Question: PLEASE COMPLETE THE ANSWER SAT 1.1 SAT 1.2 SAT 1.3 SAT 1.4 RBB RETAILING CORPORATION Statement of Comprehensive Income For the year ended December 31,

PLEASE COMPLETE THE ANSWER

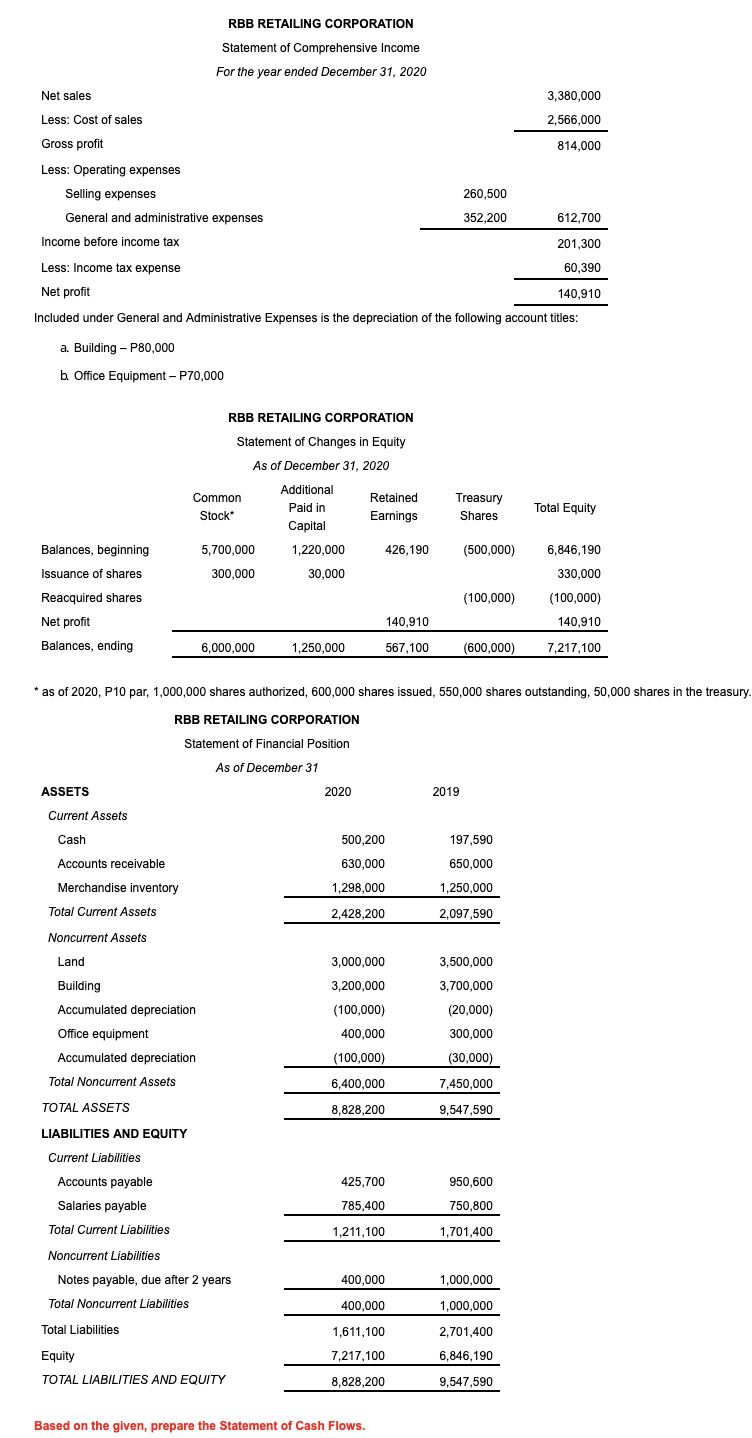

SAT 1.1

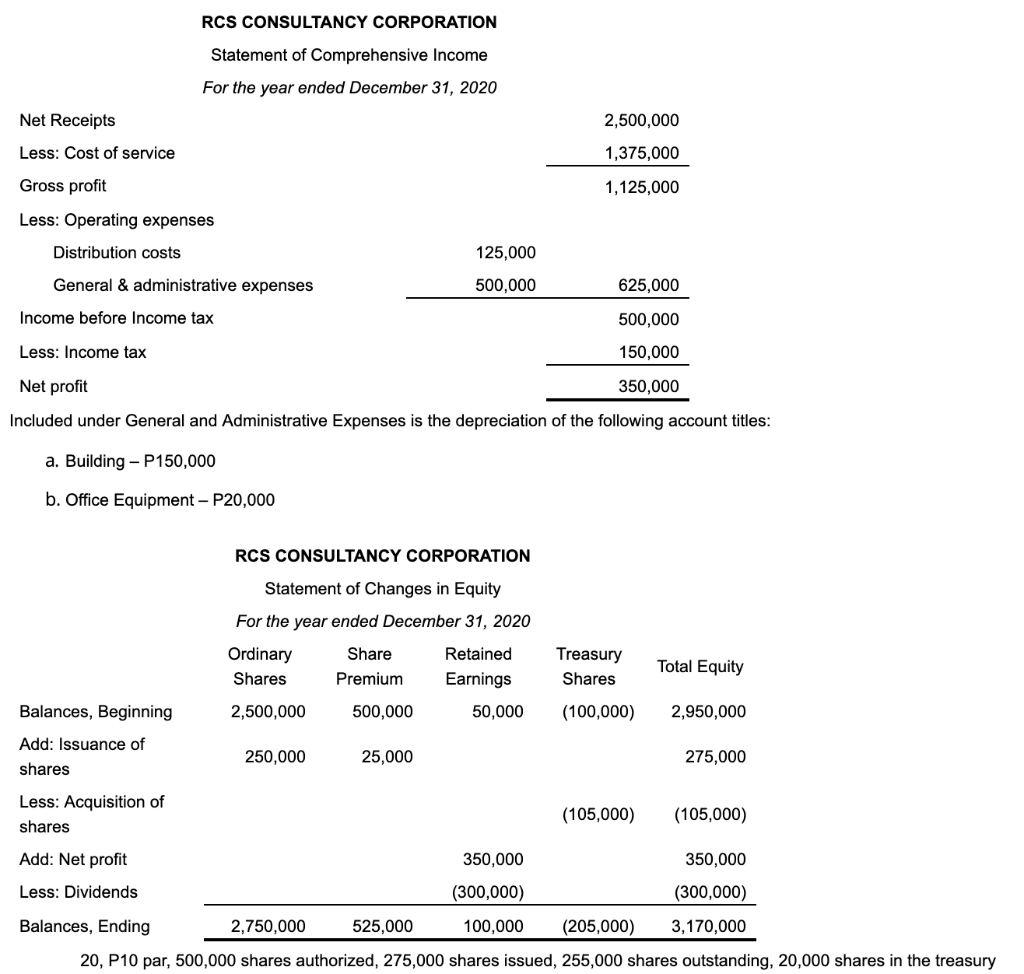

SAT 1.2

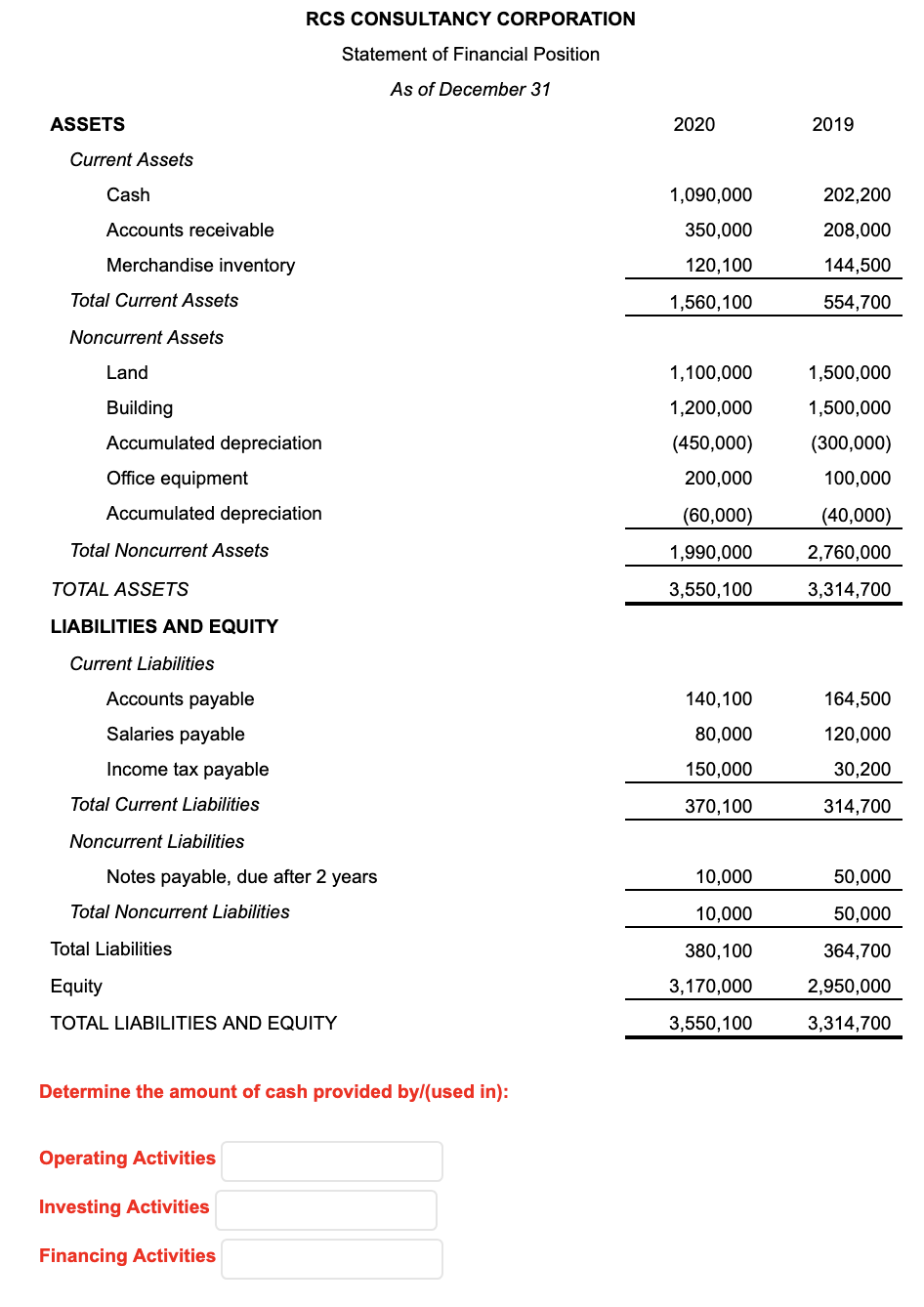

SAT 1.3

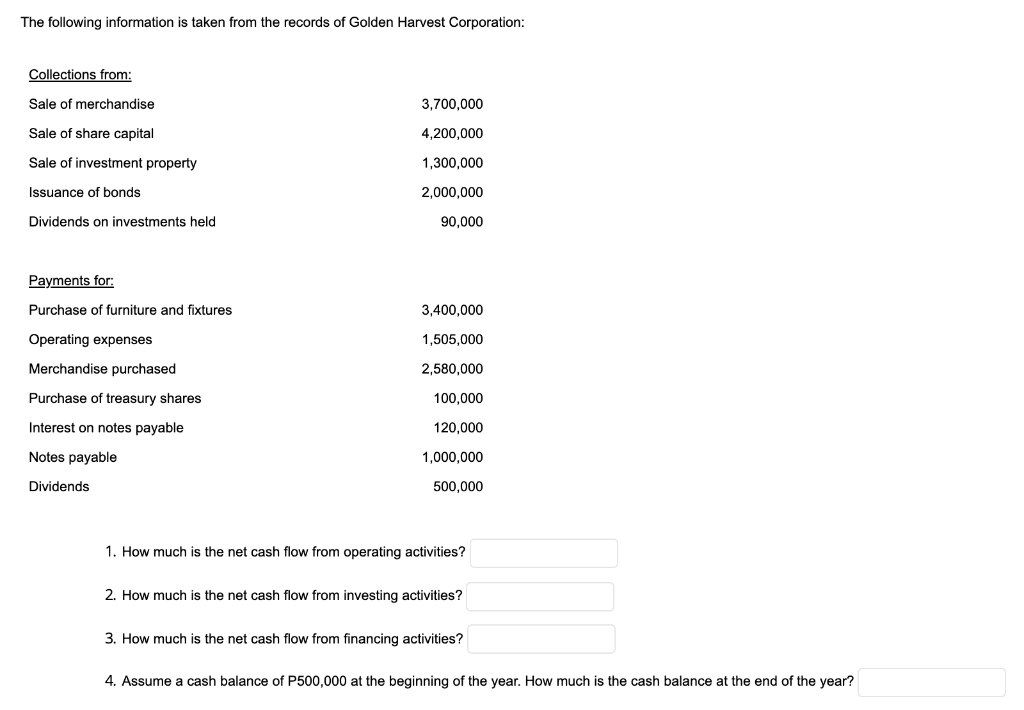

SAT 1.4

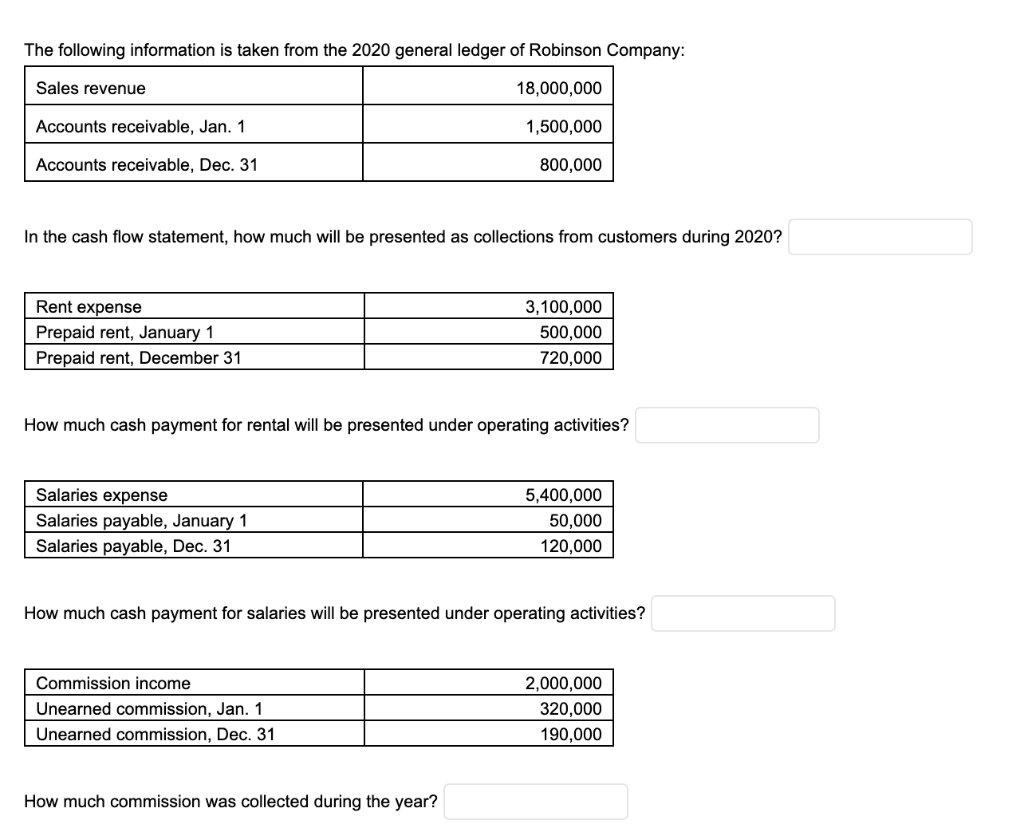

RBB RETAILING CORPORATION Statement of Comprehensive Income For the year ended December 31, 2020 Net sales Less: Cost of sales 3,380,000 2,566,000 Gross profit 814,000 Less: Operating expenses Selling expenses General and administrative expenses Income before income tax 260,500 352,200 612.700 201,300 Less: Income tax expense 60,390 Net profit 140,910 Included under General and Administrative Expenses is the depreciation of the following account titles: a. Building - P80,000 b Office Equipment - P70,000 RBB RETAILING CORPORATION Statement of Changes in Equity As of December 31, 2020 Common Stock Additional Paid in Capital Retained Earnings Treasury Shares Total Equity Balances, beginning 1,220,000 426,190 (500,000) 6,846,190 5,700,000 300,000 Issuance of shares 30,000 Reacquired shares (100,000) 330,000 (100,000) 140,910 Net profit 140,910 Balances, ending 6,000,000 1,250,000 567,100 (600,000) 7,217,100 * as of 2020, P10 par, 1,000,000 shares authorized, 600,000 shares issued, 550,000 shares outstanding, 50,000 shares in the treasury. RBB RETAILING CORPORATION Statement of Financial Position As of December 31 ASSETS 2020 2019 Current Assets Cash 500,200 197,590 630,000 650,000 1,298,000 1,250,000 Accounts receivable Merchandise inventory Total Current Assets Noncurrent Assets 2.428,200 2,097,590 Land 3,000,000 3,500,000 Building 3,200,000 3,700,000 Accumulated depreciation (100,000) 400,000 (20,000) 300,000 Office equipment (100,000) (30,000) Accumulated depreciation Total Noncurrent Assets 6,400,000 7,450,000 TOTAL ASSETS 8,828,200 9,547,590 LIABILITIES AND EQUITY Current Liabilities 425,700 950,600 Accounts payable Salaries payable 785,400 750,800 Total Current Liabilities 1,211,100 1,701,400 Noncurrent Liabilities 400,000 1,000,000 Notes payable, due after 2 years Total Noncurrent Liabilities 400,000 1,000,000 Total Liabilities 1,611,100 7,217,100 2,701,400 6,846,190 Equity TOTAL LIABILITIES AND EQUITY 8,828,200 9,547,590 Based on the given, prepare the Statement of Cash Flows. RCS CONSULTANCY CORPORATION Statement of Comprehensive Income For the year ended December 31, 2020 Net Receipts 2,500,000 Less: Cost of service 1,375,000 Gross profit 1,125,000 Less: Operating expenses Distribution costs 125,000 General & administrative expenses 500,000 625,000 Income before Income tax 500,000 Less: Income tax 150,000 Net profit 350,000 Included under General and Administrative Expenses is the depreciation of the following account titles: a. Building - P150,000 b. Office Equipment - P20,000 RCS CONSULTANCY CORPORATION Statement of Changes in Equity For the year ended December 31, 2020 Ordinary Share Retained Shares Premium Earnings Treasury Shares Total Equity Balances, Beginning 2,500,000 500,000 50,000 (100,000) 2,950,000 Add: Issuance of shares 250,000 25,000 275,000 Less: Acquisition of shares (105,000) (105,000) Add: Net profit 350,000 350,000 (300,000) Less: Dividends (300,000) Balances, Ending 2,750,000 525,000 100,000 (205,000) 3,170,000 20, P10 par, 500,000 shares authorized, 275,000 shares issued, 255,000 shares outstanding, 20,000 shares in the treasury RCS CONSULTANCY CORPORATION Statement of Financial Position As of December 31 ASSETS 2020 2019 Current Assets Cash 1,090,000 202,200 208,000 Accounts receivable 350,000 Merchandise inventory 120,100 144,500 Total Current Assets 1,560,100 554,700 Noncurrent Assets Land 1,100,000 1,500,000 1,200,000 1,500,000 Building Accumulated depreciation (300,000) (450,000) 200,000 100,000 Office equipment Accumulated depreciation (60,000) (40,000) Total Noncurrent Assets 1,990,000 2,760,000 TOTAL ASSETS 3,550,100 3,314,700 LIABILITIES AND EQUITY Current Liabilities 140,100 164,500 Accounts payable Salaries payable Income tax payable 120,000 80,000 150,000 30,200 Total Current Liabilities 370,100 314,700 Noncurrent Liabilities Notes payable, due after 2 years 10,000 50,000 Total Noncurrent Liabilities 10,000 50,000 Total Liabilities 380,100 364,700 Equity 3,170,000 2,950,000 TOTAL LIABILITIES AND EQUITY 3,550,100 3,314,700 Determine the amount of cash provided by/(used in): Operating Activities Investing Activities Financing Activities The following information is taken from the records of Golden Harvest Corporation: Collections from: Sale of merchandise 3,700,000 Sale of share capital 4,200,000 Sale of investment property 1,300,000 Issuance of bonds 2,000,000 Dividends on investments held 90,000 Payments for: Purchase of furniture and fixtures 3,400,000 1,505,000 Operating expenses Merchandise purchased 2,580,000 100,000 Purchase of treasury shares Interest on notes payable 120,000 Notes payable 1,000,000 Dividends 500,000 1. How much is the net cash flow from operating activities? 2. How much is the net cash flow from investing activities? 3. How much is the net cash flow from financing activities? 4. Assume a cash balance of P500,000 at the beginning of the year. How much is the cash balance at the end of the year? The following information is taken from the 2020 general ledger of Robinson Company: Sales revenue 18,000,000 Accounts receivable, Jan. 1 1,500,000 Accounts receivable, Dec. 31 800,000 In the cash flow statement, how much will be presented as collections from customers during 2020? Rent expense Prepaid rent, January 1 Prepaid rent, December 31 3,100,000 500,000 720,000 How much cash payment for rental will be presented under operating activities? Salaries expense Salaries payable, January 1 Salaries payable, Dec. 31 5,400,000 50,000 120,000 How much cash payment for salaries will be presented under operating activities? Commission income Unearned commission, Jan. 1 Unearned commission, Dec. 31 2,000,000 320,000 190,000 How much commission was collected during the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts