Question: Please complete in excel and show formulas Given the performance of 4 mutual funds and S&P500 over the past 15 years in table below: And

Please complete in excel and show formulas

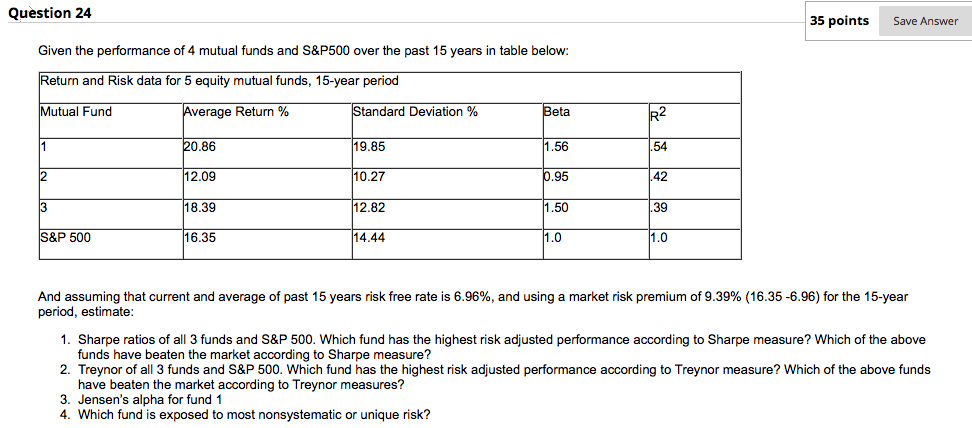

Given the performance of 4 mutual funds and S\&P500 over the past 15 years in table below: And assuming that current and average of past 15 years risk free rate is 6.96%, and using a market risk premium of 9.39% (16.35 -6.96) for the 15 -year period, estimate: 1. Sharpe ratios of all 3 funds and S\&P 500. Which fund has the highest risk adjusted performance according to Sharpe measure? Which of the above funds have beaten the market according to Sharpe measure? 2. Treynor of all 3 funds and S\&P 500 . Which fund has the highest risk adjusted performance according to Treynor measure? Which of the above funds have beaten the market according to Treynor measures? 3. Jensen's alpha for fund 1 4. Which fund is exposed to most nonsystematic or unique risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts