Question: Please complete everything from Working Capital Section. and include formulas Banff Inc. has developed a powerful efficient snow blower that is significantly less polluting than

Please complete everything from Working Capital Section. and include formulas

Please complete everything from Working Capital Section. and include formulas

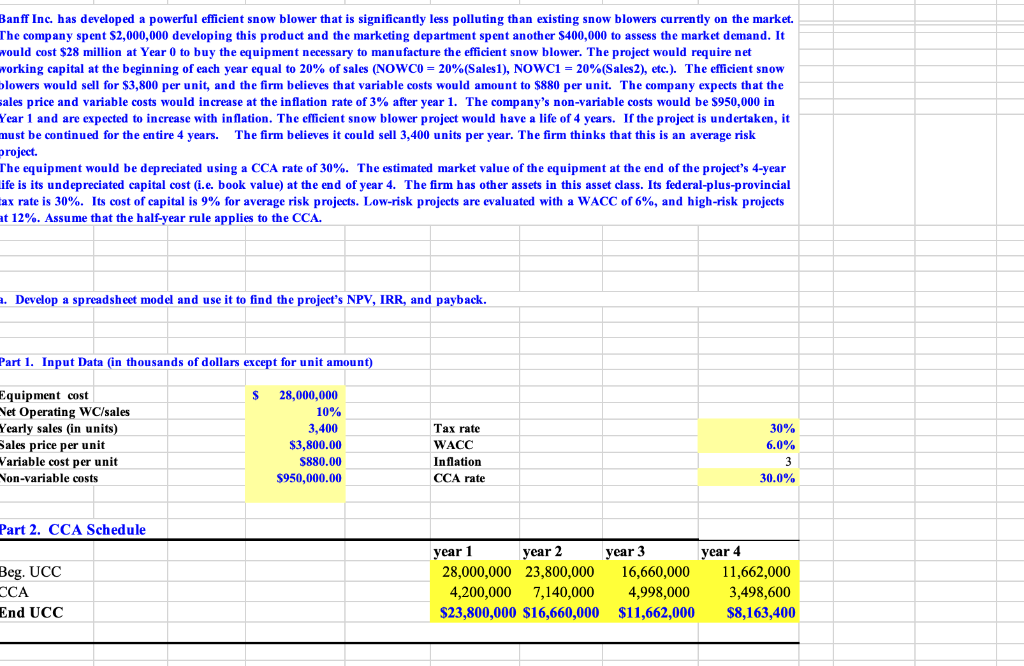

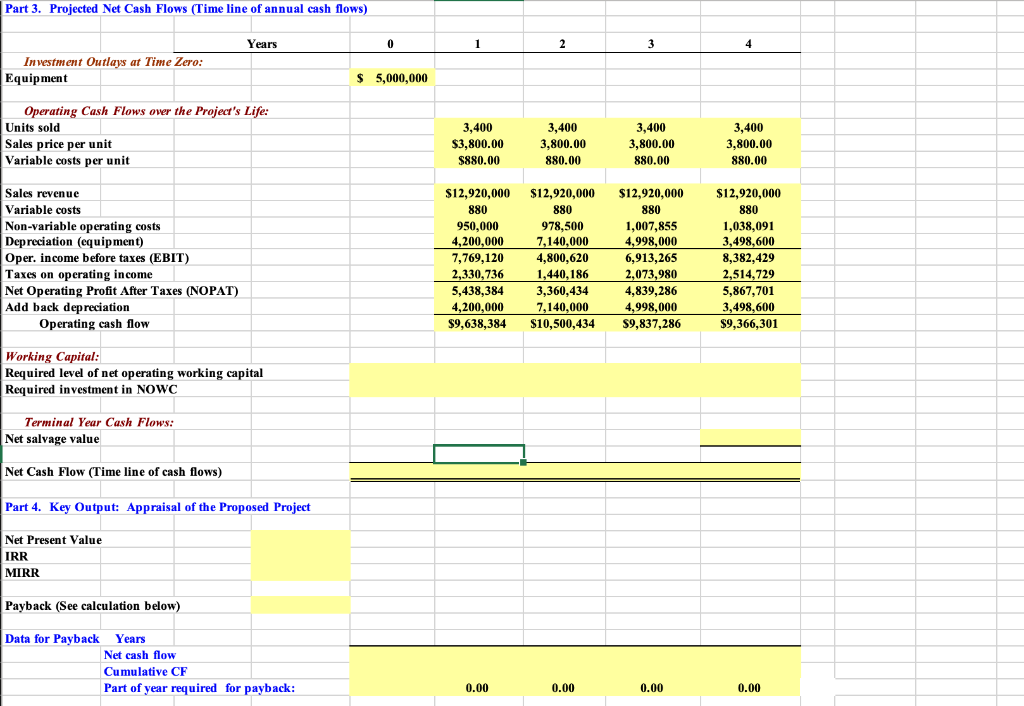

Banff Inc. has developed a powerful efficient snow blower that is significantly less polluting than existing snow blowers currently on the market. The company spent $2,000,000 developing this product and the marketing department spent another $400,000 to assess the market demand. It would cost $28 million at Year 0 to buy the equipment necessary to manufacture the efficient snow blower. The project would require net working capital at the beginning of each year equal to 20% of sales (NOWCO = 20% (Sales1), NOWC1 = 20%(Sales2), etc.). The efficient snow blowers would sell for $3,800 per unit, and the firm believes that variable costs would amount to $880 per unit. The company expects that the ales price and variable costs would increase at the inflation rate of 3% after year 1. The company's non-variable costs would be $950,000 in Year 1 and are expected to increase with inflation. The efficient snow blower project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. The firm believes it could sell 3,400 units per year. The firm thinks that this is an average risk roject. The equipment would be depreciated using a CCA rate of 30%. The estimated market value of the equipment at the end of the project's 4-year ife is its undepreciated capital cost (i.e. book value) at the end of year 4. The firm has other assets in this asset class. Its federal-plus-provincial ax rate is 30%. Its cost of capital is 9% for average risk projects. Low-risk projects are evaluated with a WACC of 6%, and high-risk projects at 12%. Assume that the half-year rule applies to the CCA. 1. Develop a spreadsheet model and use it to find the project's NPV, IRR, and payback. Part 1. Input Data (in thousands of dollars except for unit amount) S Equipment cost Net Operating WC/sales Yearly sales in units) Sales price per unit Variable cost per unit Non-variable costs 28,000,000 10% 3,400 $3,800.00 S880.00 $950,000.00 Tax rate WACC Inflation CCA rate 30% 6.0% 3 30.0% Part 2. CCA Schedule year 3 year 4 Beg. UCC SCA End UCC year 1 year 2 28,000,000 23,800,000 4,200,000 7,140,000 $23,800,000 $16,660,000 16,660,000 4,998,000 $11,662,000 11,662,000 3,498,600 $8,163,400 Part 3. Projected Net Cash Flows (Time line of annual cash flows) Years 0 1 2 3 4 Investment Outlays ar Time Zero: Equipment $ 5,000,000 Operating Cash Flows over the Project's Life: Units sold Sales price per unit Variable costs per unit 3,400 $3,800.00 $880.00 3,400 3,800.00 880.00 3,400 3,800.00 880.00 3,400 3,800.00 880.00 Sales revenue Variable costs Non-variable operating costs Depreciation (equipment) Oper. income before taxes (EBIT) Taxes on operating income Net Operating Profit After Taxes (NOPAT) Add back depreciation Operating cash flow $12,920,000 880 950,000 4,200,000 7,769,120 2,330,736 5,438,384 4,200,000 $9,638,384 $12,920,000 880 978,500 7,140,000 4,800,620 1,440,186 3,360,434 7,140,000 $10,500,434 $12,920,000 880 1,007,855 4,998,000 6,913,265 2,073,980 4,839,286 4,998,000 $9,837,286 $12,920,000 880 1,038,091 3,498,600 8,382,429 2,514,729 5,867,701 3,498,600 $9,366,301 Working Capital: Required level of net operating working capital Required investment in NOWC Terminal Year Cash Flows: Net salvage value Net Cash Flow (Time line of cash flows) Part 4. Key Output: Appraisal of the Proposed Project Net Present Value IRR MIRR Payback (See calculation below) Data for Payback Years Net cash flow Cumulative CF Part of year required for payback: 0.00 0.00 0.00 0.00 Banff Inc. has developed a powerful efficient snow blower that is significantly less polluting than existing snow blowers currently on the market. The company spent $2,000,000 developing this product and the marketing department spent another $400,000 to assess the market demand. It would cost $28 million at Year 0 to buy the equipment necessary to manufacture the efficient snow blower. The project would require net working capital at the beginning of each year equal to 20% of sales (NOWCO = 20% (Sales1), NOWC1 = 20%(Sales2), etc.). The efficient snow blowers would sell for $3,800 per unit, and the firm believes that variable costs would amount to $880 per unit. The company expects that the ales price and variable costs would increase at the inflation rate of 3% after year 1. The company's non-variable costs would be $950,000 in Year 1 and are expected to increase with inflation. The efficient snow blower project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. The firm believes it could sell 3,400 units per year. The firm thinks that this is an average risk roject. The equipment would be depreciated using a CCA rate of 30%. The estimated market value of the equipment at the end of the project's 4-year ife is its undepreciated capital cost (i.e. book value) at the end of year 4. The firm has other assets in this asset class. Its federal-plus-provincial ax rate is 30%. Its cost of capital is 9% for average risk projects. Low-risk projects are evaluated with a WACC of 6%, and high-risk projects at 12%. Assume that the half-year rule applies to the CCA. 1. Develop a spreadsheet model and use it to find the project's NPV, IRR, and payback. Part 1. Input Data (in thousands of dollars except for unit amount) S Equipment cost Net Operating WC/sales Yearly sales in units) Sales price per unit Variable cost per unit Non-variable costs 28,000,000 10% 3,400 $3,800.00 S880.00 $950,000.00 Tax rate WACC Inflation CCA rate 30% 6.0% 3 30.0% Part 2. CCA Schedule year 3 year 4 Beg. UCC SCA End UCC year 1 year 2 28,000,000 23,800,000 4,200,000 7,140,000 $23,800,000 $16,660,000 16,660,000 4,998,000 $11,662,000 11,662,000 3,498,600 $8,163,400 Part 3. Projected Net Cash Flows (Time line of annual cash flows) Years 0 1 2 3 4 Investment Outlays ar Time Zero: Equipment $ 5,000,000 Operating Cash Flows over the Project's Life: Units sold Sales price per unit Variable costs per unit 3,400 $3,800.00 $880.00 3,400 3,800.00 880.00 3,400 3,800.00 880.00 3,400 3,800.00 880.00 Sales revenue Variable costs Non-variable operating costs Depreciation (equipment) Oper. income before taxes (EBIT) Taxes on operating income Net Operating Profit After Taxes (NOPAT) Add back depreciation Operating cash flow $12,920,000 880 950,000 4,200,000 7,769,120 2,330,736 5,438,384 4,200,000 $9,638,384 $12,920,000 880 978,500 7,140,000 4,800,620 1,440,186 3,360,434 7,140,000 $10,500,434 $12,920,000 880 1,007,855 4,998,000 6,913,265 2,073,980 4,839,286 4,998,000 $9,837,286 $12,920,000 880 1,038,091 3,498,600 8,382,429 2,514,729 5,867,701 3,498,600 $9,366,301 Working Capital: Required level of net operating working capital Required investment in NOWC Terminal Year Cash Flows: Net salvage value Net Cash Flow (Time line of cash flows) Part 4. Key Output: Appraisal of the Proposed Project Net Present Value IRR MIRR Payback (See calculation below) Data for Payback Years Net cash flow Cumulative CF Part of year required for payback: 0.00 0.00 0.00 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts