Question: Please complete the 4 tables using canadian tax rules Simulation (20 minutes) Donna Forbes recently started work for James Landburg LLP, a local CPA firm.

Please complete the 4 tables using canadian tax rules

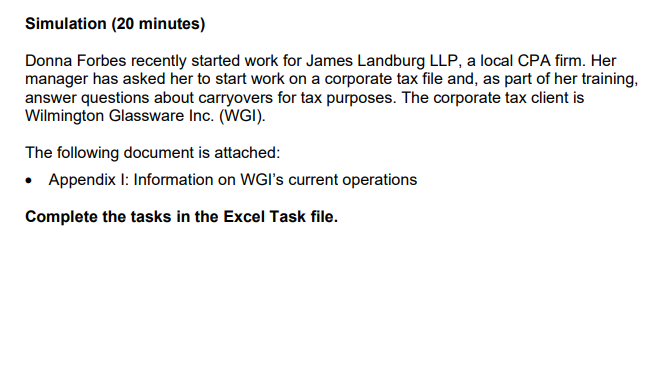

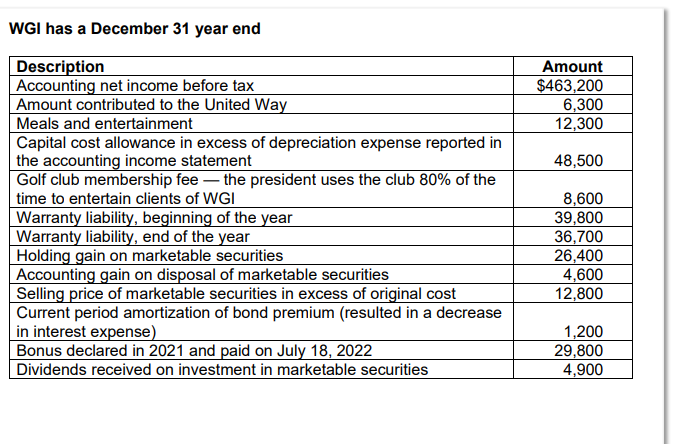

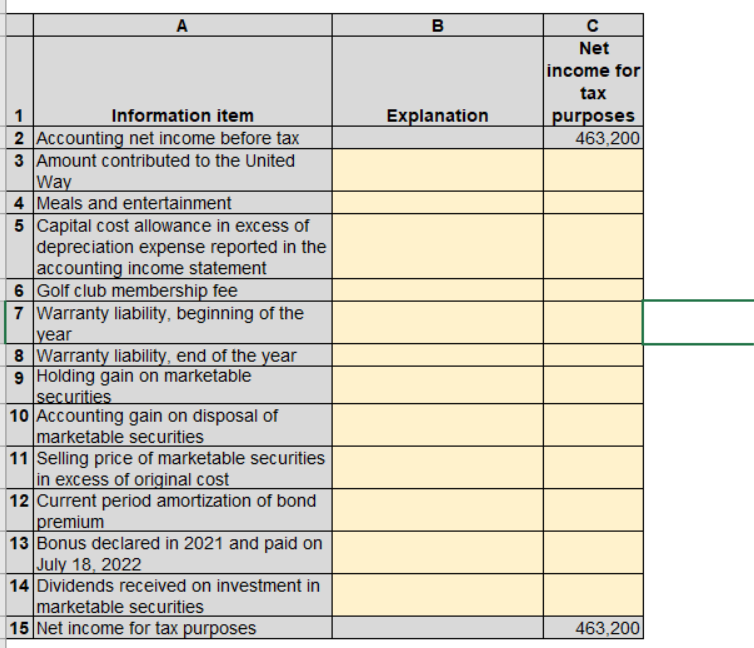

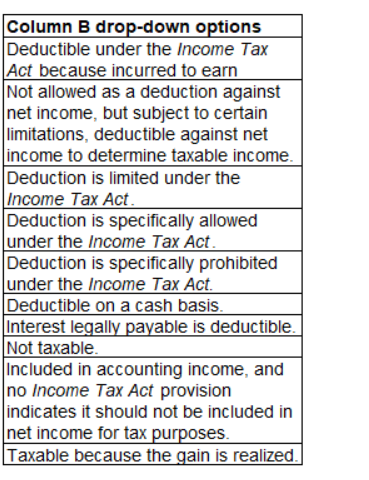

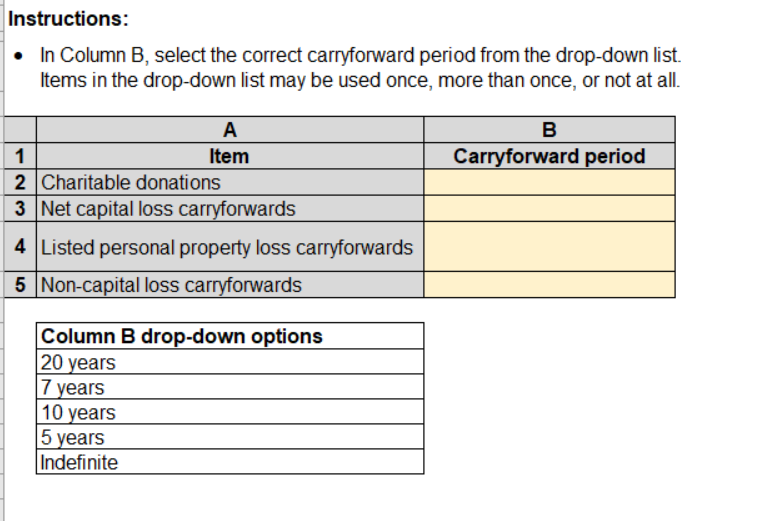

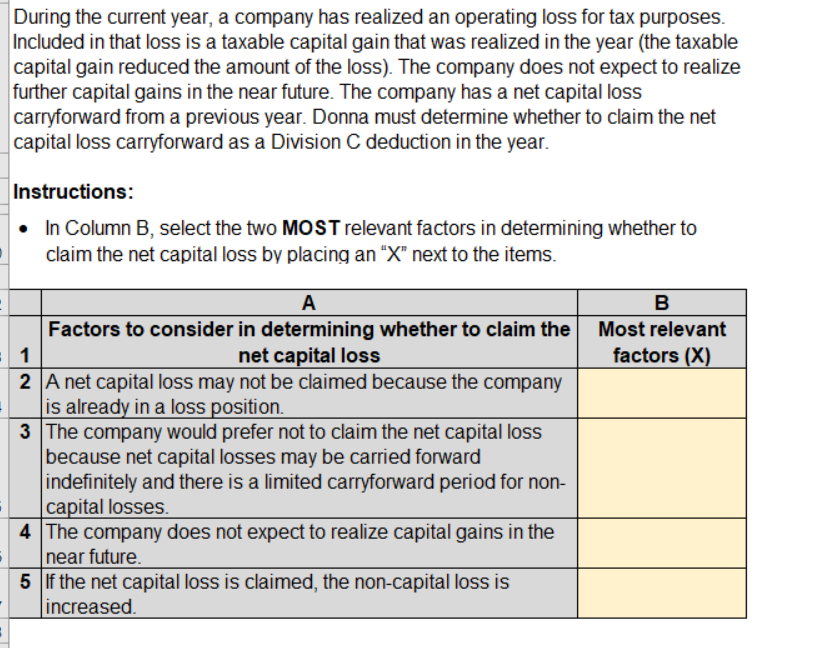

Simulation (20 minutes) Donna Forbes recently started work for James Landburg LLP, a local CPA firm. Her manager has asked her to start work on a corporate tax file and, as part of her training, answer questions about carryovers for tax purposes. The corporate tax client is Wilmington Glassware Inc. (WGI). The following document is attached: Appendix I: Information on WGI's current operations Complete the tasks in the Excel Task file. WGI has a December 31 year end Description Accounting net income before tax Amount contributed to the United Way Meals and entertainment Capital cost allowance in excess of depreciation expense reported in the accounting income statement Golf club membership fee - the president uses the club 80% of the time to entertain clients of WGI Warranty liability, beginning of the year Warranty liability, end of the year Holding gain on marketable securities Accounting gain on disposal of marketable securities Selling price of marketable securities in excess of original cost Current period amortization of bond premium (resulted in a decrease in interest expense) Bonus declared in 2021 and paid on July 18, 2022 Dividends received on investment in marketable securities Amount $463,200 6,300 12,300 48,500 8,600 39,800 36,700 26,400 4,600 12,800 1,200 29,800 4,900 A 1 Information item 2 Accounting net income before tax 3 Amount contributed to the United Way 4 Meals and entertainment 5 Capital cost allowance in excess of depreciation expense reported in the accounting income statement 6 Golf club membership fee 7 Warranty liability, beginning of the year 8 Warranty liability, end of the year 9 Holding gain on marketable securities 10 Accounting gain on disposal of marketable securities 11 Selling price of marketable securities in excess of original cost 12 Current period amortization of bond premium 13 Bonus declared in 2021 and paid on July 18, 2022 14 Dividends received on investment in marketable securities 15 Net income for tax purposes B Explanation Net income for tax purposes 463,200 463,200 Column B drop-down options Deductible under the Income Tax Act because incurred to earn Not allowed as a deduction against net income, but subject to certain limitations, deductible against net income to determine taxable income. Deduction is limited under the Income Tax Act. Deduction is specifically allowed under the Income Tax Act. Deduction is specifically prohibited under the Income Tax Act. Deductible on a cash basis. Interest legally payable is deductible. Not taxable. Included in accounting income, and no Income Tax Act provision indicates it should not be included in net income for tax purposes. Taxable because the gain is realized. Instructions: In Column B, select the correct carryforward period from the drop-down list. Items in the drop-down list may be used once, more than once, or not at all. B A Item 1 Carryforward period 2 Charitable donations 3 Net capital loss carryforwards 4 Listed personal property loss carryforwards 5 Non-capital loss carryforwards Column B drop-down options 20 years 7 years 10 years 5 years Indefinite During the current year, a company has realized an operating loss for tax purposes. Included in that loss is a taxable capital gain that was realized in the year (the taxable capital gain reduced the amount of the loss). The company does not expect to realize further capital gains in the near future. The company has a net capital loss carryforward from a previous year. Donna must determine whether to claim the net capital loss carryforward as a Division C deduction in the year. Instructions: In Column B, select the two MOST relevant factors in determining whether to claim the net capital loss by placing an "X" next to the items. A B Factors to consider in determining whether to claim the net capital loss Most relevant factors (X) 1 2 A net capital loss may not be claimed because the company is already in a loss position. 3 The company would prefer not to claim the net capital loss because net capital losses may be carried forward indefinitely and there is a limited carryforward period for non- capital losses. 4 The company does not expect to realize capital gains in the near future. 5 If the net capital loss is claimed, the non-capital loss is increased. Simulation (20 minutes) Donna Forbes recently started work for James Landburg LLP, a local CPA firm. Her manager has asked her to start work on a corporate tax file and, as part of her training, answer questions about carryovers for tax purposes. The corporate tax client is Wilmington Glassware Inc. (WGI). The following document is attached: Appendix I: Information on WGI's current operations Complete the tasks in the Excel Task file. WGI has a December 31 year end Description Accounting net income before tax Amount contributed to the United Way Meals and entertainment Capital cost allowance in excess of depreciation expense reported in the accounting income statement Golf club membership fee - the president uses the club 80% of the time to entertain clients of WGI Warranty liability, beginning of the year Warranty liability, end of the year Holding gain on marketable securities Accounting gain on disposal of marketable securities Selling price of marketable securities in excess of original cost Current period amortization of bond premium (resulted in a decrease in interest expense) Bonus declared in 2021 and paid on July 18, 2022 Dividends received on investment in marketable securities Amount $463,200 6,300 12,300 48,500 8,600 39,800 36,700 26,400 4,600 12,800 1,200 29,800 4,900 A 1 Information item 2 Accounting net income before tax 3 Amount contributed to the United Way 4 Meals and entertainment 5 Capital cost allowance in excess of depreciation expense reported in the accounting income statement 6 Golf club membership fee 7 Warranty liability, beginning of the year 8 Warranty liability, end of the year 9 Holding gain on marketable securities 10 Accounting gain on disposal of marketable securities 11 Selling price of marketable securities in excess of original cost 12 Current period amortization of bond premium 13 Bonus declared in 2021 and paid on July 18, 2022 14 Dividends received on investment in marketable securities 15 Net income for tax purposes B Explanation Net income for tax purposes 463,200 463,200 Column B drop-down options Deductible under the Income Tax Act because incurred to earn Not allowed as a deduction against net income, but subject to certain limitations, deductible against net income to determine taxable income. Deduction is limited under the Income Tax Act. Deduction is specifically allowed under the Income Tax Act. Deduction is specifically prohibited under the Income Tax Act. Deductible on a cash basis. Interest legally payable is deductible. Not taxable. Included in accounting income, and no Income Tax Act provision indicates it should not be included in net income for tax purposes. Taxable because the gain is realized. Instructions: In Column B, select the correct carryforward period from the drop-down list. Items in the drop-down list may be used once, more than once, or not at all. B A Item 1 Carryforward period 2 Charitable donations 3 Net capital loss carryforwards 4 Listed personal property loss carryforwards 5 Non-capital loss carryforwards Column B drop-down options 20 years 7 years 10 years 5 years Indefinite During the current year, a company has realized an operating loss for tax purposes. Included in that loss is a taxable capital gain that was realized in the year (the taxable capital gain reduced the amount of the loss). The company does not expect to realize further capital gains in the near future. The company has a net capital loss carryforward from a previous year. Donna must determine whether to claim the net capital loss carryforward as a Division C deduction in the year. Instructions: In Column B, select the two MOST relevant factors in determining whether to claim the net capital loss by placing an "X" next to the items. A B Factors to consider in determining whether to claim the net capital loss Most relevant factors (X) 1 2 A net capital loss may not be claimed because the company is already in a loss position. 3 The company would prefer not to claim the net capital loss because net capital losses may be carried forward indefinitely and there is a limited carryforward period for non- capital losses. 4 The company does not expect to realize capital gains in the near future. 5 If the net capital loss is claimed, the non-capital loss is increased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts