Question: Please complete question 1 part a and b Question 1 (this question has two parts a) and b) ((1+1+1) + (3+2) = 8 marks) .

Please complete question 1 part a and b

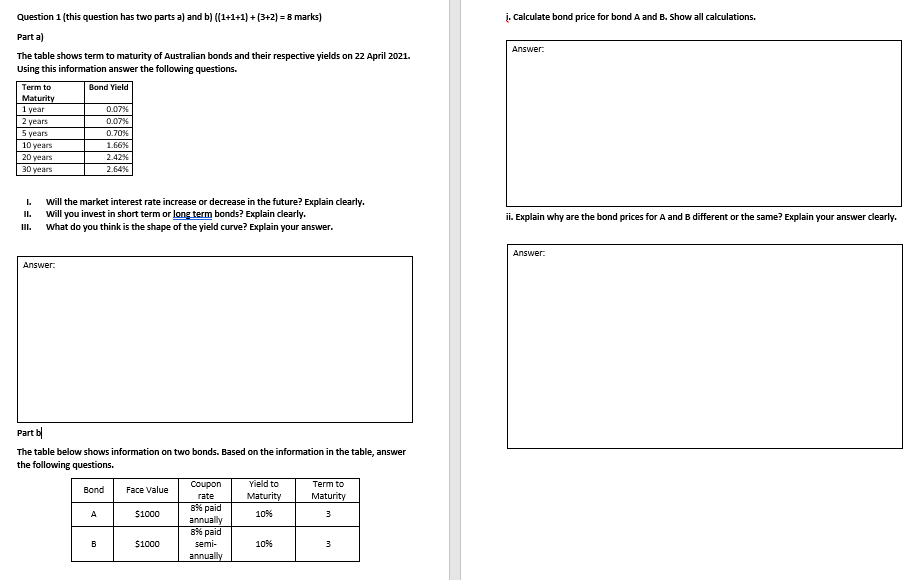

Question 1 (this question has two parts a) and b) ((1+1+1) + (3+2) = 8 marks) . calculate bond price for bond A and B. Show all calculations. Parta) Answer: The table shows term to maturity of Australian bonds and their respective yields on 22 April 2021. Using this information answer the following questions. Bond Yield Term to Maturity 1 year 0.07% 2 years 0.07% 0.70% 1.66% 5 years 10 years 20 years 30 years 2.42% 2.64% L will the market interest rate increase or decrease in the future? Explain clearly. will you invest in short term or long term bonds? Explain clearly. What do you think is the shape of the yield curve? Explain your answer. ii. Explain why are the bond prices for A and B different or the same? Explain your answer clearly. Answer: Answer: Part 6 The table below shows information on two bonds. Based on the information in the table, answer the following questions. Coupon Yield to Term to Bond Face value rate Maturity Maturity 856 paid A $1000 10% 3 annually 856 paid B $1000 1096 3 annually semi- Question 1 (this question has two parts a) and b) ((1+1+1) + (3+2) = 8 marks) . calculate bond price for bond A and B. Show all calculations. Parta) Answer: The table shows term to maturity of Australian bonds and their respective yields on 22 April 2021. Using this information answer the following questions. Bond Yield Term to Maturity 1 year 0.07% 2 years 0.07% 0.70% 1.66% 5 years 10 years 20 years 30 years 2.42% 2.64% L will the market interest rate increase or decrease in the future? Explain clearly. will you invest in short term or long term bonds? Explain clearly. What do you think is the shape of the yield curve? Explain your answer. ii. Explain why are the bond prices for A and B different or the same? Explain your answer clearly. Answer: Answer: Part 6 The table below shows information on two bonds. Based on the information in the table, answer the following questions. Coupon Yield to Term to Bond Face value rate Maturity Maturity 856 paid A $1000 10% 3 annually 856 paid B $1000 1096 3 annually semi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts