Question: Please complete requirements 4-7. fill in the adjusting Entries Post adjusting Entries to the General Ledger fill in the adjusted trial balance fill in the

Please complete requirements 4-7.

fill in the adjusting Entries

Post adjusting Entries to the General Ledger

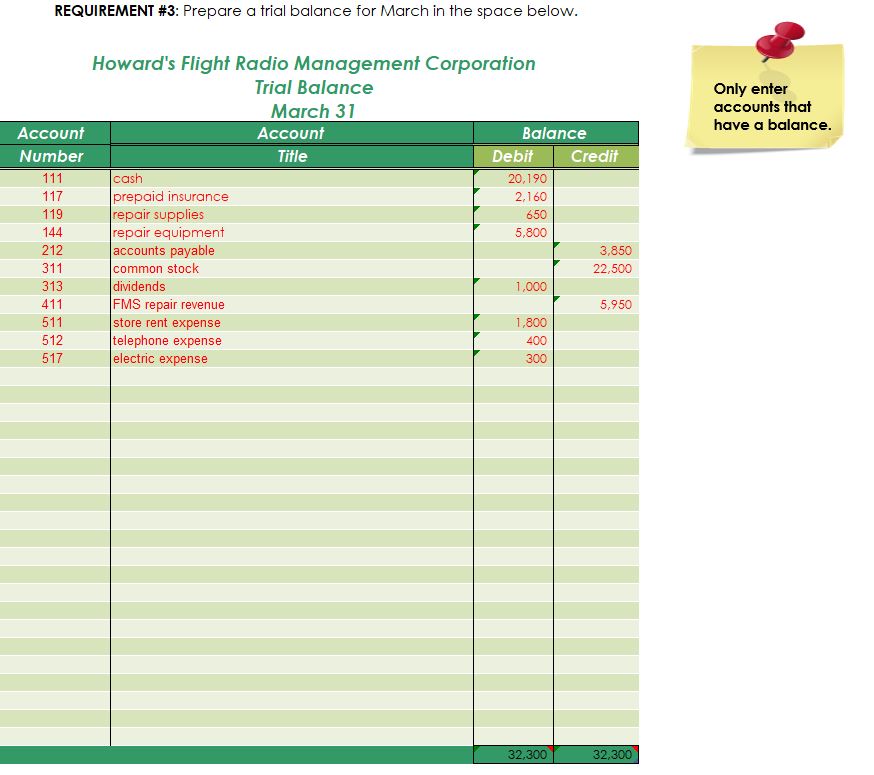

fill in the adjusted trial balance

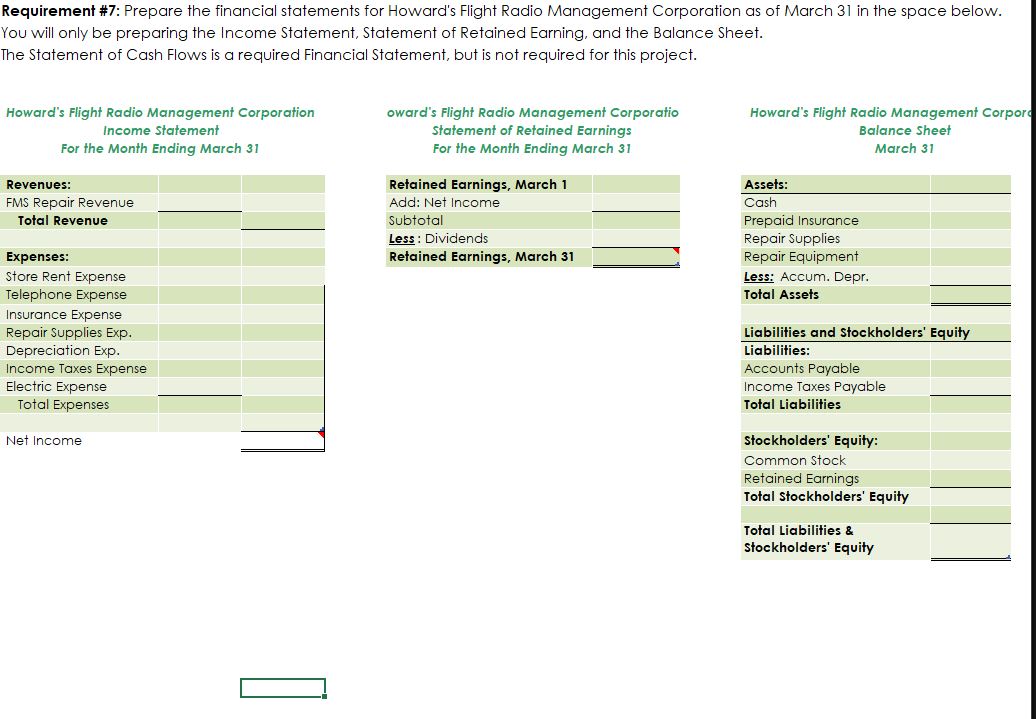

fill in the financial statements

Here is the pictures of what I'm needing help on.

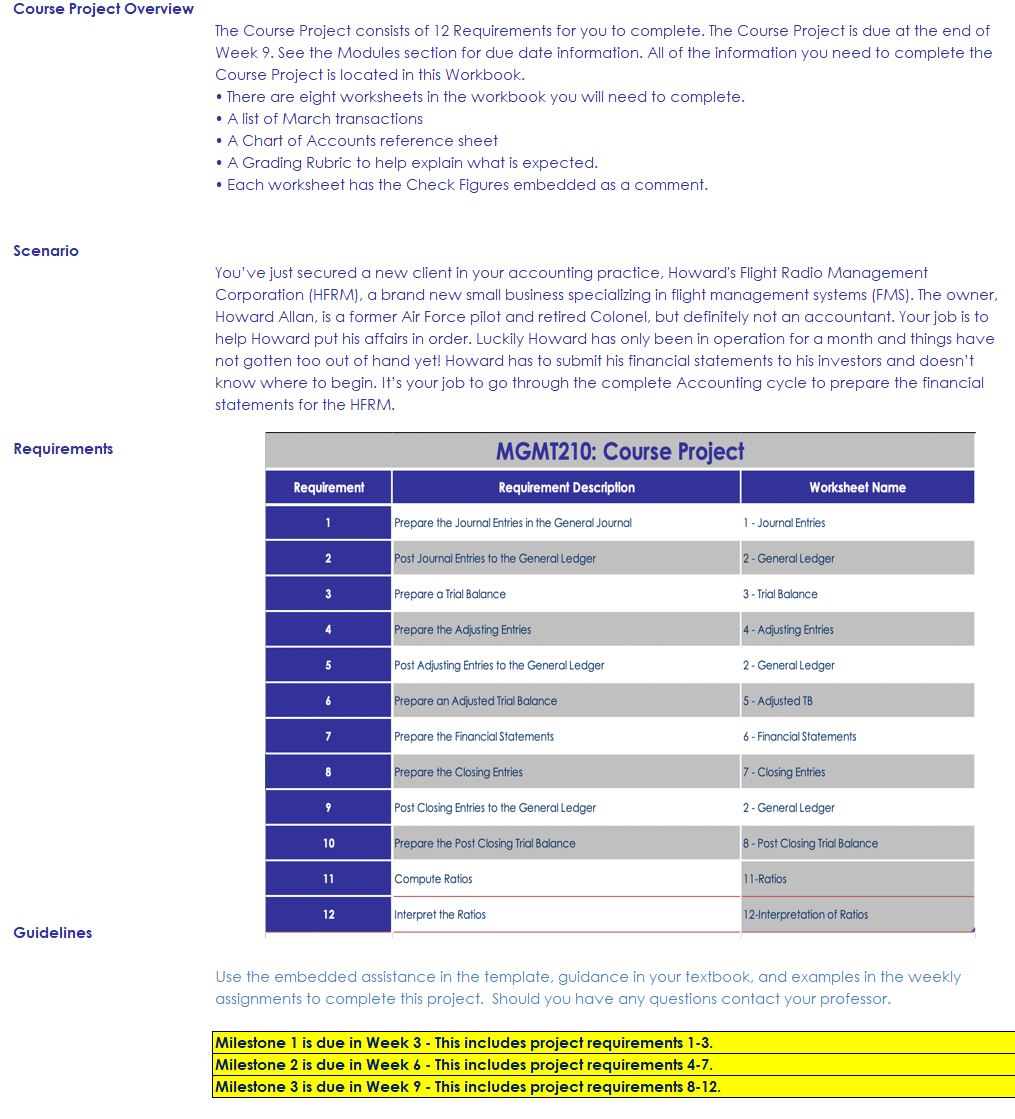

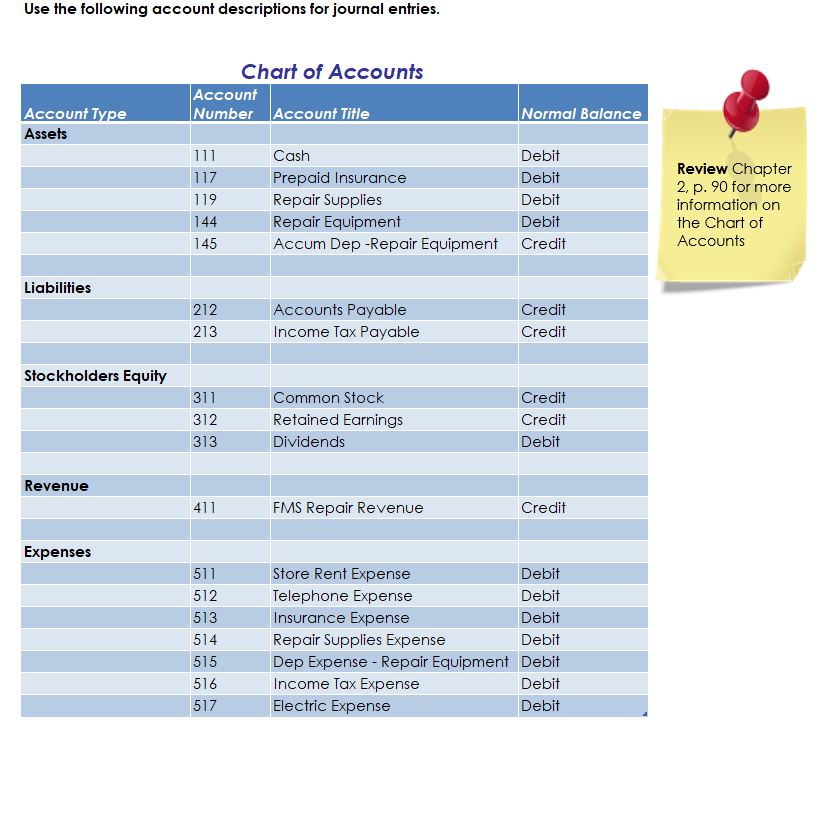

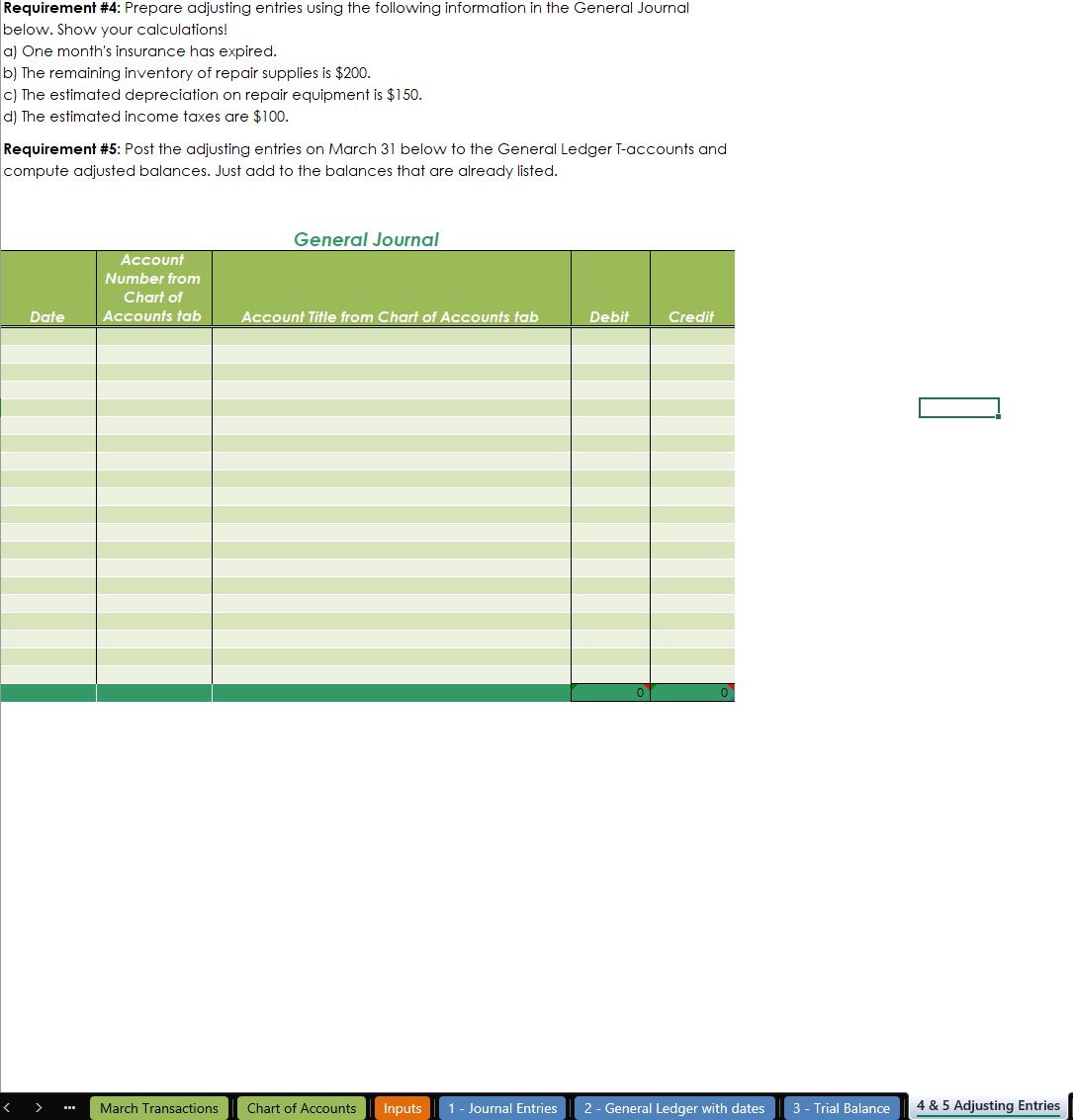

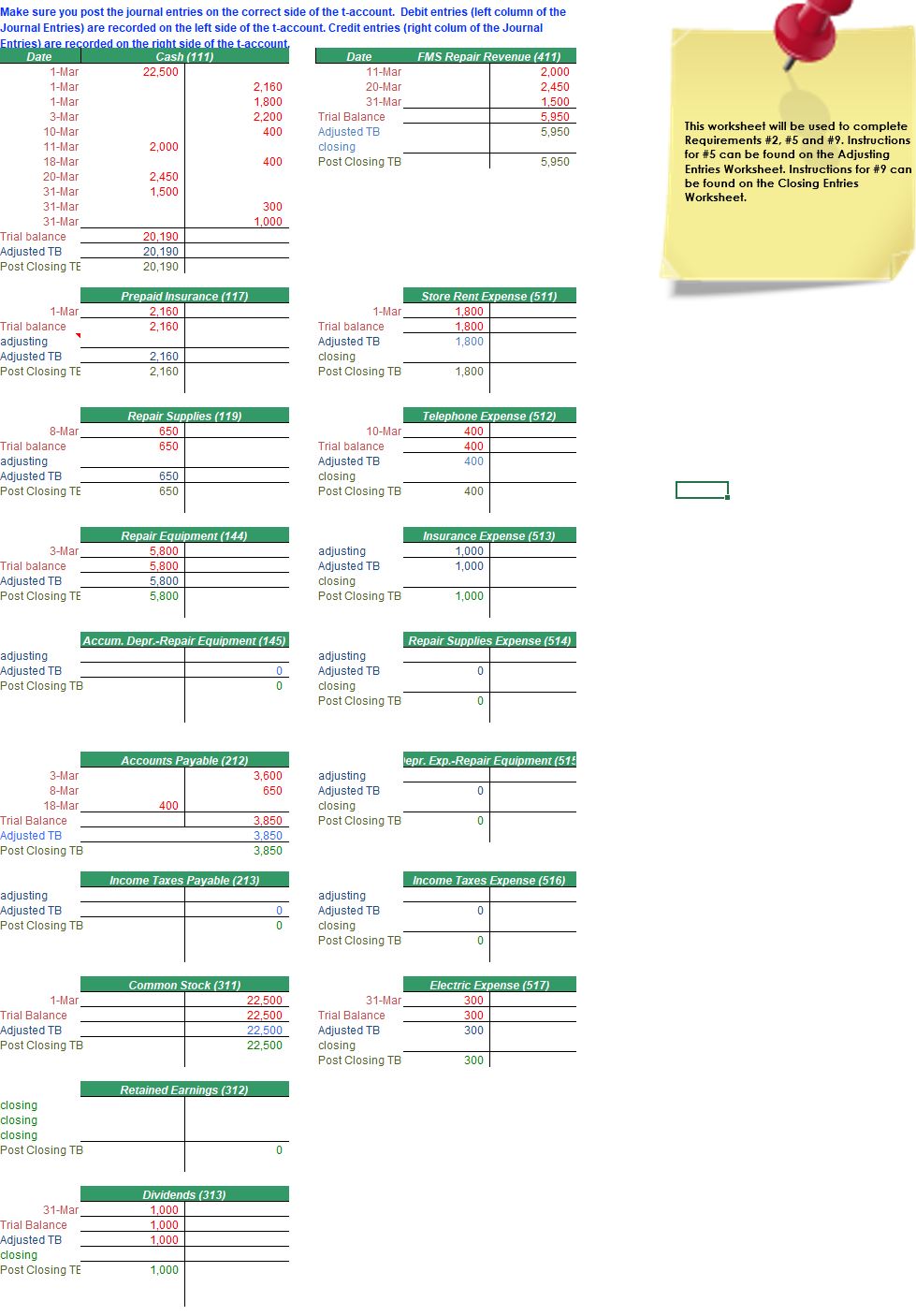

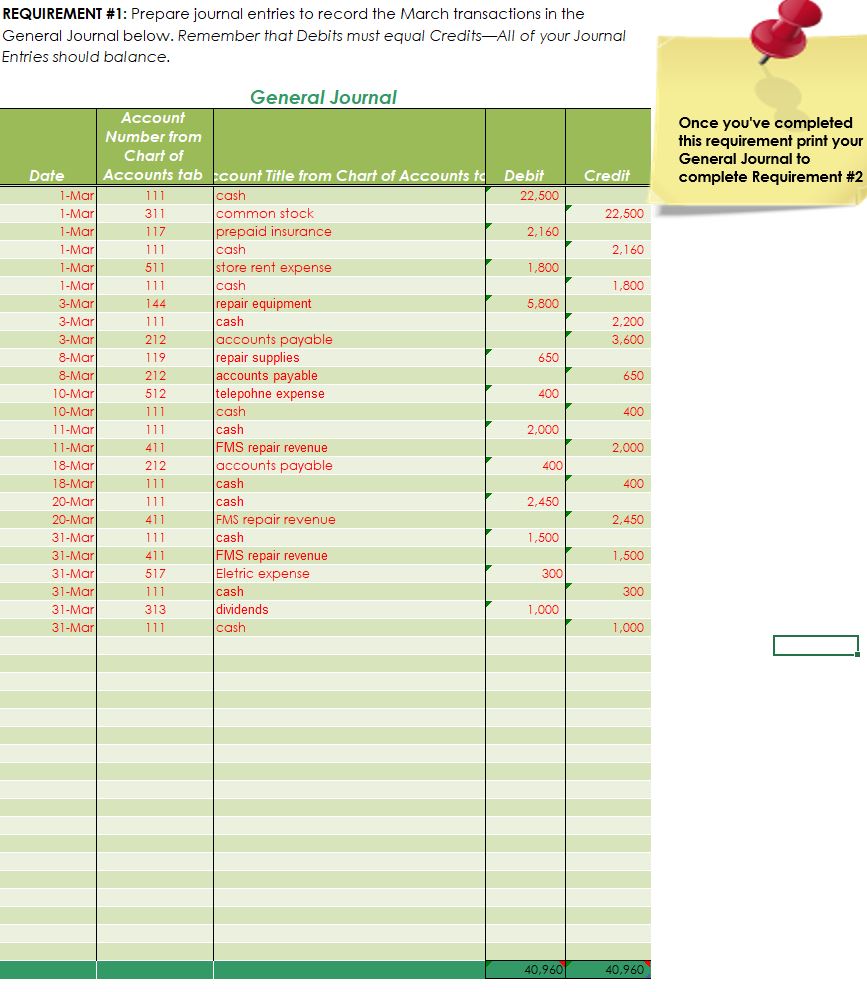

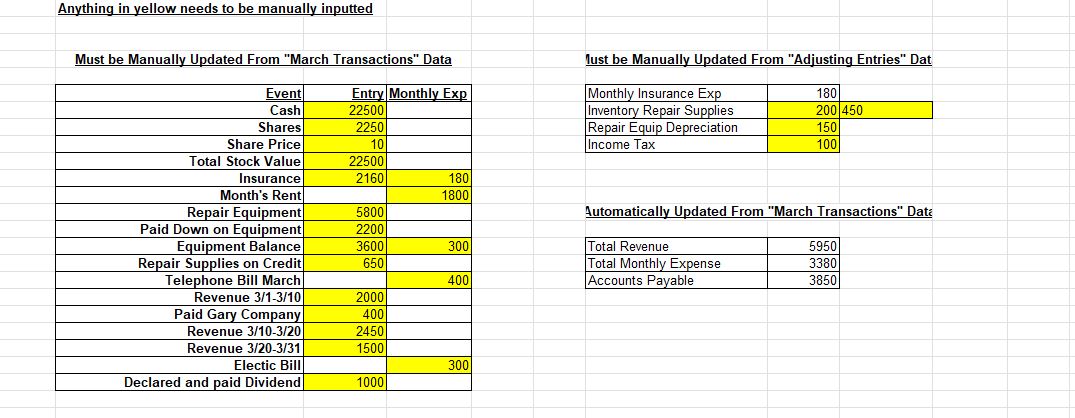

Course Project Overview Scenario Requirements Guidelines The Course Project consists of 12 Requirements for you to complete. The Course Project is due at the end of Week 9. See the Maodules section for due date information. All of the information you need to complete the Course Project is located in this Workbook. There are eight worksheets in the workbook you will need to complete. * Alist of March fransactions * A Chart of Accounts reference sheet * A Grading Rubric to help explain what is expected. Each worksheet has the Check Figures embedded as a comment. You've just secured a new client in your accounting practice, Howard's Flight Radio Management Corporation (HFRM), a brand new small business specializing in flight management systems [FMS). The owner, Howard Allan, is a former Air Force pilot and retired Colonel, but definitely not an accountant. Your job is to help Howard put his affairs in order. Luckily Howard has only been in operation for a month and things have not gotten too out of hand yet! Howard has to submit his financial statements to his investors and doesn't know where to begin. It's your job to go through the complete Accounting cycle to prepare the financial statements for the HFRM. MGMT210: Course Project Requirement Requirement Description Worksheet Name Prepare the Journal Enfries in the General Journal 1 - Jowrnal Enfries Paost Journal Enfries to the General Ledger 2 - General Ledger Prepare a Trial Balance 3 - Tricl Balance Prepare the Adjusfing Entries 4- Adjusting Enfries Post Adjusting Entries to the General Ledger 2 - General Ledger Prepare an Adjusted Trial Balance 5- Adjusted T8 Prepaore the Financial Statements 4 - Financiol Statements Prepare the Closing Enfries 7 = Closing Enfries Post Closing Enfries fo the General Ledger 2 - General Ledger Prepare the Post Closing Trial Balanice 8- Post Closing Trial Balonce Compute Ratios 11-Ratios Interpret the Rotios 12-Interpretation of Rafios Use the embedded assistance in the template, guidance in your textbook, and examples in the weekly assignments fo complete this project. Should you have any questions contact your prafessor. Milestone 1 is due in Week 3 - This includes project requirements 1-3. Milestone 2 is due in Week & - This includes project requirements 4-7. Milestone 3 is due in Week 9 - This includes project requirements 8-12. Use the following account descriptions for journal entries. e e Accounf Type Number |AccountTifle Normal Balance Assetls Liabilities Stockholders Equity Revenue Expenses 111 117 119 144 145 212 213 311 312 313 411 511 512 513 514 515 516 517 Chart of Accounts Cash Prepaid Insurance REepair Supplies Repair Equipment Accum Dep -Repair Equipment Accounts Payable Income Tax Payable Common Stock Retained Earnings Dividends FIS Repair Revenue Store Rent Expense Telephone Expense Insurance Expense Repair Supplies Expense Dep Expense - Repair Equipment Income Tax Expense Eectric Expense Debit Debit Debit Debit Credit Credit Credit Credit Credit Debit Credit Debit Debit Debit Debit Debit Debit Debit Review Chopter 2, p. 90 for more information on the Chart of Accounts Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $200. c) The estimated depreciation on repair equipment is $150. d) The estimated income taxes are $100. Requirement #5: Post the adjusting entries on March 31 below to the General Ledger T-accounts and compute adjusted balances. Just add to the balances that are already listed. General Journal Account Number from Chart of Accounts tab Account Title from Chart of Accounis fab [lgTe]} & 1 - Journal Entries 2 - General Ledger with dates 3 - Trial Balance 4 &5 Adjusting Entries I Make sure you post the journal entries on the correct side of the t-account. Debit entries (left column of the Journal Entries) are recorded on the left side of the t-account. Credit entries (right colum of the Journal Entries) are recorded on the right side of the t-account Date Cash (111) Date FMS Repair Revenue (411) -Ma 22,500 11-Ma 2,000 -Mar 2,16 20-Mar 2.450 1-Mar 1,800 31-Mar 1.500 3-Mar 2,200 Trial Balance 5,950 10-Mar 400 Adjusted TB 5,950 This worksheet will be used to complete Requirements #2, #5 and #9. Instructions 11-Mar 2,000 closing for #5 can be found on the Adjusting 18-Ma 400 Post Closing TE 5,950 Entries Worksheet. Instructions for #9 can 20-Mar 2,45 be found on the Closing Entries 31-Ma 1.500 Worksheet. 31-Mar 300 31-Ma 1.000 Trial balance 20,190 Adjusted TB 20,190 Post Closing TE 20, 190 Prepaid Insurance (117) Store Rent Expense (511) 1-Mar 2.160 1-Mar 1,800 Trial balance 2,160 Trial balance 1,800 adjusting Adjusted TB 1,800 Adjusted TB 2.160 closing Post Closing TE 2, 160 Post Closing TB .800 Repair Supplies (119) Telephone Expense (512) 8-Ma 650 10-Mar 400 Trial balance 650 Trial balance 400 adjusting Adjusted TB 400 Adjusted TB 650 closing Post Closing TE 650 Post Closing TB 400 Repair Equipment (144) Insurance Expense (513) 3-Ma 5,800 adjusting 1,000 Trial balance 5,800 Adjusted TB 1,000 Adjusted TB 5,800 closing Post Closing TE 5,800 Post Closing TB 1,000 Accum. Depr.-Repair Equipment (145) Repair Supplies Expense (514) adjusting adjusting Adjusted TB Adjusted TB Post Closing TB closing Post Closing TB Accounts Payable (212) epr. Exp.-Repair Equipment (515 3-Mar 3,600 adjusting 8-Mar 650 Adjusted TB 0 18-Ma 400 closing Trial Balance 3.850 Post Closing TB Adjusted TB 3,850 Post Closing TB 3,850 Income Taxes Payable (213) Income Taxes Expense (516) adjusting adjusting Adjusted TB 0 Adjusted TE 0 Post Closing TB closing Post Closing TB Common Stock (311) Electric Expense (517) 1-Ma 22,500 31-Ma 300 Trial Balance 22,500 Trial Balance 300 Adjusted TB 22,500 Adjusted TB 300 ost Closing TB 22,500 closing Post Closing TE 300 Retained Earnings (312) closing closing closing Post Closing TB Dividends (313) 31-Ma 1,000 Trial Balance 1,000 Adjusted TB 1,000 closing Post Closing TE 1,000REQUIREMENT #: Prepare an Adjusted Trial Balance in the space below. Howard's Flight Radio Management Corporation I Adjusted Trial Balance Only enter March 31 accounts that Account | LRIENtE have a balance. i Debit Credit Requirement #7: Prepare the financial statements for Howard's Flight Radio Management Corporation as of March 31 in the space below. You will only be preparing the Income Statement, Statement of Retained Earning, and the Balance Sheet. The Statement of Cash Flows is a required Financial Statement, but is not required for this project. Howard's Flight Radioc Management Corporation Income Statement For the Month Ending March 31 Revenues: FMS Repair Revenue Total Revenue Expenses: store Rent Expense Telephone Expense Insurance Expense Repair supplies Exp. Depreciation Exp. Income Taxes Bxpense Electric Expense Total Expenses MNet Income oward's Flight Radio Management Corporatio Statement of Retained Earnings For the Month Ending March 31 Retained Earnings, March 1 Add: Net Income Subtotal Less: Dividends Retained Earnings, March 31 e Howard's Flight Radic Management Corpor Balance Sheet March 31 Assets: Cash Prepaid Insurance Repair supplies Repair Equipment Less: Accum. Depr. Total Aszetls Liabilities and Stockholders' Equity Liabilities: Accounts Payable Income Taxes Payable Total Liabilities stockholders' Equity: Common Stock Retained Earnings Total stockholders' Equity Total Liabilities & stockholders' Equity \fAnything in yellow needs to be manually inputted Must be Manually Updated From "March Transactions\" Data lust be Manually Updated From "Adjusting Entries\" Dat Event Entry|Monthly Exp Maonthly Insurance Exp 180 Cash 22500 Inventory Repair Supplies 200(450 Shares 2250 Repair Equip Depreciation 150 Share Price 10 Income Tax 100 Total Stock Value 22500 Insurance 2160 180 Month's Rent 1800 Repair Equipment 5800 Automatically Updated From "March Transactions\" Dat: Paid Down on Equipment 2200 Equipment Balance 3600 300 Total Revenue 5950 Repair Supplies on Credit 650 Total Monthly Expense 3380 Telephone Bill March 400 Accounts Payable 3850 Revenue 3/1-3/10 2000 Paid Gary Company 400 Revenue 3/10-3/20 2450 Revenue 3/20-3/31 1500 Electic Bill 300 Declared and paid Dividend 1000 REQUIREMENT #3: Prepare a frial balance for March in the space below. Account Number 111 17 119 144 212 in 3 411 511 512 By cash prepaid insurance repair supplies repair equipment accounts payable commen stock dividends FMS repair revenue store rent expense telephone expense electric expense Trial Balance March 31 Account Title Howard's Flight Radio Management Corporation Balance 3,850 22,500 5,950 L 2 Only enter accounts that have a balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts