Question: Please complete part C . It is not 1 6 5 Million. he following is net asset information for the Dhillon Division of Pina Colada

Please complete part C It is not Million. he following is net asset information for the Dhillon Division of Pina Colada Inc.: a

Correct Answer Used

Under ASPE, determine if there is any impairment and prepare any necessary entry on December Credit account titles

are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No entry" for the account

titles and enter for the amounts. List debit entry before credit entry. ENTER AMOUNTS IN MILLIONS.

Date Account Titles and Explanation

Debit

Credit

Dec.

Loss on Impairment

Accumulated Impairment Losses Goodwill

b

Your answer is correct.

On December it is estimated that the reporting unit's fair value has increased to $ million. Under ASPE, prepare the

journal entry, if any, to record the increase in fair value. Credit account titles are automatically indented when the amount is

entered. Do not indent manually. If no entry is required, select No entry" for the account titles and enter Ofor the amounts. List debit entry

before credit entry. ENTER AMOUNTS IN MILLIONS.

Date

Account Titles and Explanation

Debit

Credit

Dec.

Under IFRS, determine if there is any impairment and prepare any necessary entry on December Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No entry" for the account titles

and enter for the amounts. List debit entry before credit entry. ENTER AMOUNTS IN MILLIONS.

Date

Account Titles and Explanation

Debit

Credit

Dec.

Loss on Impairment

Accumulated Impairment Losses Goodwill

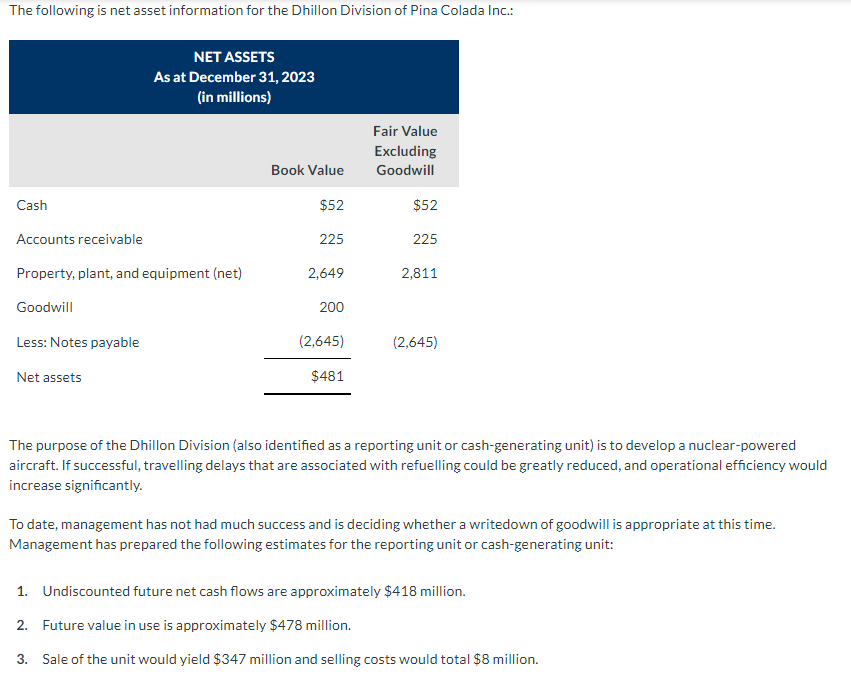

NET ASSETS

As at December

in millions

The purpose of the Dhillon Division also identified as a reporting unit or cashgenerating unit is to develop a nuclearpowered

aircraft. If successful, travelling delays that are associated with refuelling could be greatly reduced, and operational efficiency would

increase significantly.

To date, management has not had much success and is deciding whether a writedown of goodwill is appropriate at this time.

Management has prepared the following estimates for the reporting unit or cashgenerating unit:

Undiscounted future net cash flows are approximately $ million.

Future value in use is approximately $ million.

Sale of the unit would yield $ million and selling costs would total $ million.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock