Question: Please complete in Excel 1. Assume you have a one year investment horison and are trying to choose among three bonds with a par value

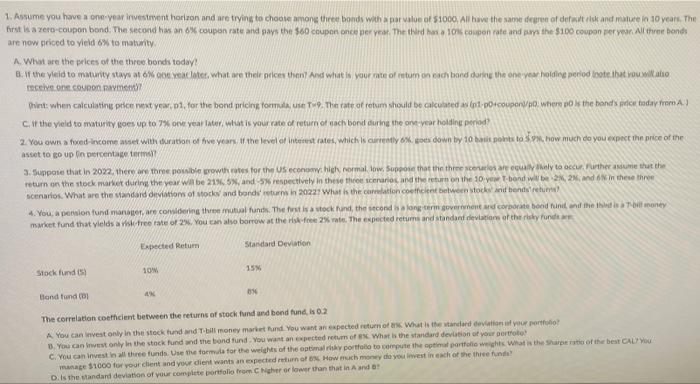

1. Assume you have a one year investment horison and are trying to choose among three bonds with a par value of 51000, All have the same degree of desk and mature in 10 years. The first is a zero-coupon bond. The second han 6% coupon rate and pay the $60 coupon once per year. The third has a 10% own rate and the $100 coupon per year. All threr bonds are now priced to yield to maturity A. What are the prices of the three bonds today! B. If the yield to maturity stwy obu yollater, what are their prices therl And what is your rate of totum on each bond during the one year holding period note that you will atio V.COM Chint when calculating price ext year, 01, for the bond pricire tommu, se The rate of return should be calculated as pecouper power is the band's pidier today from Cut the yield to maturity up to 7 onw year later. What is your rate of return of each bond cure the one year holding porod? 2. You own a foed-income with diritton of five years of the level of interest rates, which is currently goes down by 10 bat points to how much do you expect the price of the asset to go up in percentagem 3. Suppose that in 2022, there are the possible growth rates for the US econhigh normal low. Suppose that the three styly to accurate assume that the return on the stock market during the year will be 21365, and respectively in these three scenario and the return on the 10 l bond will be 2.2 and 6 in these three scenarios. What are the Mandard deviations of stock and bands returns in 2022 What is the correlation coefficient between stocles and hands retur 4. You a pension fund manager, are considering three mutual funds. The first is a stock fund, the second is a long term government and corporate bond fun and the money market fund that yields a tree rate of 2.You can also borrow at the Pak free 2% roto. The expected returns and wonderd deviation of the risky fonde en Expected Return Standard Deviation 10 15 Stock fund (5) 4 Bond tundi 0 The correlation coefficient between the returns of stock fund and bond fund, is 0.2 A You can invest only in the stock tundin Till money market and you want an expected return of what is the standard deviation of your portfolio 8. You can invest only in the stock und and the band fund. You want an expected retum of What is the standard deviation of your portfoto C. You can invest in all three funds. Use the form for the weights of the optimal portfolio to compute the optimal portfolio wehs What is the Shape of the best CALY manage $1000 for your client and your dient wants an expected return to How much money do you west in each of the three fund D. is the standard deviation of your complete portfolio from her or lower than that in And 1. Assume you have a one year investment horison and are trying to choose among three bonds with a par value of 51000, All have the same degree of desk and mature in 10 years. The first is a zero-coupon bond. The second han 6% coupon rate and pay the $60 coupon once per year. The third has a 10% own rate and the $100 coupon per year. All threr bonds are now priced to yield to maturity A. What are the prices of the three bonds today! B. If the yield to maturity stwy obu yollater, what are their prices therl And what is your rate of totum on each bond during the one year holding period note that you will atio V.COM Chint when calculating price ext year, 01, for the bond pricire tommu, se The rate of return should be calculated as pecouper power is the band's pidier today from Cut the yield to maturity up to 7 onw year later. What is your rate of return of each bond cure the one year holding porod? 2. You own a foed-income with diritton of five years of the level of interest rates, which is currently goes down by 10 bat points to how much do you expect the price of the asset to go up in percentagem 3. Suppose that in 2022, there are the possible growth rates for the US econhigh normal low. Suppose that the three styly to accurate assume that the return on the stock market during the year will be 21365, and respectively in these three scenario and the return on the 10 l bond will be 2.2 and 6 in these three scenarios. What are the Mandard deviations of stock and bands returns in 2022 What is the correlation coefficient between stocles and hands retur 4. You a pension fund manager, are considering three mutual funds. The first is a stock fund, the second is a long term government and corporate bond fun and the money market fund that yields a tree rate of 2.You can also borrow at the Pak free 2% roto. The expected returns and wonderd deviation of the risky fonde en Expected Return Standard Deviation 10 15 Stock fund (5) 4 Bond tundi 0 The correlation coefficient between the returns of stock fund and bond fund, is 0.2 A You can invest only in the stock tundin Till money market and you want an expected return of what is the standard deviation of your portfolio 8. You can invest only in the stock und and the band fund. You want an expected retum of What is the standard deviation of your portfoto C. You can invest in all three funds. Use the form for the weights of the optimal portfolio to compute the optimal portfolio wehs What is the Shape of the best CALY manage $1000 for your client and your dient wants an expected return to How much money do you west in each of the three fund D. is the standard deviation of your complete portfolio from her or lower than that in And

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts