Question: Please complete part b and INCLUDE FORMULAS. Thanks! BUS 202 Chapter 18-PI O Tell me what you want te do. View Review Data Formulas Page

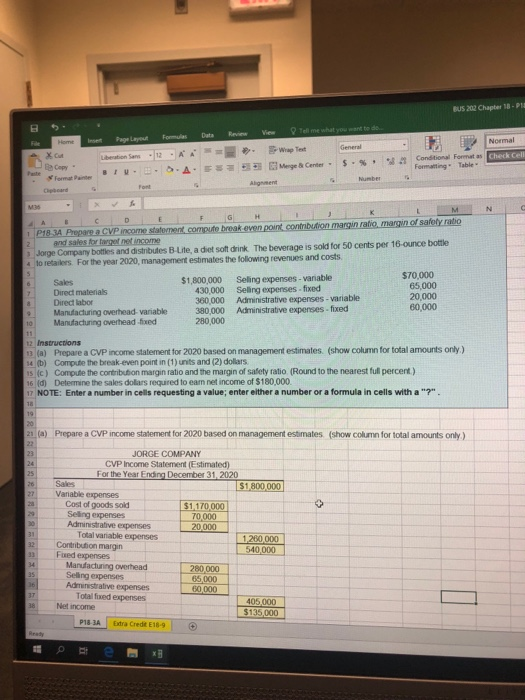

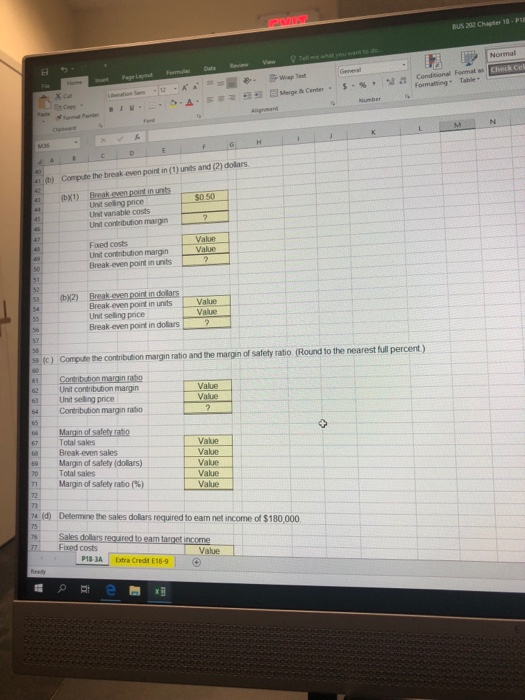

BUS 202 Chapter 18-PI O Tell me what you want te do. View Review Data Formulas Page Layout Normal Inset Home File General Wrap Test Condtional Format as Formatting Table X Cut Check Cell Liberation San E Merge & Center aCepy format Painter EE Paste Number Aignment Font Cipbeard M36 M. 1P18 3A Prepare a CVP income stateent, compute break even point contribution margin ratio, margin of safely ratio and sales for target net income Jorge Company bottles and distributes B-Lite, a diet soft drink The beverage is sold for 50 cents per 16-ounce bottle to retailers. For the year 2020, management estimates the folowing revenues and costs. $70,000 65,000 20,000 60,000 Seling expenses - variable Seling expenses - fixed Administrative expenses - variable Administrative expenses - fixed $1,800,000 430,000 360,000 380,000 280,000 Sales Direct materials Direct labor Manufacturing overhead- variable Manufacturing overhead -fixed 10 11 12 Instructions 13 (a) Prepare a CVP income statement for 2020 based on management estimates. (show column for total amounts only) 14 (b) Compute the break-even point in (1) units and (2) dollars 15 (c) Compute the contribution margin ratio and the margin of safety ratio. (Round to the nearest full percent.) 16 (d) Determine the sales dollars required to eam net income of $180,000. 17 NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?". 18 19 20 21 (a) 22 Prepare a CVP income statement for 2020 based on management estimates. (show column for total amounts only 23 24 JORGE COMPANY CVP Income Statement (Estimated) For the Year Ending December 31, 2020 25 Sales Variable expenses Cost of goods sold Seling expenses Administrative expenses Total variable expenses Contribution margin Fued expenses Manufacturing overhead Seling expenses Administrative expenses Total fixed expenses Net income $1,800,000 26 27 20 $1,170,000 70,000 20,000 29 30 31 1,260,000 540,000 32 33 34 280.000 65.000 35 36 60,000 37 405.000 $135,000 38 P18 JA Extra Credit E18-9 Ready 2MIS BUS 202 Chaeter 18- PIE Tet me what yeu want te do Normal View Revi Data Fomule M Conditional Format as Check Ce Formatting Table Geneal Page Layut Heme Wap Test Fie 12 Ltion Sane Merge & Center a-A.E Number Parte Alignment mat Paind fert 40 Compute the break even point in (1) units and (2) dolars 41 b) 42 Break even point in units Unit seling price (bX1) 43 $0.50 Unit variable costs 45 Unit contribution margin 46 47 Valun Value Faed costs Unit contribution margin Break-even point in units 48 49 51 52 53 Break-even point in dollars Break-even point in units Unit seling price Break-even point in dolars (bX2) Value Value 55 56 ST 58 5 (c) Compute the contribution margin ratio and the margin of safety ratio. (Round to the nearest full percent ) 60 Contribution margin ratio Unit contribution margin 61 Value 62 Unit seling price Contribution margin ratio Value 63 64 65 Margin of safety ratio Total sales Break-even sales Margin of safety (dollars) 66 67 Value 68 Value Value 69 70 71 Total sales Value Value Margin of safety ratio (%) 72 73 74 (d) Detemine the sales dollars reguired to eam net income of $180,000. 75 76 Sales dollars reguired to eam target income Fixed costs 77 Value P18-JA Extra Credit E16-9 Reedy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts