Question: Please complete in Excel, please also show the formulas so that i maybe able to recreate it on my own in excel and Please use

Please complete in Excel, please also show the formulas so that i maybe able to recreate it on my own in excel and Please use the following structure

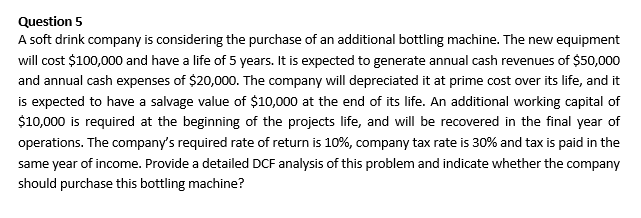

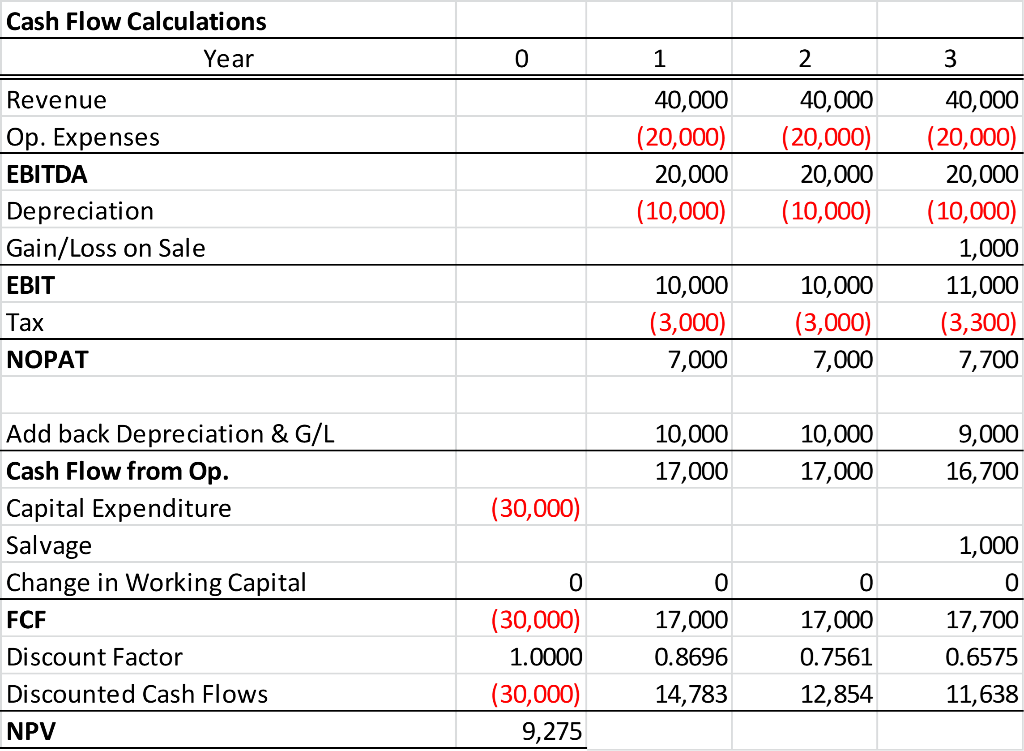

Question 5 A soft drink company is considering the purchase of an additional bottling machine. The new equipment will cost $100,000 and have a life of 5 years. It is expected to generate annual cash revenues of $50,000 and annual cash expenses of $20,000. The company will depreciated it at prime cost over its life, and it is expected to have a salvage value of $10,000 at the end of its life. An additional working capital of $10,000 is required at the beginning of the projects life, and will be recovered in the final year of operations. The company's required rate of return is 10%, company tax rate is 30% and tax is paid in the same year of income. Provide a detailed DCF analysis of this problem and indicate whether the company should purchase this bottling machine? Cash Flow Calculations Year 0 1 2 3 40,000 (20,000) 20,000 (10,000) 40,000 (20,000) 20,000 (10,000) Revenue Op. Expenses EBITDA Depreciation Gain/Loss on Sale EBIT Tax NOPAT 40,000 (20,000) 20,000 (10,000) 1,000 11,000 (3,300) 7,700 10,000 (3,000) 7,000 10,000 (3,000) 7,000 10,000 17,000 10,000 17,000 9,000 16,700 Add back Depreciation & G/L Cash Flow from Op. Capital Expenditure Salvage Change in Working Capital FCF (30,000) 1,000 0 0 0 Discount Factor 0 (30,000) 1.0000 (30,000) 9,275 17,000 0.8696 14,783 17,000 0.7561 12,854 17,700 0.6575 11,638 Discounted Cash Flows NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts