Question: Please complete in all 3 depreciation methods using the fields provided. Also include calculations. thank you in advance Blossom Company purchased equipment on account on

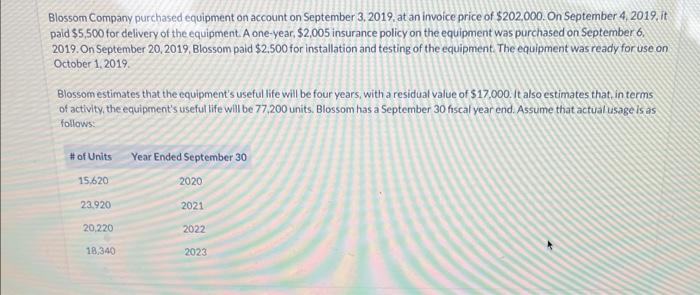

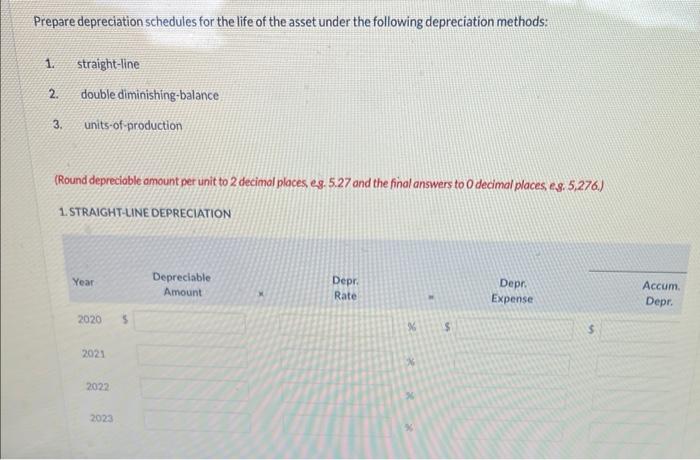

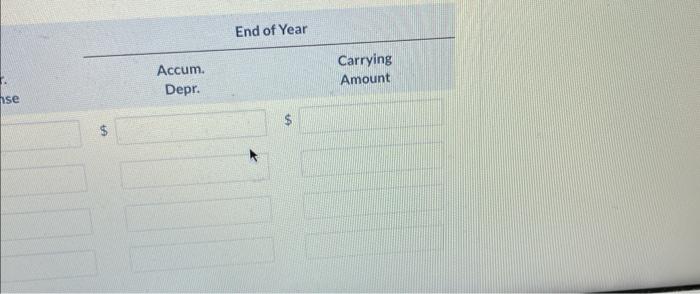

Blossom Company purchased equipment on account on September 3, 2019, at an invoice price of $202,000. On September 4, 2019, it paid $5,500 for delivery of the equipment. A one-year, $2,005 insurance policy on the equipment was purchased on September 6, 2019. On September 20, 2019, Blossom paid $2,500 for installation and testing of the equipment. The equipment was ready for use on October 1, 2019. Blossom estimates that the equipment's useful life will be four years, with a residual value of $17,000. It also estimates that, in terms of activity, the equipment's useful life will be 77,200 units. Blossom has a September 30 fiscal year end. Assume that actual usage is as follows: # of Units Year Ended September 30 15,620 23,920 20,220 18,340 2020 2021 2022 2023 Prepare depreciation schedules for the life of the asset under the following depreciation methods: 1. straight-line 2. double diminishing-balance 3. units-of-production (Round depreciable amount per unit to 2 decimal places, eg. 5.27 and the final answers to O decimal places, e.g. 5,276.) 1. STRAIGHT-LINE DEPRECIATION Year 2020 2021 2022 2023 S Depreciable Amount Depr. Rate % Depr. Expense Accum. Depr. se S Accum. Depr. End of Year Carrying Amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts