Question: please complete tax problem 2 Tax Return Problem #2-Form 1040, Schedule D, and Forms 4684 and 4797 Prepare Schedule D-Form 1040 and Forms 4684 and

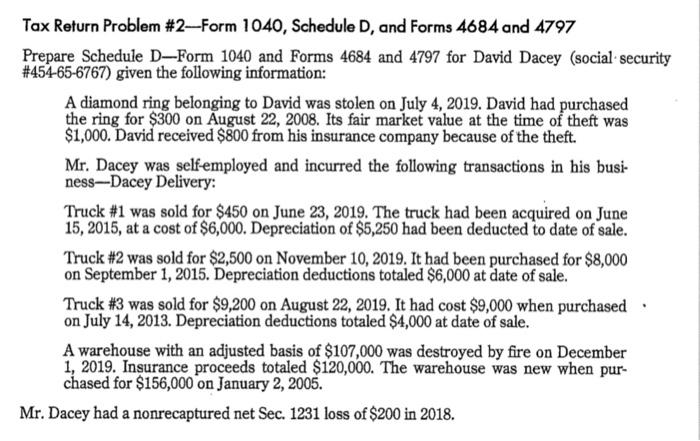

Tax Return Problem #2-Form 1040, Schedule D, and Forms 4684 and 4797 Prepare Schedule D-Form 1040 and Forms 4684 and 4797 for David Dacey (social security #454-65-6767) given the following information: A diamond ring belonging to David was stolen on July 4, 2019. David had purchased the ring for $300 on August 22, 2008. Its fair market value at the time of theft was $1,000. David received $800 from his insurance company because of the theft. Mr. Dacey was self-employed and incurred the following transactions in his busi- ness-Dacey Delivery: Truck #1 was sold for $450 on June 23, 2019. The truck had been acquired on June 15, 2015, at a cost of $6,000. Depreciation of $5,250 had been deducted to date of sale. Truck #2 was sold for $2,500 on November 10, 2019. It had been purchased for $8,000 on September 1, 2015. Depreciation deductions totaled $6,000 at date of sale. Truck #3 was sold for $9,200 on August 22, 2019. It had cost $9,000 when purchased on July 14, 2013. Depreciation deductions totaled $4,000 at date of sale. A warehouse with an adjusted basis of $107,000 was destroyed by fire on December 1, 2019. Insurance proceeds totaled $120,000. The warehouse was new when pur- chased for $156,000 on January 2, 2005. Mr. Dacey had a nonrecaptured net Sec. 1231 loss of $200 in 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts