Question: PLEASE COMPLETE PART E. PLEASE COMPLETE PART E. Use this information to answer the next six questions. Suppose a firm is considering investing in a

PLEASE COMPLETE PART "E".  PLEASE COMPLETE PART "E".

PLEASE COMPLETE PART "E".

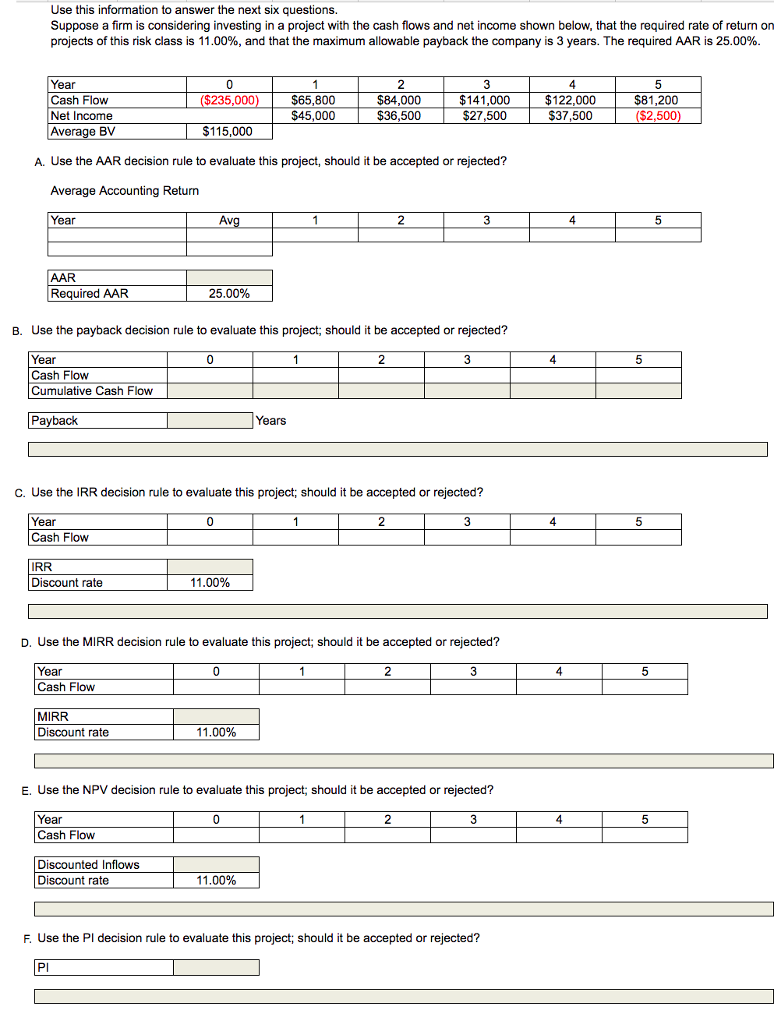

Use this information to answer the next six questions. Suppose a firm is considering investing in a project with the cash flows and net income shown below, that the required rate of return on projects of this risk class is 11.00%, and that the maximum allowable payback the company is 3 years. The required AAR is 25.00% 4 Year Cash Flovw Net Income Average BV $65,800 $45,000 $84,000 $36,500 $81,200 ($2,500 $235,000 $141,000 $122,000 $27,500 $37,500 $115,000 A. Use the AAR decision rule to evaluate this project, should it be accepted or rejected? Average Accounting Return Year Av AAR Required AAR 25.00% B. Use the payback decision rule to evaluate this project; should it be accepted or rejected? Year Cash Flow Cumulative Cash Flow Payback Years C. Use the IRR decision rule to evaluate this project, should it be accepted or rejected? Year Cash Flow IRR Discount rate 11 .00% D. Use the MIRR decision rule to evaluate this project; should it be accepted or rejected? Year Cash Flow MIRR Discount rate 11.00% E. Use the NPV decision rule to evaluate this project; should it be accepted or rejected? Year Cash Flow Discounted Inflows Discount rate 11.00% F. Use the Pl decision rule to evaluate this project; should it be accepted or rejected? PI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts