Question: Please complete in the format/fields provided. Also include any calculations used. Thank you in advance. note: this is one full question, please do complete, for

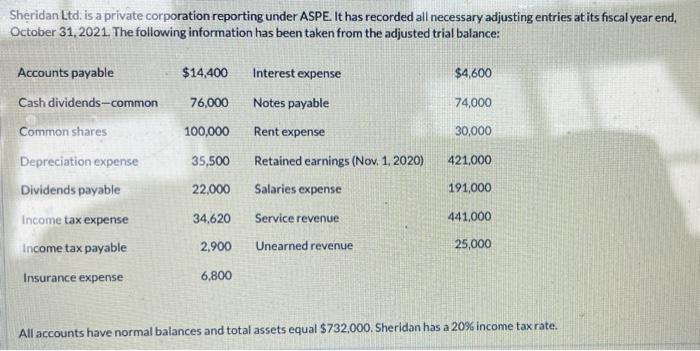

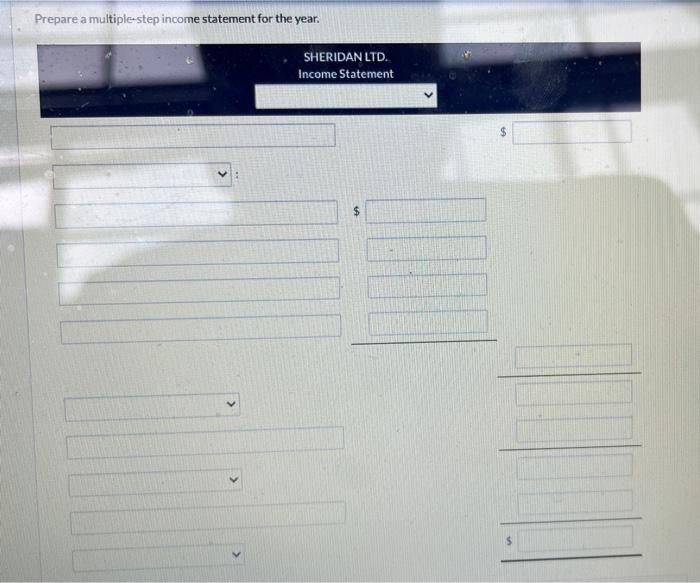

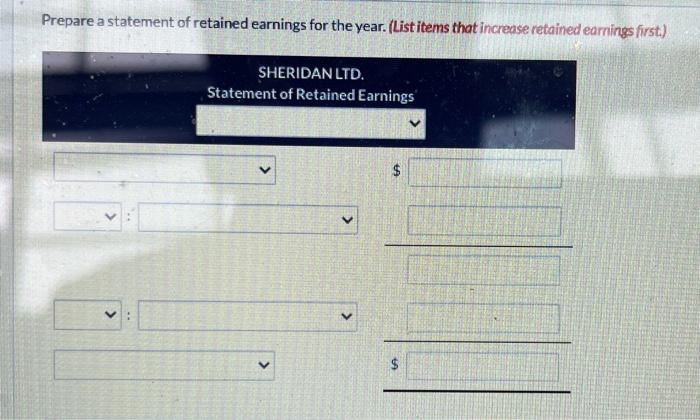

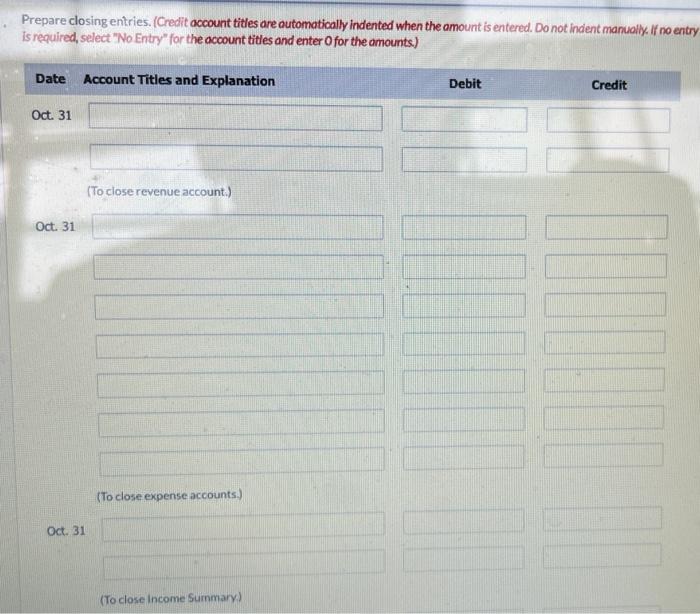

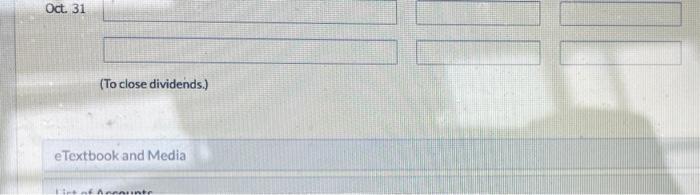

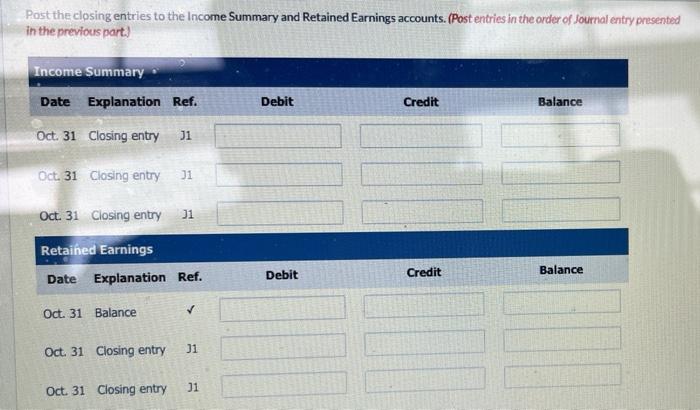

Sheridan Ltd: is a private corporation reporting under ASPE. It has recorded all necessary adjusting entries at its fiscal year end, October 31,2021 . The following information has been taken from the adjusted trial balance: All accounts have normal balances and total assets equal $732,000. Sheridan has a 20% income tax rate. In. Prepare a statement of retained earnings for the year. (List items that increase retained earnings first.) Prepare closing entries. (Credit account titles are outomatically indented when the amount is entered. Do not indent manuolly. If no entr) is required, select "No Entry" for the account titles and enter O for the amountc) Oct. 31 (To close dividends.) eTextbook and Media Post the closing entries to the Income Summary and Retained Earnings accounts. (Post entries in the order of Journal entry presented in the previous part]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts