Question: Please complete in the correct order. Each section is needed in order to complete the following section. I only need answers for the last 3

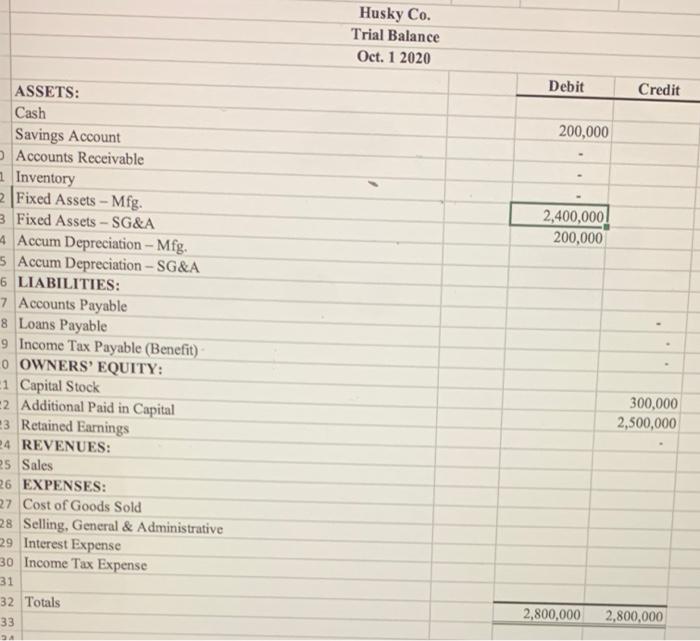

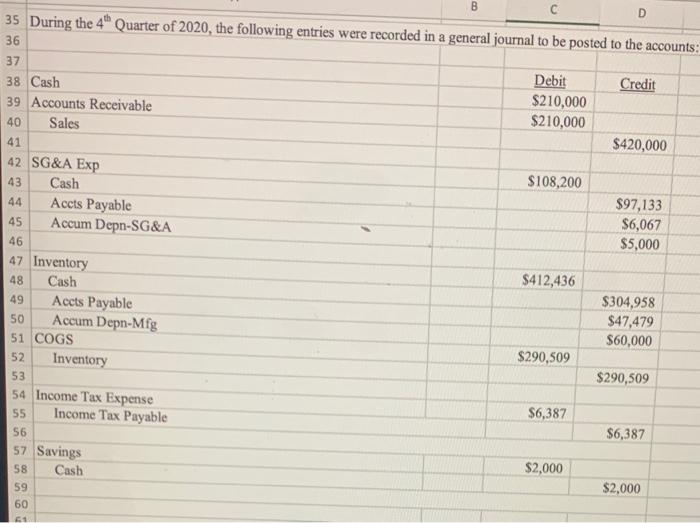

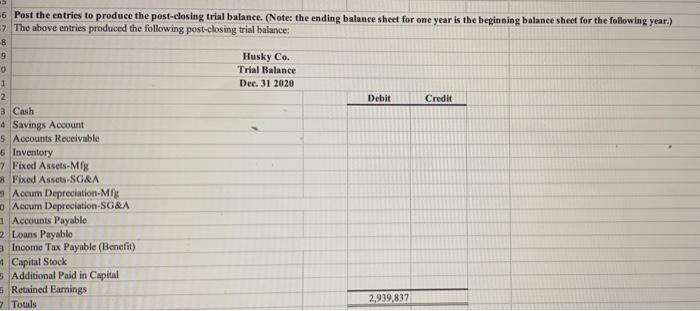

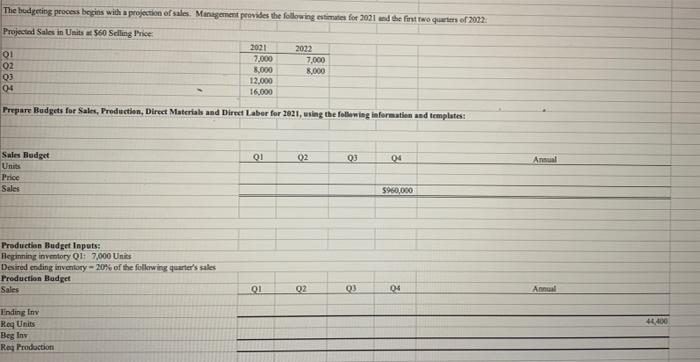

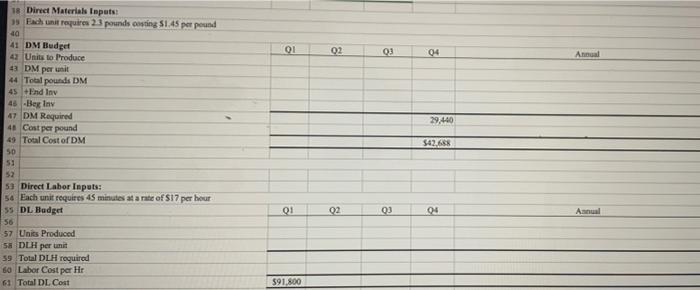

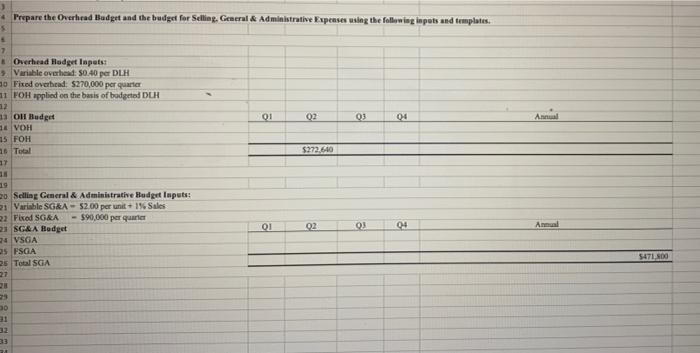

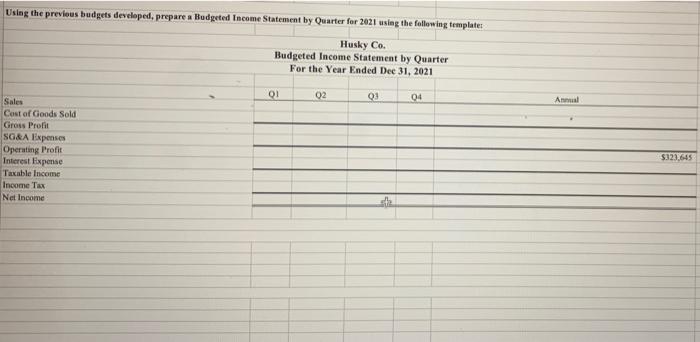

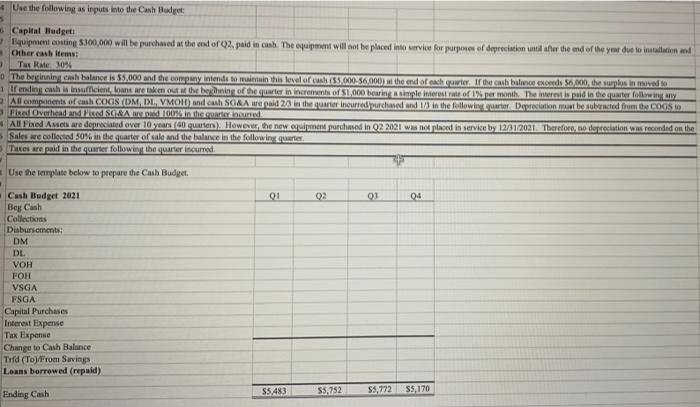

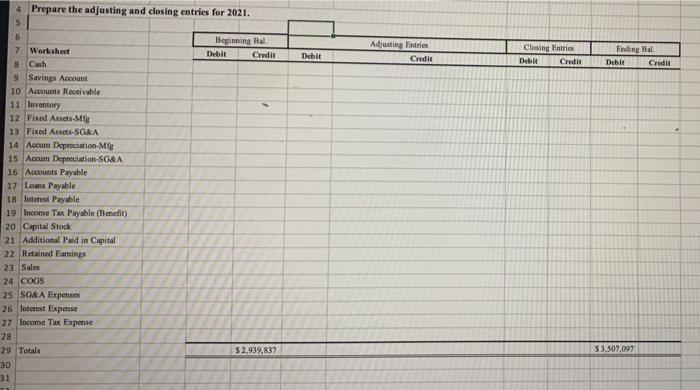

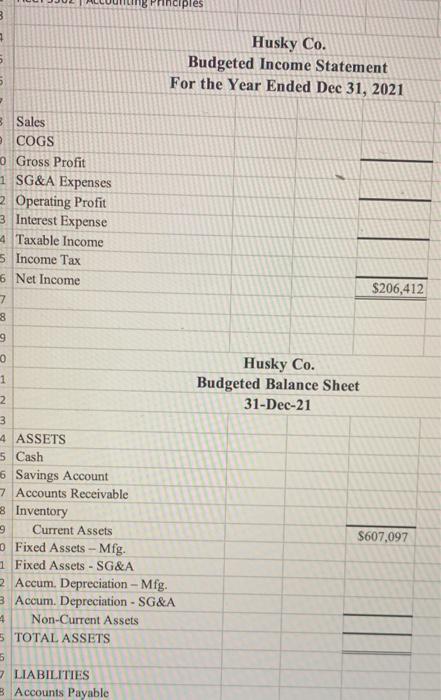

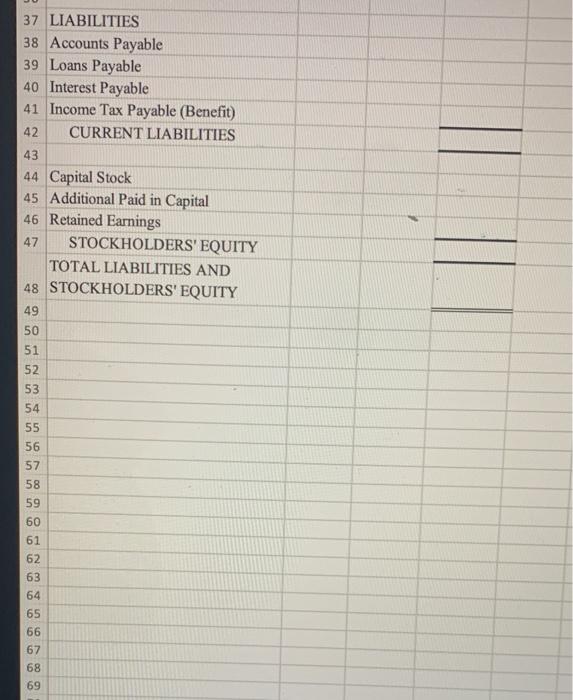

Husky Co. Trial Balance Oct. 1 2020 Debit Credit 200,000 2,400,000 200,000 ASSETS: Cash Savings Account Accounts Receivable Inventory Fixed Assets - Mfg. 3 Fixed Assets - SG&A Accum Depreciation - Mfg. 5 Accum Depreciation - SG&A 6 LIABILITIES: 7 Accounts Payable 8 Loans Payable 9 Income Tax Payable (Benefit) 0 OWNERS' EQUITY: -1 Capital Stock 2 Additional Paid in Capital 3 Retained Earnings 24 REVENUES: 25 Sales 26 EXPENSES: 27 Cost of Goods Sold 28 Selling, General & Administrative 29 Interest Expense 30 Income Tax Expense 31 32 Totals 33 300,000 2,500,000 2,800,000 2,800,000 B D 35 During the 4 Quarter of 2020, the following entries were recorded in a general journal to be posted to the accounts: 36 37 Debit Credit 38 Cash $210,000 39 Accounts Receivable $210,000 40 Sales $420,000 41 42 SG&A Exp $108,200 43 Cash $97,133 44 Accts Payable $6,067 45 Accum Depn-SG&A $5,000 46 47 Inventory $412,436 48 Cash $304,958 49 Accts Payable $47,479 50 Accum Depn-Mfg $60,000 51 COGS $290,509 52 Inventory $290,509 53 54 Income Tax Expense $6,387 55 Income Tax Payable $6,387 56 57 Savings $2,000 58 Cash $2,000 59 60 1 -6 Post the entries to produce the post-closing trial balance. (Note: the ending balance sheet for one year is the beginning balance sheet for the following year.) 7 The above entries produced the following post-closing trial balance: 8 9 Husky Co. 0 Trial Balance 1 Dec. 31 2020 2 Debit Credit 3 Cash 4 Savings Account 5 Accounts Receivable 6 Inventory 7 Fixed Assets. Mig Fixed Assets-SGRA Accum Depreciation-Mfg Accum Depreciation-SG&A 1 Accounts Payable 2 Loans Payable a Income Tax Payable (Benefit) Capital Stock 5 Additional Paid in Capital 5 Retained Earnings Totals 2,939,837 The budgeting process begins with a projection of sales Management provides the following estimates for 2031 and the first two quarters of 2022 Projected Sales in Units at 560 Selling Price: 2021 2022 01 7.000 7.000 02 8.000 8.000 03 12.000 04 16.000 Prepare Budgets for Sales Production, Direct Materials and Direct Laber for 2021, using the following information and templates 01 02 OJ 04 Annual Sales Budget Units Price Sales 5960,000 Production Budget Inputs: Beginning inventory Q1: 7,000 Units Desired ending inventory - 20% of the following quarter's sales Production Budget Sales 01 02 03 04 Annual 44.400 Tinding In Reg Units Beg In Ray Production 01 02 03 04 Anna 29.440 18 Direct Materials lapets Each unit requires 2.3 pounds casting 51.45 per pound 40 41 DM Budget 42 Units to produce 43 DM per unit 44 Total pounds DM 45 End Inv 45 -Beg iny 47 DM Required 46 Cost per pound 49 Total Cost of DM 50 51 52 5 Direct Labor Inputs: 54 Each unit requires 45 minutes at a rate of $17 per hour 55 DL Hudget 56 57 Units Produced 5 DLH per unit 59 Total DLH required 60 Labor Cost per HC 61 Total DL Cost $42.668 Q1 02 03 00 Annual 591,800 Prepare the Overhead Badget and the budget for Selling. General & Administrative Expenses using the following inputs and templates 5 5 7 * Overhead Hadget Inputs: Variable overhead: 50.40 per DLH 30 Fixed overhead S270,000 per quarter 11 FOH applied on the basis of budgeted DEH 12 13 On Budget 01 02 04 10 VOH 15 FOH 16 Total $272.640 11 03 Anal OL 02 03 04 Annual 19 20 Selling General & Administrative Hudget Inputs 21 Variable SG&A- 52.00 per unit+1% Sales 22 Fixed SGRA - $90,000 per quartet 23 SGLA Hedget 94 VSCA 35 FSOA 25 TotalSGA 27 28 54TI DO 30 31 32 33 Using the previous budgets developed, prepare a Budgeted Income Statement by Quarter for 2021 using the following template Husky Co. Budgeted Income Statement by Quarter For the Year Ended Dec 31, 2021 01 02 Q: 04 Annual Sales Cost of Goods Sold Gross Profit SC&A Expenses Operating Profit Interest Expense Taxable income Income Tax Net Income $323,645 4 Use the following as inputs into the Cash Hedge 5 Capital Budget: Equipment costing $100,000 will be purchased at the end of 2. paid in cash. The equipment will not be placed into service for purposes of depreciation until the end of the year due to itin and Other cash Items! Tax Rate 10% The bevinninh balance is 55.000 and the company intends maintain this level of cush(33.000-56,000 the end of each quarter of the cash balance exceeds the surplus in moved to 1 trending cash insuficient and retaken out the bestning of the curtain increments of S1,000 berita simple interest rate of per month Tentert is paid in the quarter following All components of cash COGS OM DL VMOH and cash SC Arad 22 in the quanto incurred purchased and 1/3 in the followinuarter Detection the subtracted from COGS 3 FeOverhead and find SCRA incurred AllFixed Assets are deprecated over 10 years ( Garten). However, the new cupen purchased in 02.2021 was no local in service by 12312021. Therefore, the depreciation was recorded on the Sales are collected 50% in the quarter of sale and the balance in the following quarter Taxes are paid in the quarter following the quarter incurred Use the template below to prepare the Cush Badget. 01 02 03 04 Cash Budget 2021 Bey Cash Collections Disbursements: DM DL VOH FOR VSGA FSGA Capital Purchases Interest Expense Tax Expense Change to Cash Balance Tyfd (To) From Savings Loans borrowed (repaid) $5,483 Ending Cash $5752 55,772 S5,170 4 Prepare the adjusting and closing entries for 2021. 5 Beginning Bal Debit Credit Debit Adjusting Entries Credit Closing Entries Credit Dub Ending Hal Debit Credit 6 7 Worksheet 8 Cash 9 Savings Account 10 Accounts Receivable 11 Inventory 12 Fixed Assets-Mfg 13 Fixed Asset-SC&A 14 Accum Depreciation-Mig 15 Accum Depreciation-SG&A 16 Accounts Payable 17 Loans Payable 18 Interest Payable 19 Income Tax Payable (Benefit) 20 Capital Stock 21 Additional Paid in Capital 22 Retained amings 23 Sales 24 COGS 25 SG&A Expenses 26 Interest Expense 27 Income Tax Expense 28 29 Totals 30 31 $ 2,939,837 $3.507,097 nciples 3 5 5 Husky Co. Budgeted Income Statement For the Year Ended Dec 31, 2021 B Sales COGS o Gross Profit 1 SG&A Expenses 2 Operating Profit 3 Interest Expense Taxable Income 5 Income Tax 6 Net Income 7 8 $206,412 9 0 1 Husky Co. Budgeted Balance Sheet 31-Dec-21 2 $607,097 3 4 ASSETS 5 Cash 16 Savings Account 7 Accounts Receivable 8 Inventory 9 Current Assets Fixed Assets -- Mfg. 1 Fixed Assets - SG&A Accum. Depreciation - Mfg. 3 Acoum. Depreciation - SG&A 4 Non-Current Assets 5 TOTAL ASSETS 5 LIABILITIES B Accounts Payable 37 LIABILITIES 38 Accounts Payable 39 Loans Payable 40 Interest Payable 41 Income Tax Payable (Benefit) 42 CURRENT LIABILITIES 43 44 Capital Stock 45 Additional Paid in Capital 46 Retained Earnings 47 STOCKHOLDERS' EQUITY TOTAL LIABILITIES AND 48 STOCKHOLDERS' EQUITY 49 50 51 52 53 54 55 D Oo 56 57 58 59 60 61 62 63 64 65 66 67 68 69 D D a os Husky Co. Trial Balance Oct. 1 2020 Debit Credit 200,000 2,400,000 200,000 ASSETS: Cash Savings Account Accounts Receivable Inventory Fixed Assets - Mfg. 3 Fixed Assets - SG&A Accum Depreciation - Mfg. 5 Accum Depreciation - SG&A 6 LIABILITIES: 7 Accounts Payable 8 Loans Payable 9 Income Tax Payable (Benefit) 0 OWNERS' EQUITY: -1 Capital Stock 2 Additional Paid in Capital 3 Retained Earnings 24 REVENUES: 25 Sales 26 EXPENSES: 27 Cost of Goods Sold 28 Selling, General & Administrative 29 Interest Expense 30 Income Tax Expense 31 32 Totals 33 300,000 2,500,000 2,800,000 2,800,000 B D 35 During the 4 Quarter of 2020, the following entries were recorded in a general journal to be posted to the accounts: 36 37 Debit Credit 38 Cash $210,000 39 Accounts Receivable $210,000 40 Sales $420,000 41 42 SG&A Exp $108,200 43 Cash $97,133 44 Accts Payable $6,067 45 Accum Depn-SG&A $5,000 46 47 Inventory $412,436 48 Cash $304,958 49 Accts Payable $47,479 50 Accum Depn-Mfg $60,000 51 COGS $290,509 52 Inventory $290,509 53 54 Income Tax Expense $6,387 55 Income Tax Payable $6,387 56 57 Savings $2,000 58 Cash $2,000 59 60 1 -6 Post the entries to produce the post-closing trial balance. (Note: the ending balance sheet for one year is the beginning balance sheet for the following year.) 7 The above entries produced the following post-closing trial balance: 8 9 Husky Co. 0 Trial Balance 1 Dec. 31 2020 2 Debit Credit 3 Cash 4 Savings Account 5 Accounts Receivable 6 Inventory 7 Fixed Assets. Mig Fixed Assets-SGRA Accum Depreciation-Mfg Accum Depreciation-SG&A 1 Accounts Payable 2 Loans Payable a Income Tax Payable (Benefit) Capital Stock 5 Additional Paid in Capital 5 Retained Earnings Totals 2,939,837 The budgeting process begins with a projection of sales Management provides the following estimates for 2031 and the first two quarters of 2022 Projected Sales in Units at 560 Selling Price: 2021 2022 01 7.000 7.000 02 8.000 8.000 03 12.000 04 16.000 Prepare Budgets for Sales Production, Direct Materials and Direct Laber for 2021, using the following information and templates 01 02 OJ 04 Annual Sales Budget Units Price Sales 5960,000 Production Budget Inputs: Beginning inventory Q1: 7,000 Units Desired ending inventory - 20% of the following quarter's sales Production Budget Sales 01 02 03 04 Annual 44.400 Tinding In Reg Units Beg In Ray Production 01 02 03 04 Anna 29.440 18 Direct Materials lapets Each unit requires 2.3 pounds casting 51.45 per pound 40 41 DM Budget 42 Units to produce 43 DM per unit 44 Total pounds DM 45 End Inv 45 -Beg iny 47 DM Required 46 Cost per pound 49 Total Cost of DM 50 51 52 5 Direct Labor Inputs: 54 Each unit requires 45 minutes at a rate of $17 per hour 55 DL Hudget 56 57 Units Produced 5 DLH per unit 59 Total DLH required 60 Labor Cost per HC 61 Total DL Cost $42.668 Q1 02 03 00 Annual 591,800 Prepare the Overhead Badget and the budget for Selling. General & Administrative Expenses using the following inputs and templates 5 5 7 * Overhead Hadget Inputs: Variable overhead: 50.40 per DLH 30 Fixed overhead S270,000 per quarter 11 FOH applied on the basis of budgeted DEH 12 13 On Budget 01 02 04 10 VOH 15 FOH 16 Total $272.640 11 03 Anal OL 02 03 04 Annual 19 20 Selling General & Administrative Hudget Inputs 21 Variable SG&A- 52.00 per unit+1% Sales 22 Fixed SGRA - $90,000 per quartet 23 SGLA Hedget 94 VSCA 35 FSOA 25 TotalSGA 27 28 54TI DO 30 31 32 33 Using the previous budgets developed, prepare a Budgeted Income Statement by Quarter for 2021 using the following template Husky Co. Budgeted Income Statement by Quarter For the Year Ended Dec 31, 2021 01 02 Q: 04 Annual Sales Cost of Goods Sold Gross Profit SC&A Expenses Operating Profit Interest Expense Taxable income Income Tax Net Income $323,645 4 Use the following as inputs into the Cash Hedge 5 Capital Budget: Equipment costing $100,000 will be purchased at the end of 2. paid in cash. The equipment will not be placed into service for purposes of depreciation until the end of the year due to itin and Other cash Items! Tax Rate 10% The bevinninh balance is 55.000 and the company intends maintain this level of cush(33.000-56,000 the end of each quarter of the cash balance exceeds the surplus in moved to 1 trending cash insuficient and retaken out the bestning of the curtain increments of S1,000 berita simple interest rate of per month Tentert is paid in the quarter following All components of cash COGS OM DL VMOH and cash SC Arad 22 in the quanto incurred purchased and 1/3 in the followinuarter Detection the subtracted from COGS 3 FeOverhead and find SCRA incurred AllFixed Assets are deprecated over 10 years ( Garten). However, the new cupen purchased in 02.2021 was no local in service by 12312021. Therefore, the depreciation was recorded on the Sales are collected 50% in the quarter of sale and the balance in the following quarter Taxes are paid in the quarter following the quarter incurred Use the template below to prepare the Cush Badget. 01 02 03 04 Cash Budget 2021 Bey Cash Collections Disbursements: DM DL VOH FOR VSGA FSGA Capital Purchases Interest Expense Tax Expense Change to Cash Balance Tyfd (To) From Savings Loans borrowed (repaid) $5,483 Ending Cash $5752 55,772 S5,170 4 Prepare the adjusting and closing entries for 2021. 5 Beginning Bal Debit Credit Debit Adjusting Entries Credit Closing Entries Credit Dub Ending Hal Debit Credit 6 7 Worksheet 8 Cash 9 Savings Account 10 Accounts Receivable 11 Inventory 12 Fixed Assets-Mfg 13 Fixed Asset-SC&A 14 Accum Depreciation-Mig 15 Accum Depreciation-SG&A 16 Accounts Payable 17 Loans Payable 18 Interest Payable 19 Income Tax Payable (Benefit) 20 Capital Stock 21 Additional Paid in Capital 22 Retained amings 23 Sales 24 COGS 25 SG&A Expenses 26 Interest Expense 27 Income Tax Expense 28 29 Totals 30 31 $ 2,939,837 $3.507,097 nciples 3 5 5 Husky Co. Budgeted Income Statement For the Year Ended Dec 31, 2021 B Sales COGS o Gross Profit 1 SG&A Expenses 2 Operating Profit 3 Interest Expense Taxable Income 5 Income Tax 6 Net Income 7 8 $206,412 9 0 1 Husky Co. Budgeted Balance Sheet 31-Dec-21 2 $607,097 3 4 ASSETS 5 Cash 16 Savings Account 7 Accounts Receivable 8 Inventory 9 Current Assets Fixed Assets -- Mfg. 1 Fixed Assets - SG&A Accum. Depreciation - Mfg. 3 Acoum. Depreciation - SG&A 4 Non-Current Assets 5 TOTAL ASSETS 5 LIABILITIES B Accounts Payable 37 LIABILITIES 38 Accounts Payable 39 Loans Payable 40 Interest Payable 41 Income Tax Payable (Benefit) 42 CURRENT LIABILITIES 43 44 Capital Stock 45 Additional Paid in Capital 46 Retained Earnings 47 STOCKHOLDERS' EQUITY TOTAL LIABILITIES AND 48 STOCKHOLDERS' EQUITY 49 50 51 52 53 54 55 D Oo 56 57 58 59 60 61 62 63 64 65 66 67 68 69 D D a os

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts