Question: please complete solving the question with the numbers I posted and show the final aswers. A company is considering the purchase of a capital asset

please complete solving the question with the numbers I posted and show the final aswers.

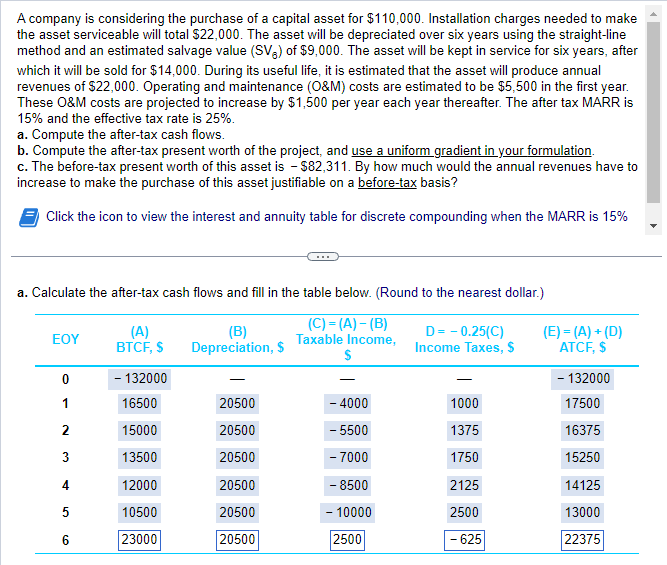

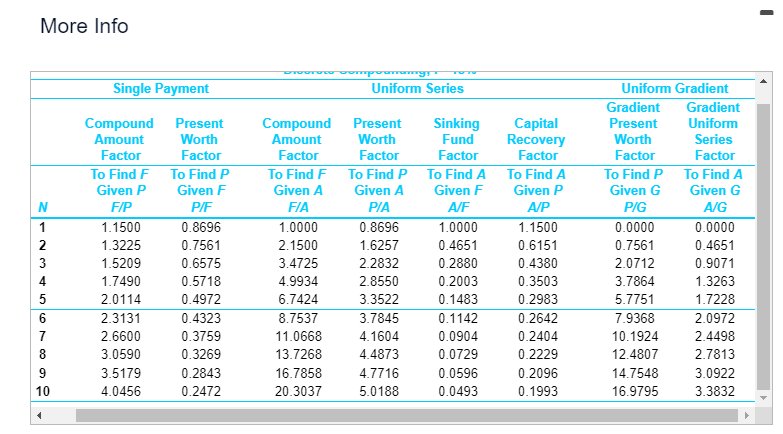

A company is considering the purchase of a capital asset for $110,000. Installation charges needed to make the asset serviceable will total $22,000. The asset will be depreciated over six years using the straight-line method and an estimated salvage value (SV6) of $9,000. The asset will be kept in service for six years, after which it will be sold for $14,000. During its useful life, it is estimated that the asset will produce annual revenues of $22,000. Operating and maintenance (O\&M) costs are estimated to be $5,500 in the first year. These O\&M costs are projected to increase by $1,500 per year each year thereafter. The after tax MARR is 15% and the effective tax rate is 25%. a. Compute the after-tax cash flows. b. Compute the after-tax present worth of the project, and use a uniform gradient in your formulation. c. The before-tax present worth of this asset is $82,311. By how much would the annual revenues have to increase to make the purchase of this asset justifiable on a before-tax basis? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% a. Calculate the after-tax cash flows and fill in the table below. (Round to the nearest dollar.) More Info

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts