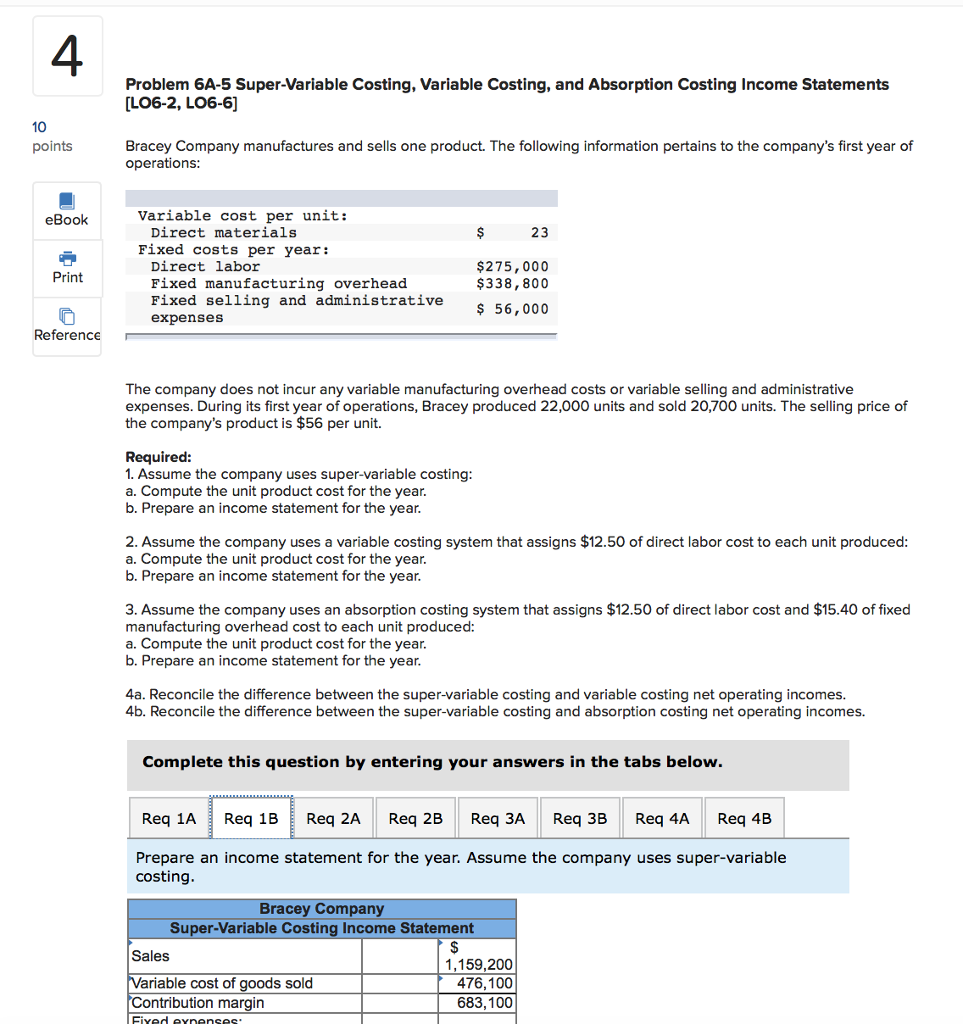

4 Problem 6A-5 Super-Variable Costing, Variable Costing, and Absorption Costing Income Statements [LO6-2, LO6-6) 10 points Bracey Company manufactures and sells one product. The following information pertains to the company's first year of operations eBook Variable cost per unit: Direct materials 23 Fixed costs per year: $275,000 $338,800 Direct labor Fixed manufacturing overhead Fixed selling and administrative expenses Print $ 56,000 Reference The company does not incur any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, Bracey produced 22,000 units and sold 20,700 units. The selling price of the company's product is $56 per unit. Required: 1. Assume the company uses super-variable costing a. Compute the unit product cost for the year. b. Prepare an income statement for the year 2. Assume the company uses a variable costing system that assigns $12.50 of direct labor cost to each unit produced a. Compute the unit product cost for the year. b. Prepare an income statement for the year 3. Assume the company uses an absorption costing system that assigns $12.50 of direct labor cost and $15.40 of fixed manufacturing overhead cost to each unit produced: a. Compute the unit product cost for the year b. Prepare an income statement for the year 4a. Reconcile the difference between the super-variable costing and variable costing net operating incomes 4b. Reconcile the difference between the super-variable costing and absorption costing net operating incomes. Complete this question by entering your answers in the tabs below. Req 1AReq 1BReq 2A Req 2B Req 3A Req 3B Req 4AReq 4B Prepare an income statement for the year. Assume the company uses super-variable costing Bracey Company Super-Variable Costing Income Statement Sales riable cost of goods sold ontribution margin 1,159,200 476,100 683,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts