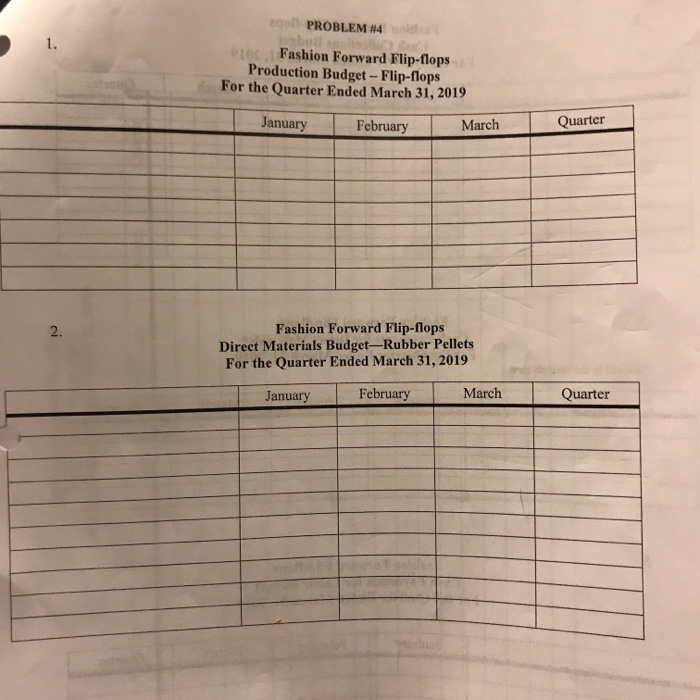

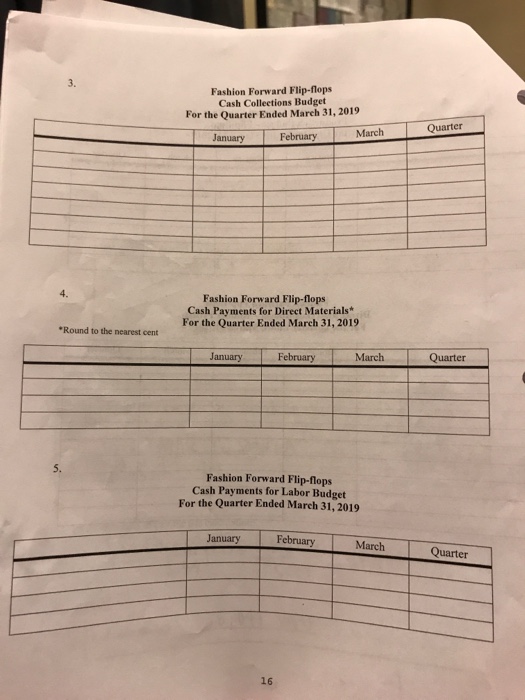

Question: Please complete parts 1-6 and show work PROBLEM #4 Objective The objective of Problem 4 is to reinforce your understanding of the preparation of gets,

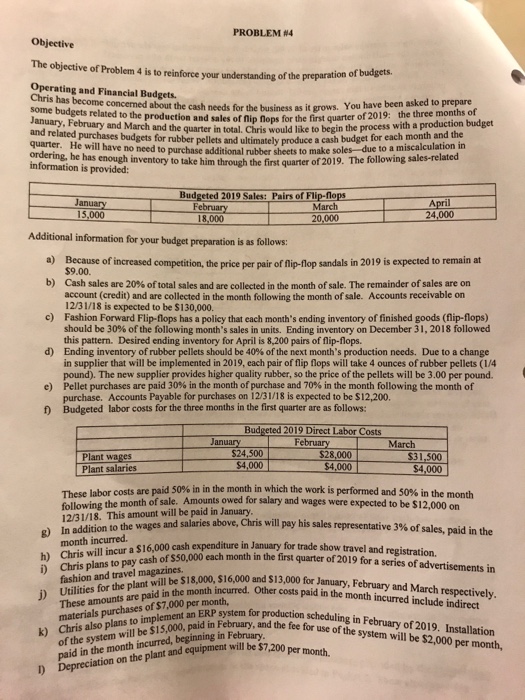

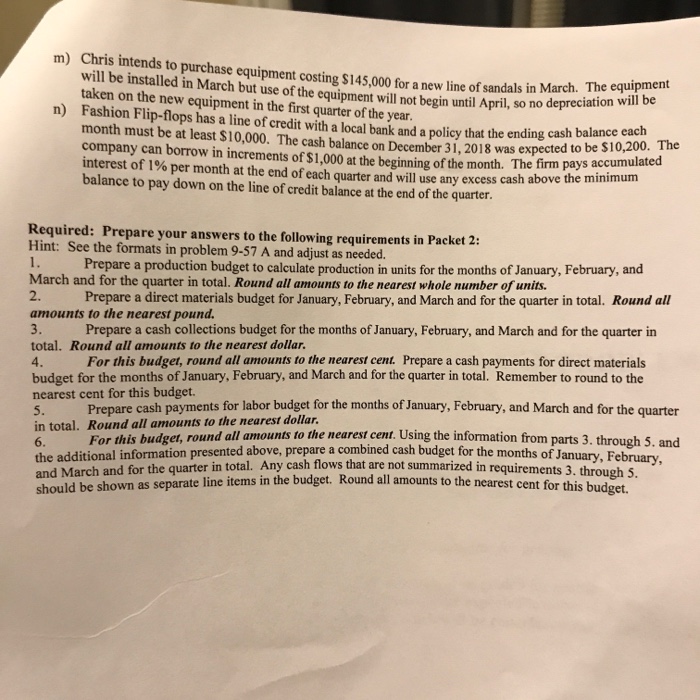

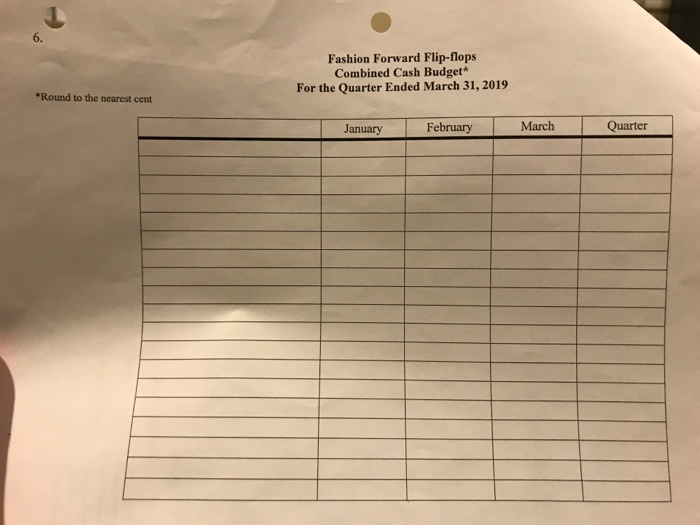

PROBLEM #4 Objective The objective of Problem 4 is to reinforce your understanding of the preparation of gets, Operating and Financial Budgets Chris has become concerned about the some budgets related to the production and sales of nip fops for the tin b ein the process with a producthr cash needs for the business as it grows. You have been asked to prepare of 2019: the three months of and the quarter in total and related quarter. He will have no need to purchase additional rubber sheets to m ordering, he has enough inventory to take him through the first quarter of 201 information is provided: ets and ultimately produce a cash budget for each month and the ake soles- due to a miscalculation in purchases budgets for rubber pell 9. The following sales-related Budgeted 2019 Sales: Pairs of Flip-flops March 20,000 15,000 24,000 Additional information for your budget preparation is as follows: a) Because of increased competition, the price per pair of flip-flop sandals in 2019 is expected to remain at $9.00. Cash sales are 20% oftotal sales and are collected in the month of sale. The remainder of sales are on account (credit) and are collected in the month following the month of sale. Accounts receivable on 12/31/18 is expected to be $130,000. Fashion Forward Flip-flops has a policy that each month's ending inventory of finished goods (flip-flops) should be 30% of the following month's sales in units. Ending inventory on December 31, 2018 followed this pattern. Desired ending inventory for April is 8,200 pairs of flip-flops. Ending inventory of rbber pellets should be 40% of the next month's production needs. Due to a change in supplier that will be implemented in 2019, each pair of flip flops will take 4 ounces of rubber pellets (1/4 pound). The new supplier provides higher quality rubber, so the price of the pellets will be 3.00 per pound. Pellet purchases are paid 30% in the month of purchase and 70% in the month following the month of purchase. Accounts Payable for purchases on 12/31/18 is expected to be $12,200. Budgeted labor costs for the three months in the first quarter are as follows: b) c) d) e) f) Budgeted 2019 Direct Labor Costs March $28,000 $24,500 $4,000 Plant Plant salaries 54,000 These labor costs are paid 50% in in the month in which the work is performed and 50% in the month following the month of sale. Amounts owed for salary and wages were expected to be $12,000 on 12/31/18. This amount will be paid in January In addition to the wages month incurred. Chris will incur a $16,000 and salaries above, Chris will pay his sales representative 3% of sales, paid in the above, g) cash expenditure in January for trade show travel and registration. cash of ss0,000 each month in the first quarter of 2019 for a series of advertisements in and travel magazb 8000, 6,000 and $13,000 for January, February and March respectively h) Utilities for These amounts are paid in the month incurred. the plant amounts are pof s70 id in the month incurred. Other costs paid in the month incurred include indirect Re sytem for production scheduling in February of 2019. Installation esrrchase lt Chris also plans to February, and the feefor use of the system will be $2,000 per month, of the system will be $15,000, paid in and paid in the month incurred, beginning in February Depreciation on the plant and k) l)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts