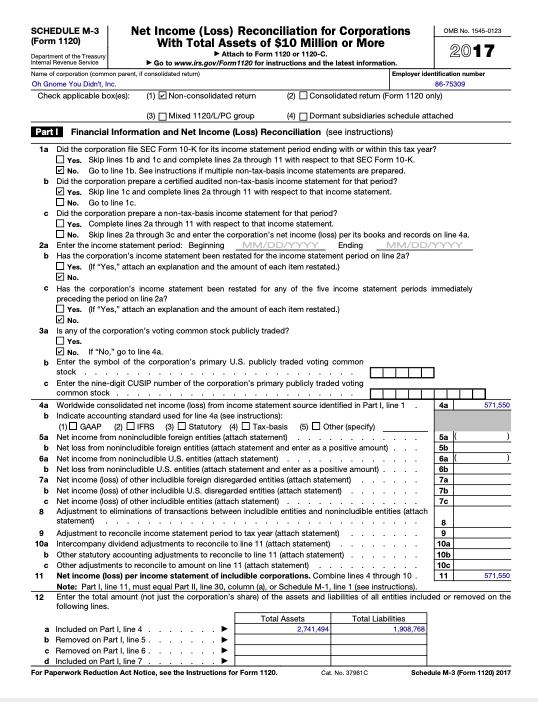

Question: Complete Schedule M-3 using the Excel sheet. Print the file titled Schedule M-3 partially completed.pdf . Complete Parts II and III of Schedule M-3

Complete Schedule M-3 using the Excel sheet.

- Print the file titled “Schedule M-3 – partially completed.pdf ”.

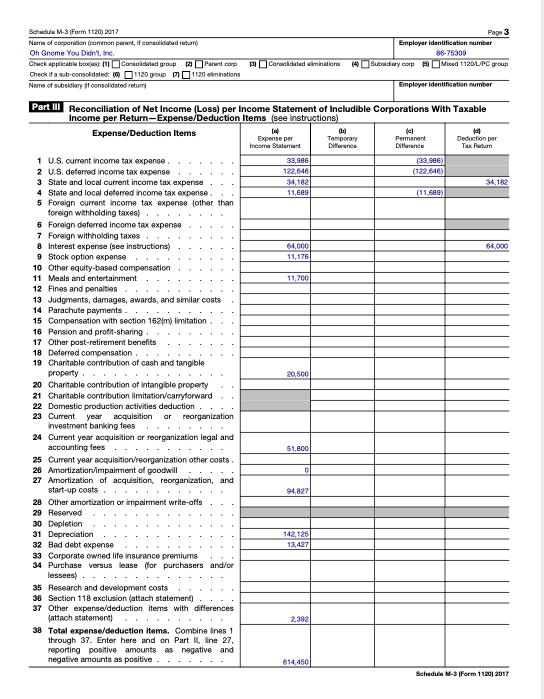

- Complete Parts II and III of Schedule M-3 by hand:

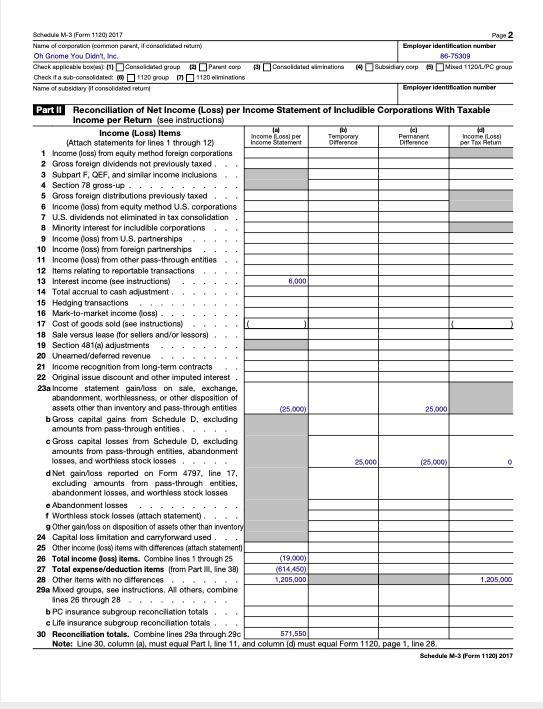

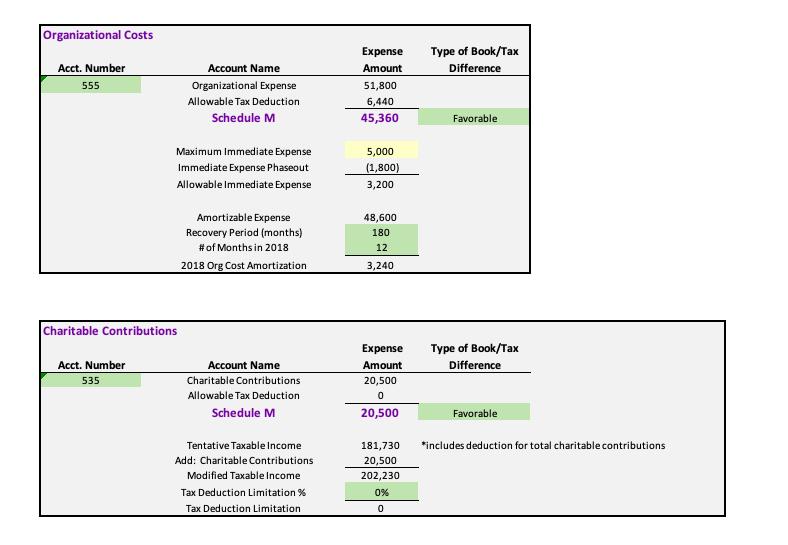

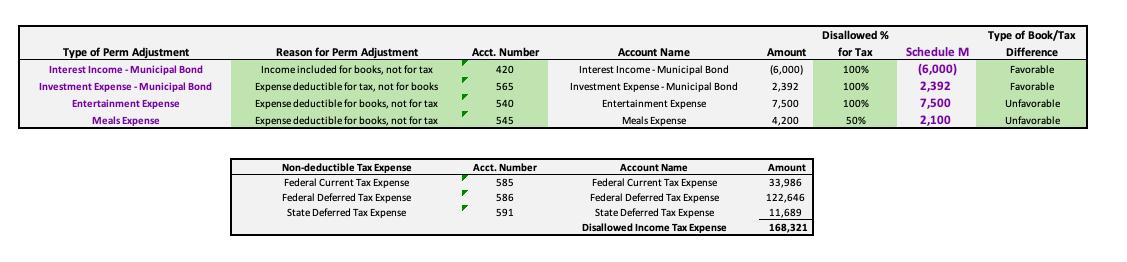

- Locate the rows with book-tax differences and input the book-tax adjustment you calculated in Step 1, making sure you properly input the adjustment in the Temporary or Permanent columns on the Schedule M-3.

- Compute the resulting taxable income/deduction and input your answer in column (d) of the applicable row.

- Hint – in Part III, expense amounts are shown as positive amounts. Therefore, if a book-tax difference reduces book expense, you will show a negative number in the Temporary or Permanent columns.

- The book-tax differences associated with capital losses and income tax expense have already been completed for you.

- In Part III, total each column in Row 38 – column (a) has already been totaled for you.

- in Part II, subtotal each column in Row 26 as instructed on the form – column (a) has already been subtotaled for you.

- In Part II Line 27, fill in the amounts you totaled for each column in (d) above.

- In Part II, input the total for each column in Row 30, following the specific instructions on the form.

- Checkpoint – Schedule M-3 Part II Row 30 column (d) should equal the taxable income you calculated in Step 1 (on the “Book-to-tax Rec” Excel worksheet).

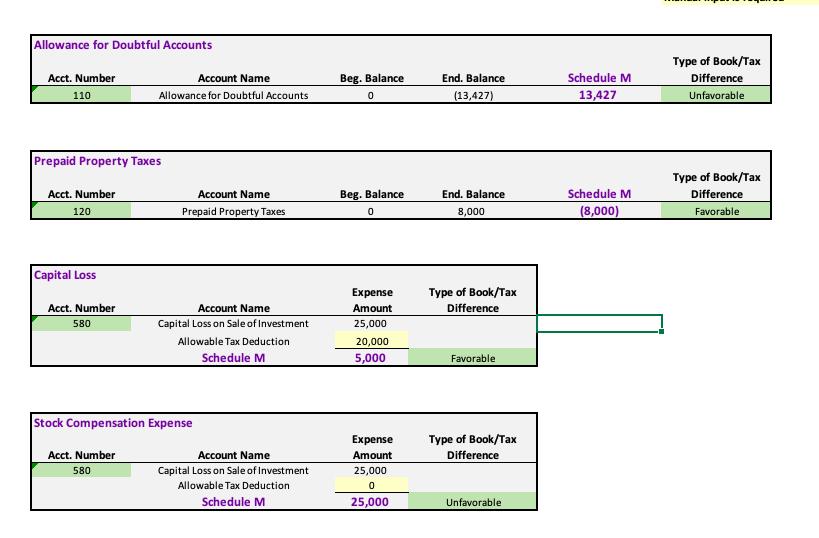

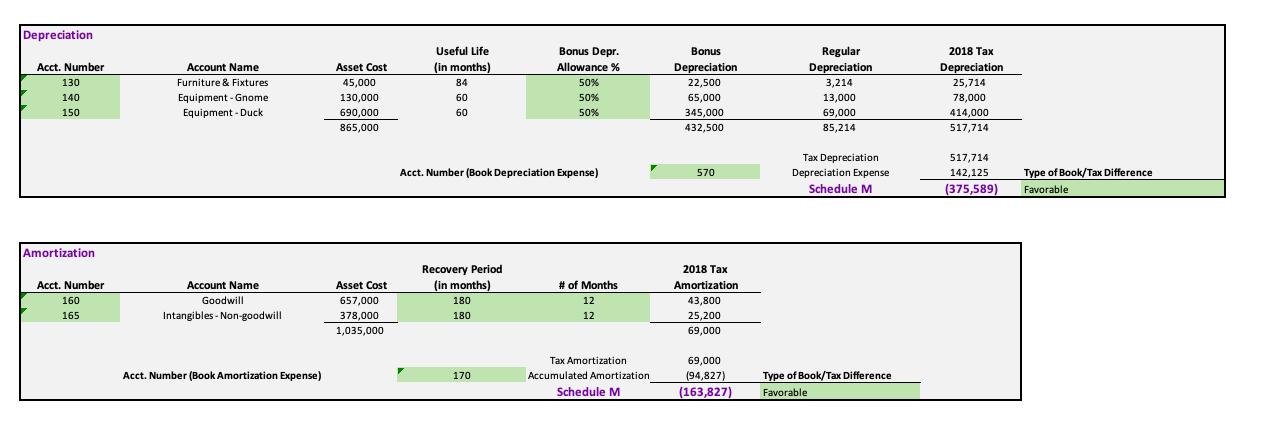

Allowance for Doubtful Accounts Acct. Number 110 Prepaid Property Taxes Acct. Number 120 Capital Loss Account Name Allowance for Doubtful Accounts Acct. Number 580 Account Name Prepaid Property Taxes Account Name Capital Loss on Sale of Investment Allowable Tax Deduction Schedule M Stock Compensation Expense Acct. Number 580 Account Name Capital Loss on Sale of Investment Allowable Tax Deduction Schedule M Beg. Balance 0 Beg. Balance 0 Expense Amount 25,000 20,000 5,000 Expense Amount 25,000 0 25,000 End. Balance (13,427) End. Balance 8,000 Type of Book/Tax Difference Favorable Type of Book/Tax Difference Unfavorable Schedule M 13,427 Schedule M (8,000) Type of Book/Tax Difference Unfavorable Type of Book/Tax Difference Favorable

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

To complete Schedule M3 using the provided information follow these steps Part II Reconciliation of ... View full answer

Get step-by-step solutions from verified subject matter experts