Question: Please complete in excel. I have a test coming up on similar material soon and have no idea what to do. Please help thank you.

Please complete in excel. I have a test coming up on similar material soon and have no idea what to do. Please help thank you.

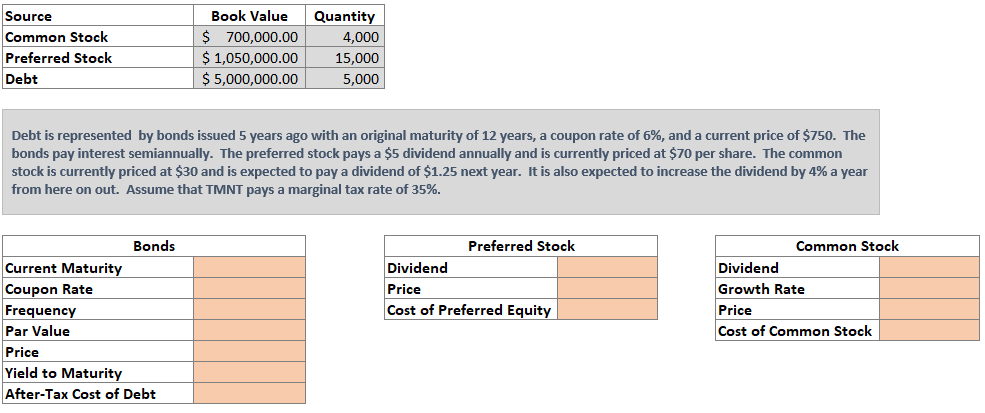

Source Common Stock Preferred Stock Debt Book Value $ 700,000.00 $ 1,050,000.00 $ 5,000,000.00 Quantity 4,000 15,000 5,000 Debt is represented by bonds issued 5 years ago with an original maturity of 12 years, a coupon rate of 6%, and a current price of $750. The bonds pay interest semiannually. The preferred stock pays a $5 dividend annually and is currently priced at $70 per share. The common stock is currently priced at $30 and is expected to pay a dividend of $1.25 next year. It is also expected to increase the dividend by 4% a year from here on out. Assume that TMNT pays a marginal tax rate of 35%. Bonds Current Maturity Coupon Rate Frequency Par Value Price Yield to Maturity After-Tax Cost of Debt Preferred Stock Dividend Price Cost of Preferred Equity Common Stock Dividend Growth Rate Price Cost of Common Stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts