Question: Please complete in the exact formats provided for clarification. Thank you in advance. The partnership of Lau & Min started the fiscal year on January

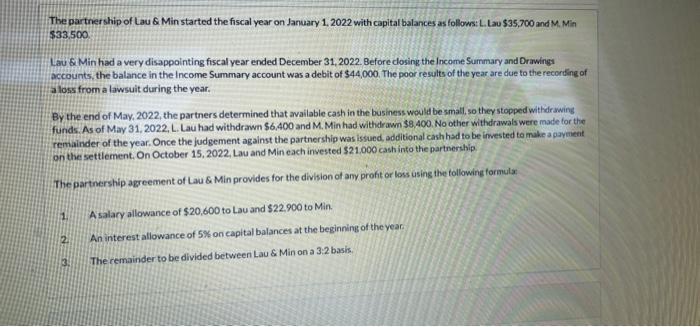

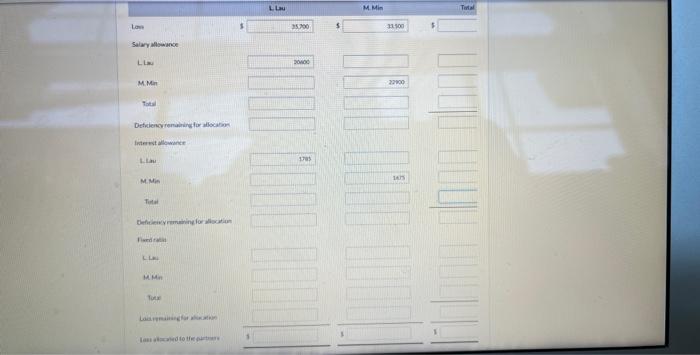

The partnership of Lau \& Min started the fiscal year on January 1.2022 with capital balances as follows:L.Lau $35,700 and M. Min $33.500. Lau S Min had a very disappointing fiscal year ended December 31, 2022. Before closing the income Summary and Drawings accounts, the balance in the Income Summary account was a debit of \$44,000. The poor results of the year are due to the recorting of aloss from a lawsuit during the year. By the end of May, 2022 , the partners determined that available cash in the business would be small, so they stopped withdrawing funds. As of May 31, 2022, L. Lau had withdrawn $6,400 and M. Min had withdram $8.400. No other withdrawals were made for the remainder of the year. Once the judgement against the partnership was issued, additional cash had to be invested to make a paymient on the settlement. On October 15, 2022, Lau and Min each invested 321,000 cash into the partnership. The partinership agreement of Lau \& Min provides for the division of any profit or loss using the following formula: 1. A salary allowance of $20,600 to Lau and $22,900 to Min. 2. An interest allowance of 5% on capital balances at the beginning of the year: 3. The remainder to be divided between Lau \& Min on a 3:2 basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts