Question: Please complete the above Form 8995-A and provide steps 16. Rob Wiggle operates a small plumbing supplies business as a sole proprietor. In 2021, the

Please complete the above Form 8995-A and provide steps

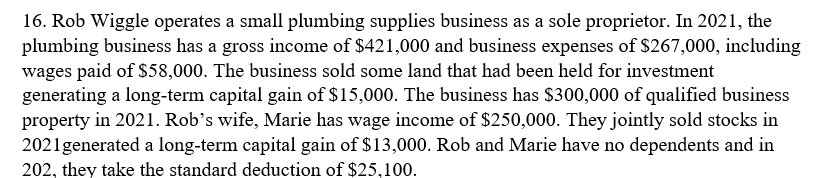

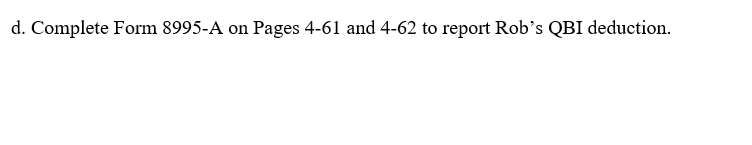

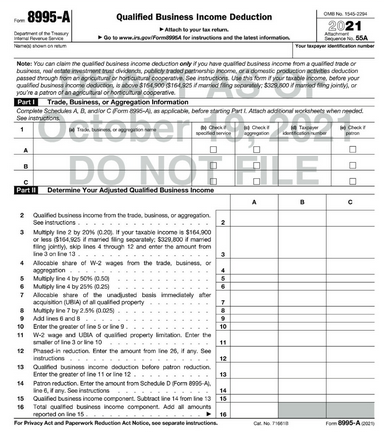

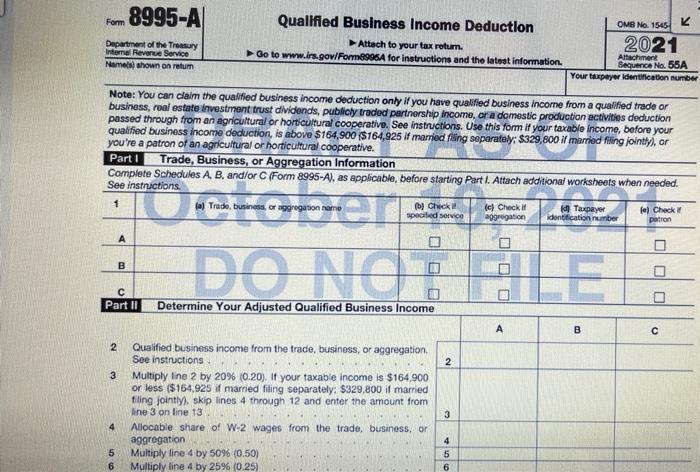

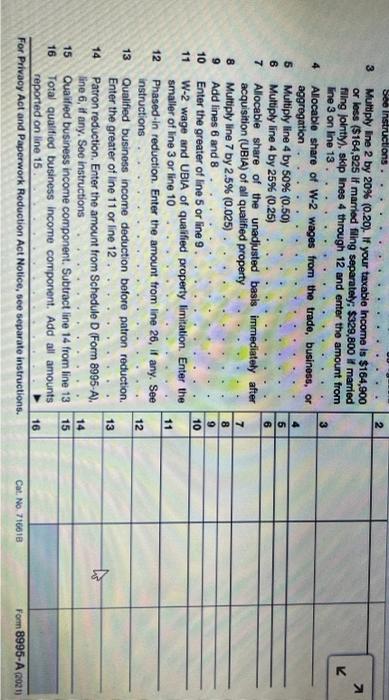

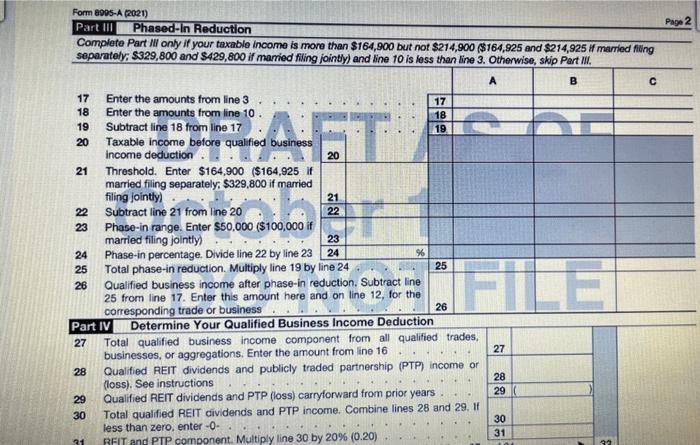

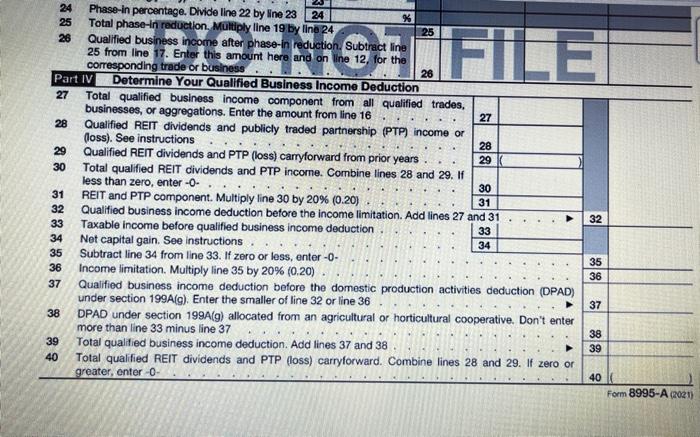

16. Rob Wiggle operates a small plumbing supplies business as a sole proprietor. In 2021, the plumbing business has a gross income of $421,000 and business expenses of $267,000, including wages paid of $58,000. The business sold some land that had been held for investment generating a long-term capital gain of $15,000. The business has $300,000 of qualified business property in 2021. Rob's wife, Marie has wage income of $250,000. They jointly sold stocks in 2021generated a long-term capital gain of $13,000. Rob and Marie have no dependents and in 202, they take the standard deduction of $25,100. d. Complete Form 8995-A on Pages 4-61 and 4-62 to report Rob's QBI deduction. For 8995-A Demofthe Tury Qualified Business Income Deduction Attach to your tax return Go to www.irs.gov/Form954 for instructions and the latest information DO NOT Part II Determine Your Adjusted Qualified Business Income Note: You can claim the qualified business income deduction only if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production activities deduction passed through from an agricultural or horticultural cooperative See instructions. Use this form if your taxable income, before your qualified business income deduction, is above $164,900 $164,525 if married filing separately $329,800 if married filing jointly, or you're a patron of an agricultural or horticultural cooperative Part I Trade, Business, or Aggregation Information Complete Schedules A, B, and/or C Form 8996-A), as applicable, before starting Part I. Attach additional worksheets when needed. See instructions October Ale. aggregation 2 Qualified business income from the trade, business, or aggregation See instructions..... 3 Multiply Ine 2 by 20% (0.20). If your taxable income is $164.900 or less ($164,525 if married fling separately: $329,800 if maried fing jointly, skip lines 4 through 12 and enter the amount from Ine 3 on line 13.. 8 9 Add lines 6 and 8. 10 11 4 Allocable share of W-2 wages from the trade, business, or aggregation.... 5 Multiply line 4 by 50% (050) Multiply line 4 by 25% (0.25) 6 7 Allocable share of the unadjusted basis immediately acquisition (UBA) of all qualified property Check Multiply line 7 by 2.5% (0.025). 14 15 16 Enter the greater of line 5 or line 9. 13 Qualified business income deduction before patron reduction. Enter the greater of line 11 or line 12. 2 49 Patron reduction. Enter the amount from Schedule D Form 8996-A ne 6, if any. See instructions. Qualified business income component. Subtract line 14 from line 13 Total qualified business income component Add all amounts reported on line 15. For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. 10 W-2 wage and UBIA of qualified property limitation. Enter the smaller of line 3 or line 10 11 12 Phased-in reduction. Enter the amount from line 26, if any. See instructions. 12 13 14 15 16 4 5 7 8 A OMB No 1545-2294 2021 A 55A Your taxpayer nation number B ber Check pon DOD 0 Form8995-A202) 4-62 Chapter 4. Additional Income and the Qualified Business Income Deduction Fom 80-A 2001) Part II Phased-in Reduction Complete Part only if your taxable income is more than $164,900 but not $214,900 ($164,925 and $214,925 if married fling separately: $329,800 and $429,800 if married filing jointly) and line 10 is less than line 3. Otherwise, skip Part 17 18 19 20 21 22 23 24 25 26 31 32 33 34 35 36 37 Enter the amounts from line 3 Enter the amounts from line 10. Subtractie 18 from line 17 38 39 AFT 40 Taxable income before qualfed business income deduction Threshold. Enter $164,000 ($164.025 married filing separately $329,800 if married filing jointly 21 22 Subtract line 21 from line 20 Phase-in range. Enter $50.000 ($100,000 married fling jointly) 23 Phase-in percentage Divide line 22 by line 23 24 Total phase-in reduction Multiply line 19 by line 24 Qualified business income after phase-in reduction. Subtract line 25 from line 17. Enter this amount here and on line 12, for the coresponding trade or business Part IV Determine Your Qualified Business Income Deduction 27 Total qualified business income component from all qualified trades. businesses, or aggregations. Enter the amount from line 16 17 18 19 B.FILE 25 20 29 Qualified REIT dividends and PTP (oss) carryforward from prior years... 30 Total qualified REIT dividends and PTP income. Combine lines 28 and 29. If less than zero, enter- REIT and PTP component. Multiply line 30 by 20% (0.20) Qualified business income deduction before the income limitation. Add lines 27 and 31 Taxable income before qualified business income deduction Net capital gain. See instructions. Subtract line 34 from line 33. If zero or less, enter-O- Income limitation Multiply line 35 by 20% (0.20) - Qualified business income deduction before the domestic production activities deduction (DPAD) under section 199Aig). Enter the smaller of line 32 or line 36 27 Qualified PEIT dividends and publicly traded partnership (PTP) income or foss) See instructions. 28 30 31 33 34 DPAD under section 19A) allocated from an agricultural or horticultural cooperative. Don't enter more than line 33 minus line 37 Total qualified business income deduction. Add lines 37 and 38 32 35 36 37 Total Qualified REIT dividends and PTP (oss) carryforward. Combine lines 28 and 29. I zero or greater, enter 0- 40 C Form 8995-A Form 8995-A Department of the Treasury Internal Revenue Service Name(s) shown on return Note: You can claim the qualified business income deduction only if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production activities deduction passed through from an agricultural or horticultural cooperative. See instructions. Use this form if your taxable income, before your qualified business income deduction, is above $164,900 ($164,925 if married filling separately: $329,800 if married filing jointly), or you're a patron of an agricultural or horticultural cooperative. A Part II Part I Trade, Business, or Aggregation Information Complete Schedules A, B, and/or C (Form 8995-A), as applicable, before starting Part I. Attach additional worksheets when needed. See instructions. (a) Trade, business, or aggrega name TOctober: DO NOT Determine Your Adjusted Qualified Business Income B 4 Qualified Business Income Deduction Attach to your tax return. Go to www.irs.gov/Form8996A for instructions and the latest information. 3 5 6 2 Qualified business income from the trade, business, or aggregation. See instructions Multiply line 2 by 20% (0.20 ). If your taxable income is $164,900 or less ($164,925 if married filing separately: $329,800 if married filing jointly), skip lines 4 through 12 and enter the amount from line 3 on line 13 (b) Check if specified service Allocable share of W-2 wages from the trade, business, or aggregation Multiply line 4 by 50% (0.50) Multiply line 4 by 25% (0.25) 2 3 456 (c) Check if aggregation 00 OMB No. 1545 A 2021 Attachment Sequence No. 55A Your taxpayer identification number (d) Taxpayer identification number B K (e) Check if patron 0 8 9 10 11 12 667 3 4 13 14 15 16 See Instructions. Multiply line 2 by 20% (0.20 ). If your taxable income is $164,900 or less ($164,925 if married filing separately; $329,800 if married filling jointly), skip lines 4 through 12 and enter the amount from line 3 on line 13. Allocable share of W-2 wages from the trade, business, or aggregation Qualified business income deduction before patron reduction. Enter the greater of line 11 or line 12. Patron reduction. Enter the amount from Schedule D (Form 8995-A). line 6, if any. See instructions Qualified business income component. Subtract line 14 from line 13 Total qualified business income component. Add all amounts reported on line 15. For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Multiply line 4 by 50% (0.50) Multiply line 4 by 25% (0.25) Allocable share of the unadjusted basis immediately after acquisition (UBIA) of all qualified property Multiply line 7 by 2.5% (0.025). Add lines 6 and 8 Enter the greater of line 5 or line 9. W-2 wage and UBIA of qualified property limitation. Enter the smaller of line 3 or line 10 Phased-in reduction. Enter the amount from line 26, if any. See instructions 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Cat. No. 716618 K 7 Form 8995-A (2021) Form 8995-A (2021) Part III Phased-in Reduction Complete Part Ill only if your taxable income is more than $164,900 but not $214,900 ($164,925 and $214,925 if married filing separately; $329,800 and $429,800 if married filing jointly) and line 10 is less than line 3. Otherwise, skip Part III. B 7 18 19 20 17 Enter the amounts from line 3 Enter the amounts from line 10. Subtract line 18 from line 17 Taxable income before qualified business income deduction 21 22 23 24 25 26 ZAFT 20 28 29 30 Threshold. Enter $164,900 ($164,925 if married filing separately: $329,800 if married filing jointly) 21 22 Subtract line 21 from line 20 Phase-in range. Enter $50,000 ($100,000 if married filing jointly) Phase-in percentage. Divide line 22 by line 23 Total phase-in reduction. Multiply line 19 by line 24 Qualified business income after phase-in reduction. Subtract line 25 from line 17. Enter this amount here and on line 12, for the corresponding trade or business Determine Your Qualified Business Income Deduction 23 24 % 31 RFIT and PTP component. Multiply line 30 by 20% (0.20) 17 18 19 25 26 Part IV 27 Total qualified business income component from all qualified trades. businesses, or aggregations. Enter the amount from line 16 Qualified REIT dividends and publicly traded partnership (PTP) income or (loss). See instructions . Qualified REIT dividends and PTP (loss) carryforward from prior years Total qualified REIT dividends and PTP income. Combine lines 28 and 29. If less than zero, enter-0- A FILE 27 28 29 30 31 C Page 2 24 Phase-in percentage. Divide line 22 by line 23 24 25 Total phase-in reduction, Multiply line 19 by line 24 26 Qualified business income after phase-in reduction. Subtract line 25 from line 17. Enter this amount here and on line 12, for the corresponding trade or business Determine Your Qualified Business Income Deduction Part IV 27 28 29 30 31 32 33 34 35 36 37 38 39 40 % ENG FILE 25 26 Total qualified business income component from all qualified trades, businesses, or aggregations. Enter the amount from line 16 Qualified REIT dividends and publicly traded partnership (PTP) income or (loss). See instructions Qualified REIT dividends and PTP (loss) carryforward from prior years. Total qualified REIT dividends and PTP income. Combine lines 28 and 29. If less than zero, enter -0-.. 27 28 29 30 REIT and PTP component. Multiply line 30 by 20% (0.20) 31 Qualified business income deduction before the income limitation. Add lines 27 and 31 Taxable income before qualified business income deduction Net capital gain. See instructions. Subtract line 34 from line 33. If zero or less, enter -0- Income limitation. Multiply line 35 by 20% (0.20). 33 34 Qualified business income deduction before the domestic production activities deduction (DPAD) under section 199A(g). Enter the smaller of line 32 or line 36 DPAD under section 199A(g) allocated from an agricultural or horticultural cooperative. Don't enter more than line 33 minus line 37 Total qualified business income deduction. Add lines 37 and 38 Total qualified REIT dividends and PTP (loss) carryforward. Combine lines 28 and 29. If zero or greater, enter-0- 32 35 36 37 38 39 40 Form 8995-A (2021)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts